In a recent report, the Biden administration criticizes cryptocurrencies, saying that the financial system, consumers, and the environment are all negatively affected. On Monday, the Council of Economic Advisers released their annual publication, the Economic Report of the President, which explains the president’s economic priorities and strategies for the coming year.

AI-generated US president Joe Biden, source: Midjourney

In the March 2023 edition, they devoted an entire chapter to the topic of digital assets, detailing the many ways in which cryptocurrencies are harmful and central bank digital currencies (CBDCs) are the way to go. Well, let’s have a look at why it might actually be the opposite.

The beginning of the report

The first part of the digital asset report points to people’s beliefs around the crypto space, explaining that crypto could increase financial inclusion or it could enable fast digital payments. Moreover, people believe cryptocurrencies are actual investment vehicles and offer money-like functions.

Then the report states “the reality of crypto assets,” several pages long. We picked 5 claims from the report that we contradicted which can be seen below.

1. Claim: “Cryptocurrencies are mostly speculative assets”

The report stated, “crypto assets are very volatile, and, hence, highly risky.” Yes, they are very volatile. Bitcoin fell 80% several times. But didn’t also stocks of the biggest banks in the world also collapse and will probably never recover? Silicon Valley Bank, Silvergate, First Republic Bank, and several others might be doomed forever, while Bitcoin always recovered.

Related article: Credit Suisse ends up being bought by UBS for a bargain price

Even the fiat currencies are volatile. The Lebanese pound lost a lot in the last few years against Bitcoin. Reportedly, the currency lost 98% of its value since 2019. The USA, Europe, and most parts of the world experience devaluation of their currencies due to high inflation. The volatility is everywhere. Period.

Bitcoin vs Lebanese Pound chart, source: twitter.com

While there are tons of crypto scams in the world, Bitcoin is the best-performing asset by far. It has a proven track record of 14 years and is still running. While this is not as much as S&P 500 or other stock indices, Bitcoin proved time and time again that it is heading upward in the long run.

“Because they are very volatile, crypto assets can be used for speculation, an investment strategy that seeks to make a profit from short-run trading,” the report explained.

Aren’t stocks or fiat currencies also available for short-term trading? Yes. Almost all asset classes can be traded through derivates, including crypto. The US dollar is traded on the foreign exchange market for speculative purposes as well as stocks. In this sense, crypto is no different.

2. Claim: “Cryptocurrencies don’t perform all the functions of money as USD”

The angle of this view is the only thing that matters. While the government wants to adopt CBDCs, stablecoins are already fulfilling all the needs of a digital currency. There is actually no need to use CBDCs for people. However, the government has a different opinion.

“Cryptocurrencies do not serve, from an economic perspective, as an effective alternative to the U.S. dollar,” the report stated.

There are three primary functions of money:

- As a unit of account which the prices of other items can be compared to

- It serves as a medium of exchange, allowing for the purchase and sale of various goods and services

- It serves as a store of value when there is little to no fluctuation in the purchasing power of a certain amount of currency over relatively short time periods

Although Bitcoin prices fluctuate dramatically, stablecoins solve this issue. The combination of Bitcoin for long-term savings and investing with stablecoins as a means of payment could be all that people need.

Also read: How to invest in Bitcoin?

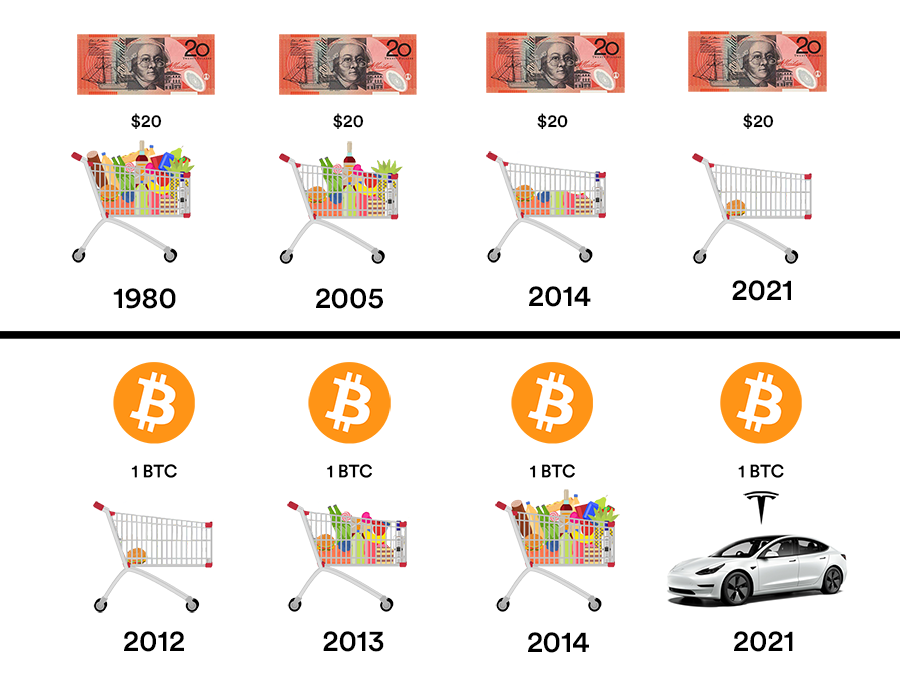

Bitcoin should mainly be used as a store of value, which it is. Moreover, people can use it to compare its price to other items. For example, 1 bitcoin ten years ago could buy an iPhone. Now it can buy a car. So, cryptocurrencies don’t perform all the functions of money, they do even more. Bitcoin is a protector against inflation as it is a deflationary asset.

