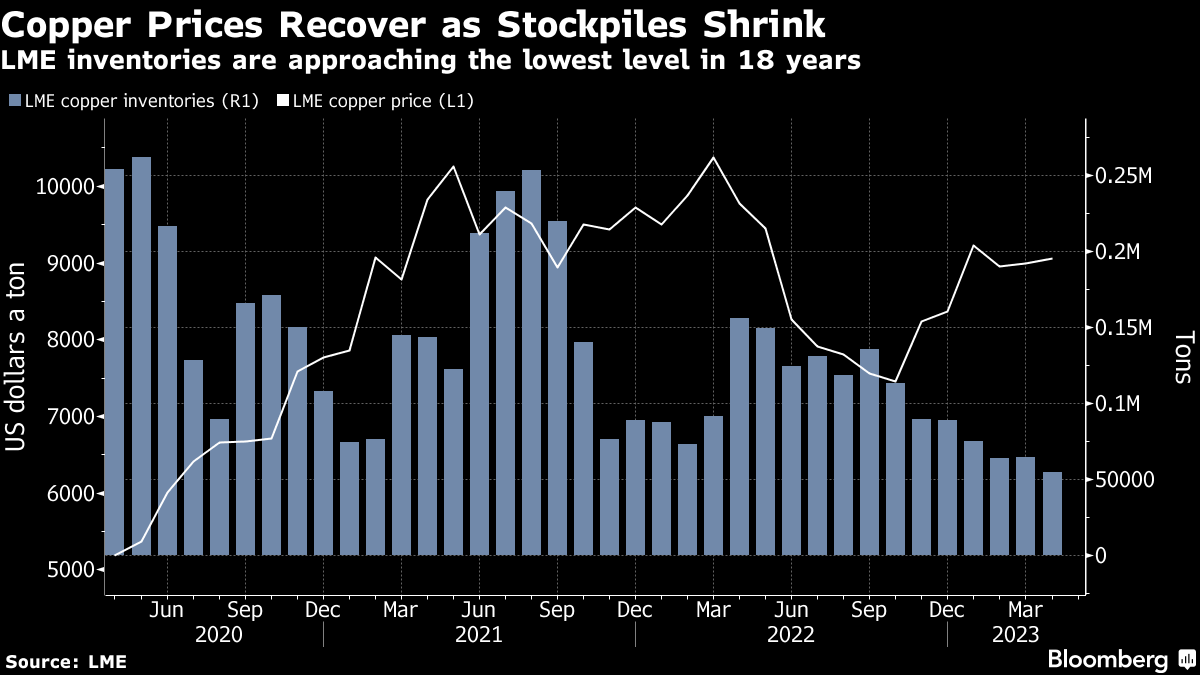

Price vs. inventories

Copper is widely used in both industrial and commercial parts of the economy. Because of its perfect conductivity, similar to silver, copper is used as wires in most electrical equipment. The massive industrialization in the electrical industry in the 2000s sparked significant demand from China.

With the rise of urbanization and higher demand for consumer electronics and appliances, plus the fact that copper is part of the government’s reserve system, with applications throughout industries and a close connection to the energy sector, the commodity catches investors’ eyes and is closely watched. It has a solid position in business planning but is an asset in the portfolio.

We analyzed also: LNG sinks lower after winter – rebound is unlikely

The current situation in inventories shows, that copper has the tightest supply in the last 18 years. Easy math leads to the logical consequence, the higher price. The chart below shows the correlation between the inventories and the commodity’s price. From 2020 the inventories plunged more than 78% from 250,000 tons to only 54,000 tons in April 2023. On the other hand, the price skyrocketed 80% in that period and settled at 9,000 USD/ton quoted on London Metal Exchange.

Copper price vs. stockpiles, source: Bloomberg

Industry is hurt

The higher revenues from higher prices of copper is a likable effect, but the problem lies in the very tight supply. It is important to mention that the biggest part of the copper demand is in China, which slowly reopens the economy after the Covid-zero policy. The short-term stockpiles level represents less than a week´s worth of consumption. The electrical industry faces quite a problem, how to handle the situation. Many analysts and financial houses predict the price above the $10,000 price mark. China is not even in full mode and supply is already struggling.

Read more: How to trade earnings releases

Deficit territory in the market is in the sight. It seems the supply boost will not be smooth at all. Many miners of the commodity hesitate to open new greenfields for mining. Higher revenues from higher prices are favorable, but at what cost if the industry will not have a satisfactory level of production?

Comments

Post has no comment yet.