Banking in the centre of the action

What the Silicon Valley Bank (SVB) began a week ago was continued by Signature Bank, Credit Suisse, and the First Republic Bank. Financial market turbulences dominated the news throughout the week, ensuring that the market remained turbulent.

Even with market worries, the Fed will likely hike the rate of interest by 25 basis points (bps) on the following Wednesday. If the US central bank remains on hold for fear of the current environment, it might cause a market shock that could negate the good news of a pause in the tightening cycle.

The S&P 500 sank 1.2%, while the Dow Jones dropped 1.3%, and the Nasdaq Composite declined 0.8%. To save the market, investors are putting money into technology. Nvidia gained 0.8% after Morgan Stanley upgraded its rating. Microsoft also closed the day in the green over 1.5%.

More to read: Midjourney V5 is out – how to make top quality pictures thanks to AI

As anticipated, the European Central Bank (ECB) increased the interest rate by 50 bps and suspended forward guidance. Current events are overshadowing economic statistics, but next week’s PMIs will likely get attention.

Dollar was unable to benefit from the turmoil

The US Dollar Index had its lowest weekly closing value in the past five weeks. The decline in market mood did not lift the dollar sufficiently. If worries of systemic risk begin to dominate price activity, the US dollar might stage a robust recovery.

The USD/CAD pair completed the week around 1.3700, which is much higher than its weekly low. On Tuesday, February’s Consumer Price Index will be the most important economic news from Canada next week.

The AUD/USD pair experienced its strongest week in months, aided by a lower US dollar as well as positive Australian job statistics. Since mid-January, GBP/USD had its greatest weekly performance, moving above 1.2200. Next week, the Monetary Policy Committee of the Bank of England will meet. Market investors anticipate a final rate rise of 25 bps.

Solid gold wins over liquid gold

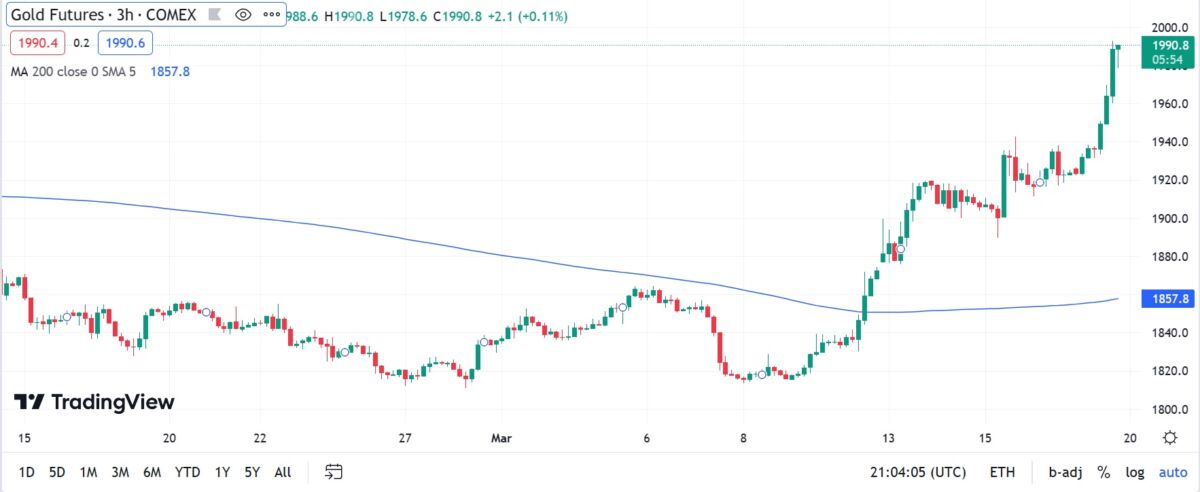

Gold futures were another significant winner this week, gaining more than a hundred dollars and reaching only $10 below $2,000. The yellow metal fully embraced it’s safe haven role. Silver futures followed, and added 4.5% in the green to close above $22.6.

Gold futures 3H chart, source: tradingview.com

For the fourth time in five days, crude prices fell on Friday, capping off the worst week for crude prices since the coronavirus epidemic three years ago, that all but eliminated demand for oil.

Also interesting: ADBE pumps after strong earnings and upgraded guidance

This time, however, the downturn was less related to supply and demand and more related to the confidence problem at the banks, that offer liquidity for trading in oil as well as other commodities.

After a 15-month low at $65.27 WTI finished down 2.4%, at $66.74 per barrel. The benchmark for US crude fell 13% for the week. At $72.97, Brent decreased by 2.3%. The benchmark for world crude oil earlier hit a session low of $71.44 and was down more than 13% for the week.

Comments

Post has no comment yet.