Examples of the purchasing power of Bitcoin vs fiat money, source: twitter.com

3. Claim: “Crypto asset mining as a risk to the environment”

Crypto mining consumes a lot of energy, that’s true. However, by October 2022, Bitcoin has reduced its carbon dioxide equivalent emissions to 48.88 metric tons from the previous year’s level of 59 metric tons. This level is gradually falling, which is becoming better for the environment each year.

You should also read this: What is the difference between cryptocurrency mining and staking?

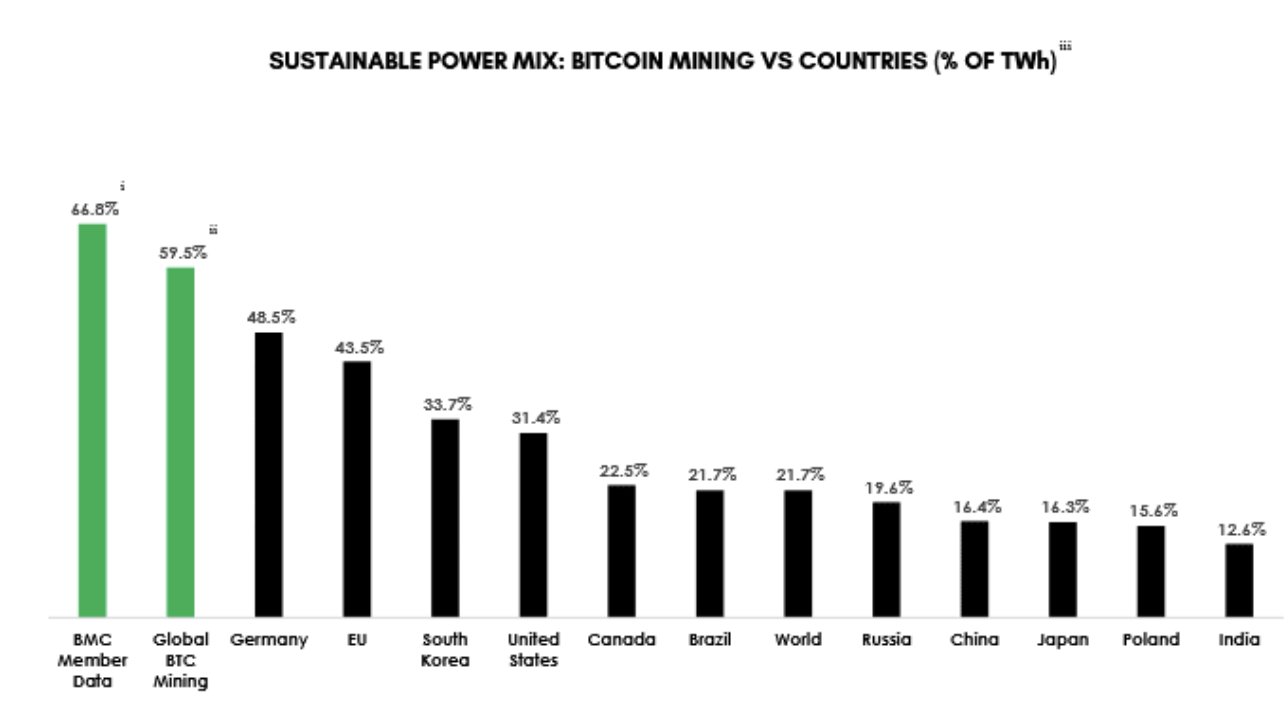

Moreover, the Bitcoin mining industry sees one of the highest percentages of green mining. In other words, sustainable energy is used a lot for Bitcoin mining. So while the report focused on the high consumption of electricity in crypto mining, it forgot to mention how much green energy is used.

“Globally, Bitcoin accounts for 0.42 percent of all electricity usage,” the report said.

According to Bitcoin Magazine, Bitcoin mining uses about 0.15% of the world’s total energy supply, or 253 TWh. The numbers vary from source to source, so it’s not important whether it is 0.42% or 0.15% as the numbers are neglibable. How much green energy is used is important. Reportedly, the Bitcoin network uses a greener energy mix than Germany.

Sustainable power mix, source: bitcoinminingcouncil.com

As a positive indicator of progress, renewable energy now reportedly accounts for 59.5% of the total energy used in Bitcoin mining worldwide. Most people don’t realize this, but there are tons of examples of how mining companies are using sustainable energy to mine Bitcoin.

