Investing may be a terrific way to build wealth over time, but there are so many opportunities out there that it can be overwhelming to choose. Bullion and stock markets are two of the most common ways to invest. Therefore, it’s crucial to weigh the pros and cons of each while making an investment decision.

The definition

Gold and silver are examples of precious metals that may be purchased in the form of “bullion,” which includes bars, coins, and ingots. These metals have served as money reserves for millennia and are now seen as a reliable investment during economic turmoil. Mining output, geopolitical events, and investor attitude are all contributors to the bullion price.

Stocks, on the other hand, indicate a stake in a corporation. A stock represents a fractional share of ownership in a corporation. Several elements, including the company’s financial performance, industry developments, and macroeconomic conditions, combine to establish a stock’s value.

Don’t miss: Comparison of Barrick Gold Corporation vs. Kinross Gold

Is buying bullion or shares a better long-term investment? The investing objectives, level of comfort with risk, and time horizon should all factor into the investors’ final decision. Let’s look at some of the more important considerations for this choice.

Price volatility

The price volatility of bullion is far lower than that of equities. Over more extended periods, the price of gold bullion tends to be more steady, with less volatility. This is because bullion’s supply and demand variables, which determine its worth, tend to fluctuate gradually over long periods.

On the other hand, stock prices are sometimes subject to wild fluctuations in response to news, earnings reports, and other market-related factors. For investors, this volatility may be both a gift and a disadvantage. One positive aspect is the potential for rapid financial growth. But, unfortunately, it also opens the door to substantial losses if you aren’t attentive.

Risk vs. reward

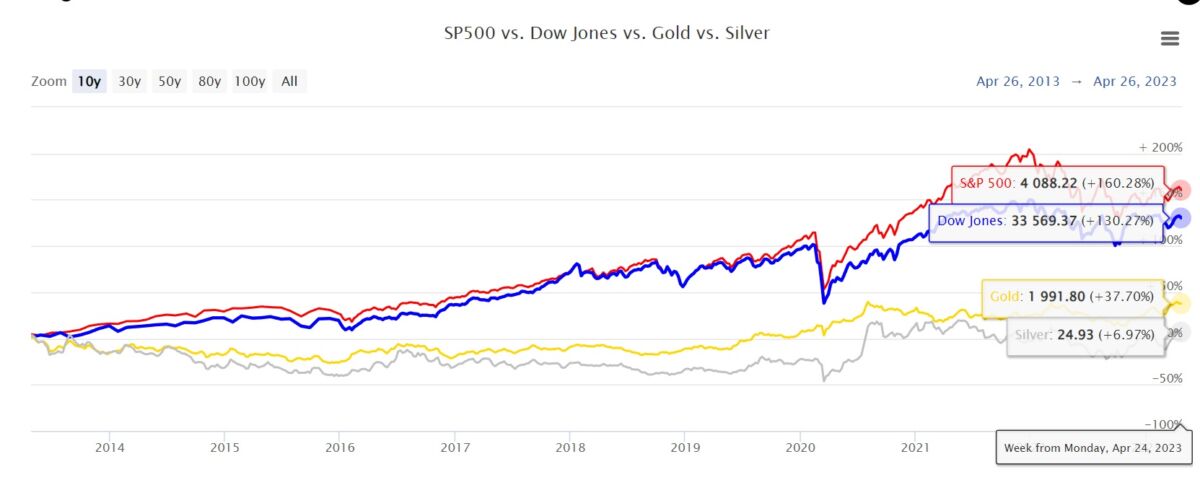

The risk-reward ratio is also crucial when choosing between bullion and stock market investments. In comparison to equities, investing in bullion is often seen as a safer bet. In addition, because bullion prices are less sensitive to macroeconomic variables like interest rates and inflation, it provides a more stable investment option over the long term.

Also read: Copper sees extremely low level of stockpiles – what does it mean?

There is a price to pay for this degree of consistency. If one is looking for high returns, go elsewhere than bullion. Gold and silver may appreciate over time, but they won’t likely outperform a well-performing stock in terms of return on investment. This suggests that equities may be preferable to other investment vehicles for those seeking substantial long-term growth potential.

Stocks vs bullion chart, source: longtermtrends.net

Liquidity

The term “liquidity” describes an asset’s ease of purchase and sale. For example, stocks are often more liquid than bullion. This is due to the massive amount of daily trades that occur on stock exchanges, where equities are traded. This facilitates stock transactions during all market hours.

Conversely, actual bullion, such as coins and bars, might be less liquid than paper bullion. This is since transferring and storing actual bullion may be difficult and expensive. However, bullion can be bought and sold swiftly and simply on many internet markets.

Diversification

Investing in many types of assets or businesses diversifies the risk and increases the potential reward. For example, gold bullion and stock market shares both have their place in a balanced portfolio.

Another exciting topic: How to invest in silver

Many people invest in bullion as a hedge in this uncertain economic climate. Investors can lower their portfolio risk by including bullion along with equities and other assets. This is because the bullion price typically acts in the opposite direction of equities and fixed-income instruments.

Conversely, stock investments can help to spread the risk by exposing the investor to various markets and businesses. In addition, diversification allows investors to lessen the influence of any firm or sector’s performance on their portfolio. This is because business and industry-specific events, such as shifts in management or new regulations, can significantly impact the performance of particular stocks.

Effects on taxes

When deciding whether or not to invest in bullion or stocks, it is essential to consider the related tax consequences. For example, equities are often more tax efficient when comparing stocks with bullion. This is because capital gains taxes on equities are often far lower than those on bullion.

But there are a few notable outliers. For example, gains on gold investments may be postponed or eliminated entirely if, for instance, the bullion is held in a tax-deferred retirement account. If one wants to know how their investment decisions may affect their taxes, they should talk to a tax expert.

Conclusion

In conclusion, you should consider your investment objectives, risk tolerance, and time horizon before buying bullion or equities. Investing in bullion is a safer bet than the stock market’s volatility. However, when compared to equities, bullion’s potential for large profits is relatively low.

There is greater diversity, the possibility of substantial long-term return with stock investments, and greater volatility and risk. Gold bullion and stock market shares have their place in a balanced portfolio. Whether you put your money into bullion or equities relies on your unique situation and objectives.

Comments

Post has no comment yet.