To hike or not to hike the rates

The gold experiences a volatile session, while the last week is able daily volatility in the several % ranges. The fact is the precious metal is under pressure from the development of the US yield bond yields. Government bond yields rise because of fundaments such as inflation and therefore possible further rate hiking. The definition is that higher interest rates rises bond yields. To add, gold is a noninterest asset, so in the time when other financial assets with the interest bring more appreciation, then assets with no interest lose their competitiveness.

Read more: Comparison of Barrick Gold Corporation vs. Kinross Gold

This pressure has a negative impact on gold’s development. Gold erases almost 4% from last week’s top of $2063.4 until today’s low at $1981.4. On the other side, the US 10 years government bond yields gained 8% to level 3.62%.

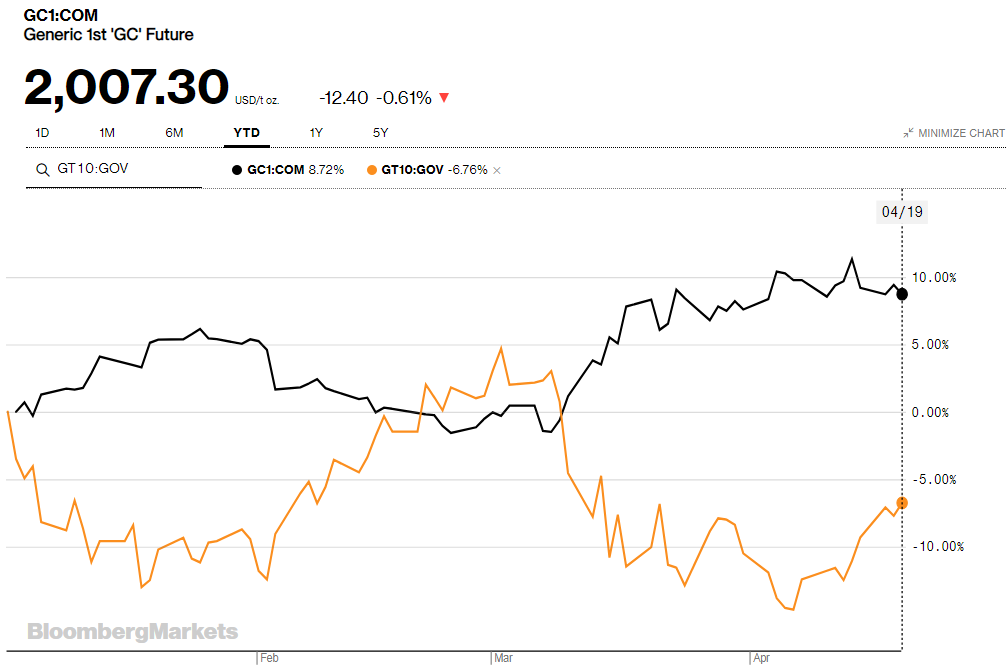

Gold futures vs. US10-year bonds yield, source: author’s analysis

Monetary policy decides everything

The fact is that the negative correlation between gold and bond yield development persists for longer periods too. The rule applies not just for the short term. The 10-years yield is commonly used because it shows how strongly investors believe that the specific country will be able to pay its commitment. The fear of higher rates is significantly seen within the markets this year.

Year-to-date chart of Gold futures vs. US10-year yields, source: author’s analysis

Year to date chart shows that negative correlation is nothing new for the markets and works perfectly. While gold is up 8.72%, yields are down -6.76%. And every time the gold rises, yields decline and vice versa. This is mostly because of Fed’s monetary policy and fights against inflation.

Volatility is better than a flat market

“Volatility is better than a flat market” is the motto of traders. Of course, the possibility of profitable trades is the same for losses, but a volatile session brings chances to better read the market and therefore to be better prepared for further development. The point is to keep risk management tight. Gold is this year very closely connected with the Fed’s policy and rates decisions.

The fear factor works efficiently. So every possibility of higher rates and further hikes this year could have a negative effect on gold. The biggest moves on yellow precious metal were closely connected with this fundament.

Comments

Post has no comment yet.