4. Claim: “There have been limited economic benefits from DLT technology”

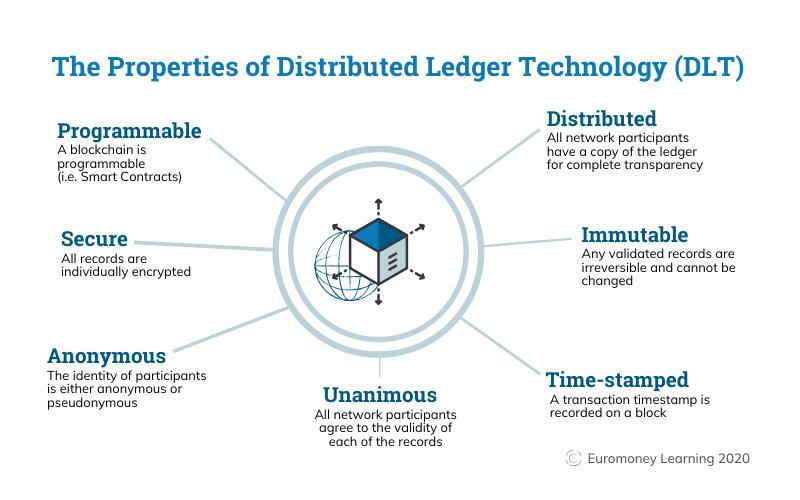

The report explained that DLT’s (distributed ledger technology) success in enabling secure transactions between parties without trusting one another is a significant technological breakthrough.

Consider reading: What is blockchain technology?

This success led to huge excitement and enthusiasm related to DLT technology, with companies wanting to adopt blockchain to profit from the trend. This is true. However, the use cases of DLT are enormous. DLT is more than just the ability to send transactions without the need for a trust party.

Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin use DLT to record transactions, which are open source, and available to see for everybody, at any given time. No transaction can be hidden. DLT can also be used to create immutable and transparent records of goods flowing through the supply chain. This makes it easier to track the provenance of products and identify any issues with quality or safety.

The features of DLT, source: phemex.com

This technology can be used in asset management as well. DLT can be used to create digital representations of traditional assets such as real estate, stocks, and bonds. This can make it easier and faster to transfer ownership rights and settle transactions. Higher liquidity is what can prevent financial markets from severe market crashes.

Moreover, DLT can be used to create self-sovereign digital identities that are secure and private. This can help individuals protect their personal data along with privacy. Obviously, governments do not want people to have absolute control over their finances or data. Needless to say that this technology is still new and many new use cases could be discovered in the future.

5. Claim: “CBDC would have the potential to offer significant benefits”

Okay, CBDCs actually might have some benefits, that’s true. But for who? CBDCs will not reportedly use DLT technology and will rely on a central party – the central bank. CBDCs are essentially the creation of central banks, a new money tool designed to bring them higher control over money.

“It could enable a payment system that is more efficient, provide a foundation for further technological innovation, facilitate faster cross-border transactions, and be environmentally sustainable,” the report stated.

But the world already has a payment system that is very efficient, transparent, and beneficial for its users. Stablecoins like USDT along with USDC and Bitcoin proved to be some of the most-sought financial tools in the world. When banks stop withdrawals, people go to crypto. When banks collapse, people run to crypto. There is no need for CBDCs.

Cryptocurrencies vs CBDCs

If you read through the whole article, you must be wondering about the differences between crypto and CBDC. First of all, there are significant differences between cryptocurrencies and CBDCs, or even stablecoins and CBDCs.

Of course, the government will promote their product – CBDC – which will mainly benefit them. However, they are trying to sell this as beneficial for people, as Bitcoin Magazine showed in their tweet.

NEW: 🇺🇸 Biden Admin publishes report attacking #Bitcoin and Proof of Work mining, while promoting CBDC

"A U.S. CBDC would have the potential to offer significant benefits" 🤡 🤡 🤡 pic.twitter.com/HncUSojnxM

— Bitcoin Magazine (@BitcoinMagazine) March 22, 2023

The sentence “U.S. CBDC would have the potential to offer significant benefits,” just doesn’t sound right. While cryptocurrencies like Bitcoin or Ethereum are decentralized, CBDCs are centralized. That means the government can restrict who can own what, controlling the whole network.

Read more: The threats of CBDCs – why we should not take it lightly

If people start using CBDCs, they can say goodbye to privacy. Everything will be recorded on a private blockchain, allowing the government to have complete control over people’s finances. That is not what people want. Unfortunately, that’s what’s coming.

Final thoughts

While the report had some good points about where people in the crypto industry should improve, I disagree with most of them. However, it also stated, “stablecoins can be subject to run risk.” Yes, stablecoins can crash. They can actually crash the same way as banks did in March 2023.

However, if they have enough capital reserves, like Tether (USDT issuer) and Circle (USDC issuer) have, nothing will happen. Maybe a temporary USDC depeg like recently, but that’s it. Banks? They may have smaller reserves than stablecoins and are more prone to “run risk.” That’s my two cents.

CBDCs versus #Bitcoin @thecryptoc0up1e pic.twitter.com/meePlHgVla

— Bitcoin (@Bitcoin) March 21, 2023

Comments

Post has no comment yet.