The negative trend for the USD continued Thursday, sending the US dollar index to the lowest level since February.

At the March 2023 Federal Open Market Committee (FOMC) meeting, the Federal Reserve (Fed) unanimously opted to maintain its rate rise path of 25bps, the same as in February, raising the Fed Funds Target Rate (FFTR) to 4.75 – 5.00%. This is the highest rate since September 2007.

Dovish decision

Moreover, the decision contained a dovish tilt as the Committee [now] anticipates that additional policy tightening may be necessary to achieve a monetary policy stance that is sufficiently restrictive to return inflation to 2% over time,” which sounded less aggressive than the previous statement that “continuing increases in the target range will be appropriate” (in the February FOMC meeting).

The median terminal rate forecast for the Dotplot remained unchanged at 5.1%. Only one Fed official placed his/her dot below 5%, with most members’ dots converging just above 5%, indicating expectations of at least one more 25-bps hike. In contrast, seven members anticipate 50 to 75 bps of hikes.

Another exciting topic: Oil is recovering before Fed’s rate announcement – will it hold?

Powell also minimized the likelihood of a rate decrease this year, with the dot plot indicating none. Yet, markets reached a different judgment. Following a 50/50 possibility of a last rate rise in May, they anticipate that economic growth would decelerate to the point where the Fed will lower rates by 75 basis points in the year’s second half.

On the banking sector, the Fed noted that the American financial system is robust and solid. However, recent events are expected to result in tighter lending conditions for families and companies, harming economic activity, hiring, and inflation. The magnitude of these consequences is unknown.

The US central bank also reduced its median prediction for real GDP growth this year from 0.5% to 0.4%, indicating that the financial crisis already had a modest effect on economic activity.

As a result of the monetary policy decision, US yields dropped, dragging the greenback sharply lower.

Goldman presents an interesting observation

As financial system pressures threatened to disrupt lending and economic activity, Goldman Sachs researchers analyzed how the Federal Reserve established policy in the past. They examined 1966, 1984, 1994-95, and 1998, excluding severe recessions. They discovered that the central bank softened monetary policy in two of the four instances and delayed tightening in a third.

“Overall, historical evidence shows that the FOMC tends to avoid tightening monetary policy in times of financial stress and prefers to wait until the severity of the situation becomes obvious unless it is sure that other policy instruments would effectively limit financial stability threats,” they said.

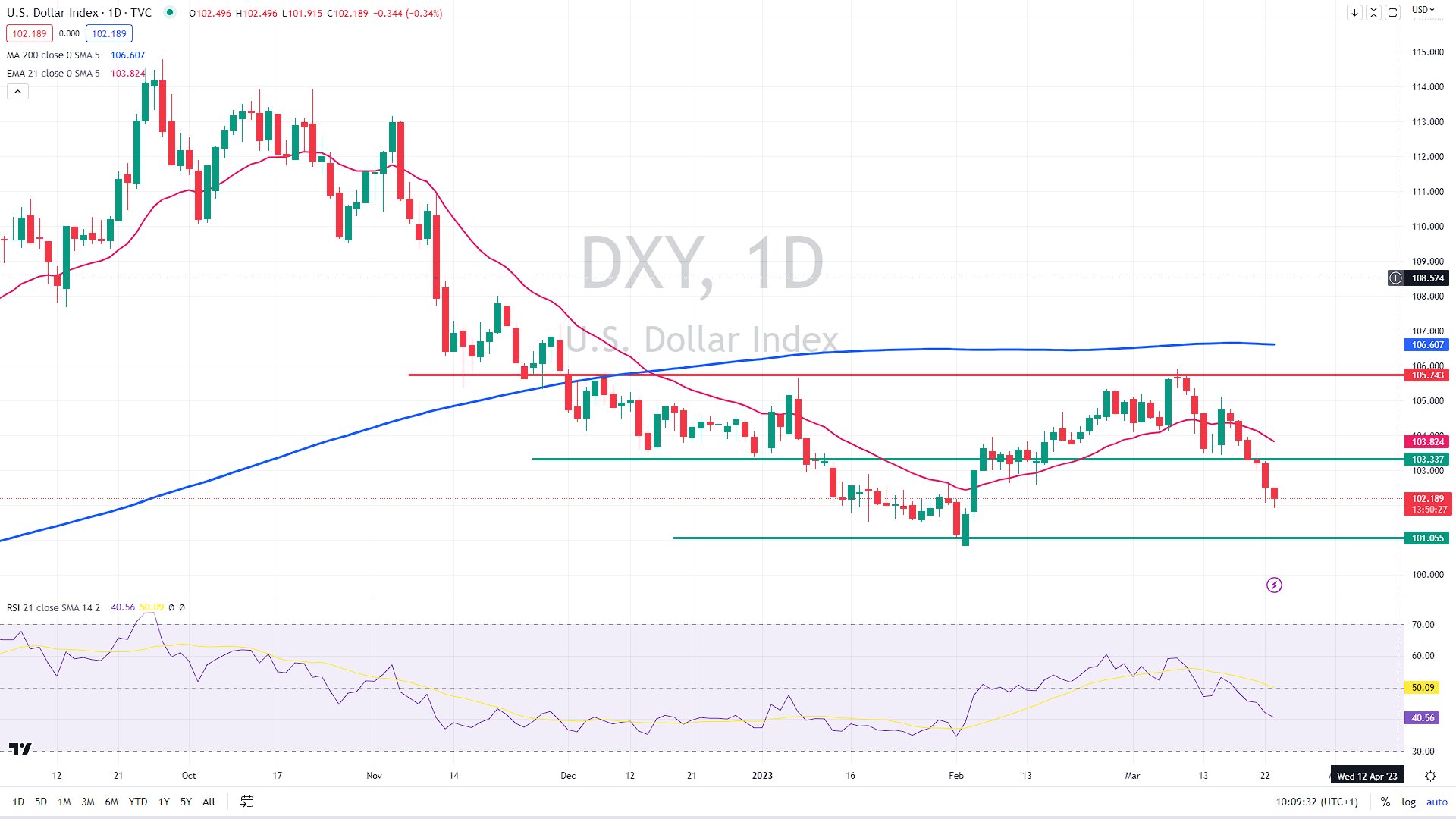

Technically speaking, the price has dropped below 103.30, which was the support of previous lows. Therefore, the bearish momentum was confirmed, likely targeting the cycle lows at 101 now.

Dollar index daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.