The market shines green despite mixed messages

The S&P 500 lost ground on Thursday as local banking came to the spotlight again. First Republic Bank continued its downward trend by more than 6%, dampening confidence on the wider financial sector as attention shifted back to the health of smaller banks.

Sentiment increased after US Treasury Chief Janet Yellen shook financial markets by stating that the US authorities had no plans to implement depositor insurance for all depositors on Wednesday. In addition, Fed Chair Powell stressed that the financial system remains robust following the Fed’s actions to supply liquidity to the markets.

More to read: US President’s Economic Report is wrong about crypto – here’s why

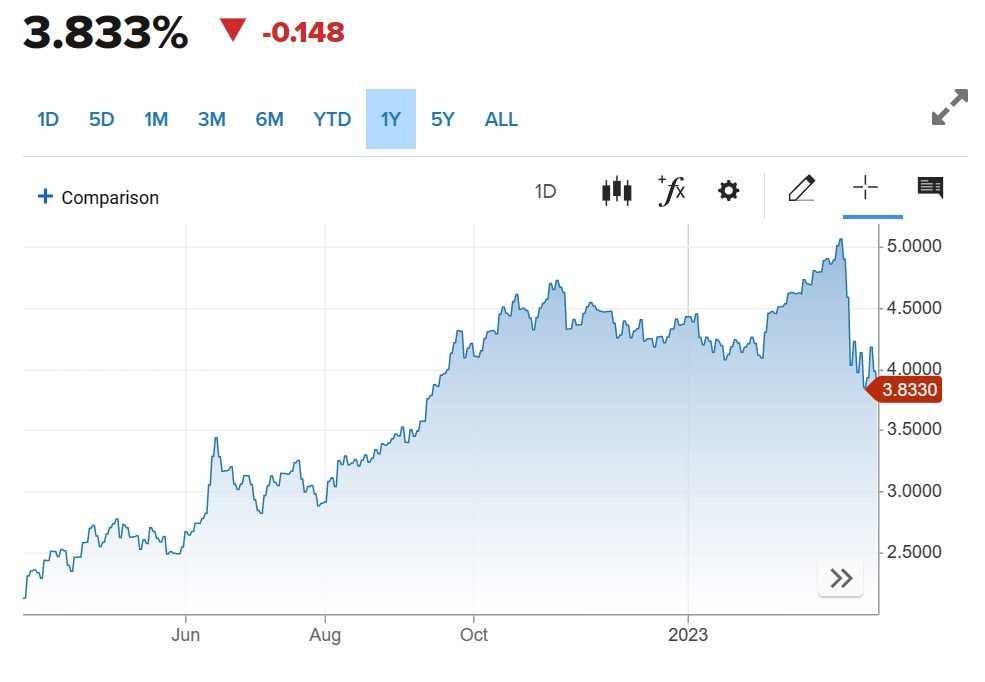

The Fed raised interest rates yesterday, forecasts one more increase this year, and ruled out rate cuts, but the markets are not satisfied. The rates on US Treasury bonds continue to decline as investors anticipate one more Fed rate rise followed by a pause, however still think cuts may come. The yield on 2-year bonds declined nine basis points to 3.833%, while the yield on 10-year bonds dipped one basis point to 3.422%.

2-year Treasury yield chart, source: CNBC

Facebook, Apple, Microsoft, and Google pulled down from session highs but remained positive. The big corps managed to gain more than 2%, except Apple, which gained 0.7%. The S&P 500 climbed 0.3%, while the Dow Jones gained 0.23% and the Nasdaq surged 1%.

The dollar is not enjoying the current market

The Dollar Index which measures the greenback’s value relative to a basket of six other currencies, first fell 0.01% to 102.528 after reaching a weekly low of 101.910. Even though the index was able to return to the green 0.24%, it appears that all of its major competitors gained ground.

The Fed raised rates less than the central banks of Switzerland and the United Kingdom. As a result, the pound rose 0.13% versus the dollar to reach $1.22845. Also, the dollar depreciated against the franc and was last worth 0.1% less at 0.916%.

Also interesting: FTSE struggles after BoE hike – future movement uncertain

The Japanese currency also appreciated, with USD/JPY decreasing by 0.57% to 130.69. The Australian dollar halted for the day and closed level with a 0.01% loss. NZD/USD rose by 0.47% vs the US dollar.

The day ends with a mixed performance for the commodity groups

Gold for April delivery finished at $1,995.90 per ounce on the New York Comex on Thursday, up $46.30, or 2.4%, from the previous day’s close. In pursuit of Monday’s one-year high of over $2,015, the benchmark gold futures contract reached a session high just above $2,001.

Following the lead of the yellow metals, silver futures increased by more than 1.5%. The May contract for the precious metal closed at $23.220, a gain of 1.9%.

Crude markets halted a three-day rise and fell as much as 2% on Thursday. Rumours that oil bulls were disappointed that OPEC+ might not announce a larger production cut brought in the bears. WTI crude closed down 94 cents, or 1.3%, at $69.96 a barrel, below the critical $70 support level with Brent crude at $75.21, nearly 2% lower.

Comments

Post has no comment yet.