Previous asset changes

In the previous week, there was a quite strong market rally after inflation-driven data. However, bonds did not participate in this rally, and the yield curve remains very inverted. Oil continued in free-fall at the start of the week, thus still supporting our thesis of economic slowdown and demand destruction. The fundamental narrative as well as our thesis is well supported by the most current data from the Chinese economy, where house prices, fixed investments, industrial production, and retail sales keep slowing and dropping below consensus estimates. The PBoC also lowered the loan prime rate by almost 100 bps.

Asset movements, Source: Investro Analytics Team

Current anticipations

Many events have been released at the very end of the previous week. In our latest analysis of the S&P 500, we also revealed the inflation breakdown and current expectations. However, we are firmly convinced that the Fed will stay hawkish—despite a potential inflation peak and market expectations about a “soft landing” going through.

You may have missed:

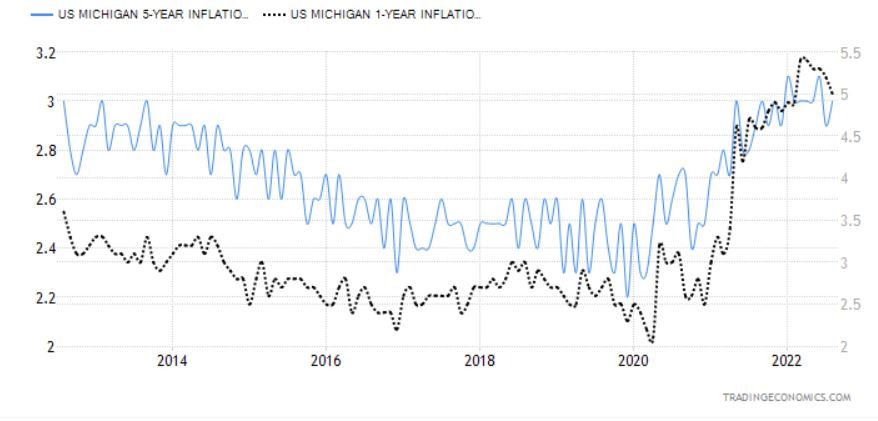

The preliminary results of the U.S. Michigan 5-year inflation expectations as well as 1-year inflation expectations have been released. These indicators are super important for the Fed’s members because they care about long-term inflation expectations, so they contribute to the overall setting of the policy.

The preliminary results of U.S. Mich 5-year inflation expectations came in at a stunning 3.0% in August, far exceeding the 2.8% forecast.

The short-term preliminary inflation expectations measured by U.S. Mich 1-year inflation expectations ended at 5.0% slightly below the consensus (5.1%). That was the reason why the market rallied. The real data will be available at the end of August.

US Michigan inflation expectations, Source: US MICH via tradingeconomics.com

This week’s Fed “warning”

While the market has rallied on short-term expectations, we remain cautious, because the Fed maintains its policy primarily through long-term inflation expectations. These results will not be satisfactory and, despite the lower than estimated CPI report, it is a clear sign that the Fed will not be less aggressive. FOMC members will be more cautious, because they are near the neutral rate. However, in the previous statements from members, they are still revealing information that they are far from their goals on inflation.

Read also: Cryptocurrency exchanges are fighting a crucial legal battle

According to Investing.com, there are many FOMC members speaking and interviews during this week, and we are firmly convinced that they will release a hawkish stance, which could harm the markets:

*FOMC MEMBER WALLER (MON. 10:50AM)

*FOMC MEMBER BOWMAN (TUES. 9:30AM)

*FOMC MEMBER GEORGE (THURS. 1:20PM)

*FOMC MEMBER KASHKARI (THURS. 1:45PM)

*FOMC MEMBER BARKIN (FRI. 9:00AM)

Short covering as the narrative of the market rally

At the very beginning of the following text, we need to emphasize what “short-covering” means. According to fool.com:

“A short cover is when an investor sells a stock that he or she does not own, it is known as selling the stock short. Essentially, short selling is a way to bet that the price of a stock will decline. The way to exit a short position is to buy back the borrowed shares in order to return them to the lender, which is known as short covering. Once the shares are returned, the transaction is closed, and no further obligation by the short seller to the broker exists”.

According to the previous definition, this market rally could be purely interpreted as a short-covering one. The issue is that this is the 3rd strongest short-covering rally in the last ten years. A great contrarian indicator for being short. The market participants have been closing their short positions during the previous week very significantly.

Cumulative 4-week Short trading flow (short-covering rally), Source: GS Prime, twitter

The market believes that a narrative of “soft-landing” will be more probabilistic. As the inflation rate fell below the consensus. However, as we said previously, long-term inflation expectations rose. Because the Fed has a dual mandate, we believe a soft landing will be difficult to achieve. It focuses on inflation and employment.

Read also: Spain plans new gas pipeline link with France

We are convinced that taming inflation will be difficult without taming economic growth (already a technical recession) and keeping employment at current levels. Despite the information that the labour market is currently strong. And to not forget, all in addition to satisfying the market with bond and stock performance. All these inputs are too hard to achieve.

SPY short-sale volume

At the chart, you can see SPY and its short sale volumes are still decreasing. Short sale volumes reached a short-term high in early June. Just compare it to the COVID-19 horizon, or to the 02-03/2022 short sale volumes. The short volumes significantly decreased, thus being a strong contrarian indicator to end bullish positions or to enter a possible slight short position.

SPY and SPY´s short sale volume data, Source: Tradingview

Trading idea

In our previous macro report, we remained still bearish on oil, but halved our position. We also halved our position in bonds, with great maturities and took some profits. We did so because we believed the risk/reward profile was not as good as in previous weeks. In the middle of the week, we revealed a bearish thesis on the SPX, to which we added a short position.

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.