Summary

- The macroeconomic outlook starts to be bullish for bonds, but not for stocks as a further decrease in EPS is expected.

- Leading indicators such as industrial commodities are in big drawdowns and ISM New Orders suggest a slowdown.

- We believe the peak in core inflation figures is behind us. However, if we do not see the next deceleration, the valuation of the S&P 500 is unjustifiably high.

- The market believes in a soft landing. However, it is absolutely questionable because FOMC members are still very hawkish.

- The markets rallied after inflation data, which is all that we were still talking about. However, there is no QE anymore, so we need to be cautious.

- We believe the market is still unreasonably high, given current fundamentals.

In general, the recession is not good for stocks. There are plenty of reasons for that. Consumer sentiment is decreasing significantly, which will impact the companies’ revenues and volumes negatively, as there could be a “demand-freeze”. On the other hand, due to consecutively surging inflation, not only CPI but mainly PPI (Producer Price Index) causes the margin depreciation and tries to shift the additional costs to customers and clients, thus leading once again to lowered demand, if wages do not grow the same.

In summary, EPS, revenues, and profit margins tend to decline. The potential “ease” in monetary tightening is bullish, but mainly for bonds as bonds are not imposed to the same factors as stocks are.

Read also: Forex outlook: GBP/USD, USD/CHF, and GBP/JPY

Macroeconomic Outlook

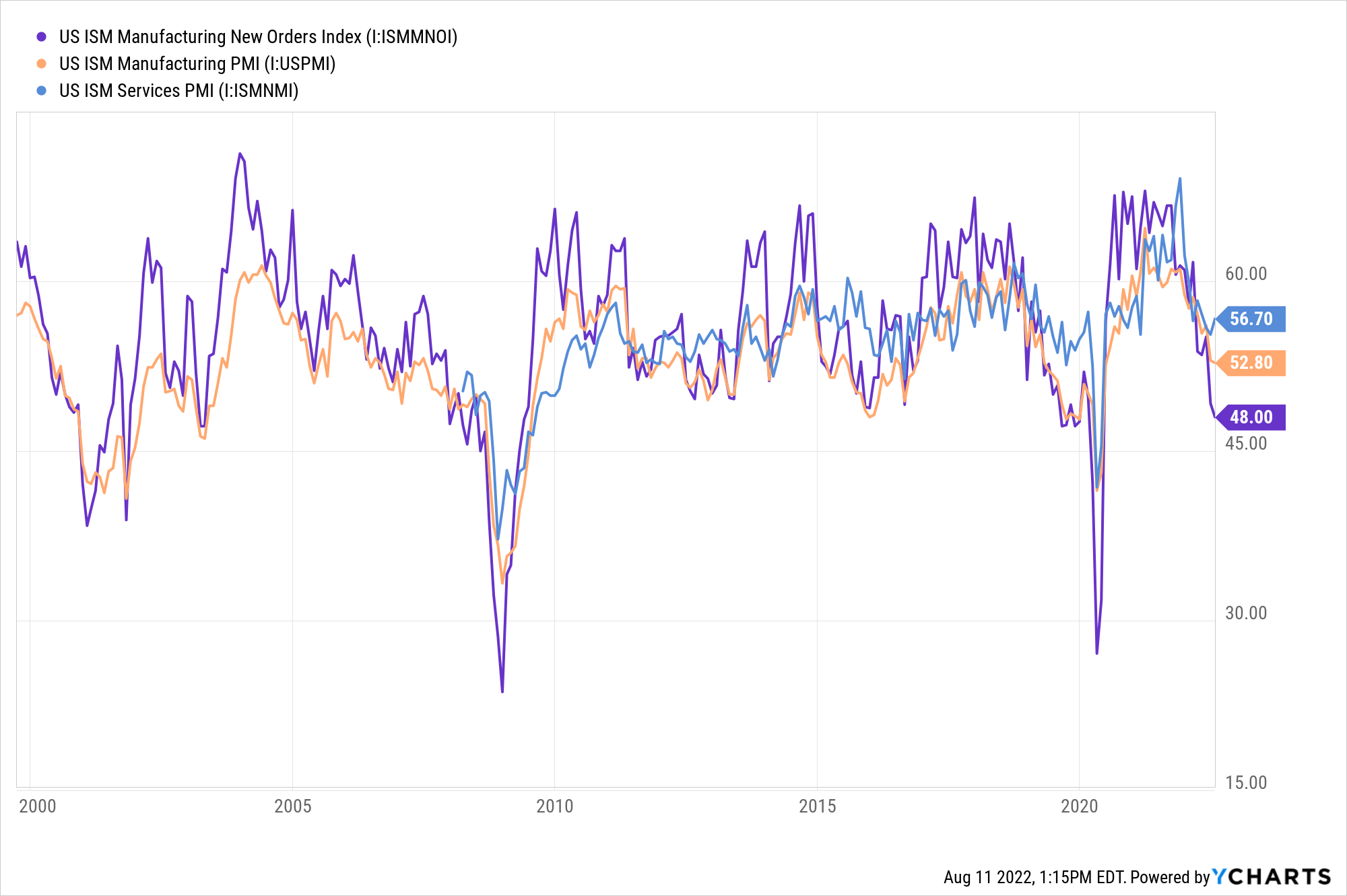

Check our weekly macro reports for the most current macro articles, which drive our opinions. There are several indicators which suggest that the US (as well as the global) economy is facing a slowdown. According to some leading indicators, it is not a recession yet, but according to others, it is. There is a slowdown, but there is no recession at the moment. On the contrary, ISM New Orders suggests we are at 2013-2014 and 2015-2016 lows. There is a contraction, but it is reversible, and the Fed is raising interest rates in such a hostile business environment. It can lead to a recession. However, the situation in Europe is much worse. There is an energy crisis already and it will surely lead to a recession in my point of view. This already reflects the Euro’s weakness.

However, the economy in the USA is mainly driven by services, and manufacturing already faces a solid slowdown, mainly in new orders. ISM Manufacturing PMI’s number as well as Service PMI’s one represent only a slowdown and not a recession yet. However, based on many leading indicators, we expect a further deceleration in PMI both in manufacturing and services.

US ISM Manufacturing (+ New orders) / Services PMI, Source: Investro analytics via YCHARTS

Inflation peaked, but the issue is still not solved

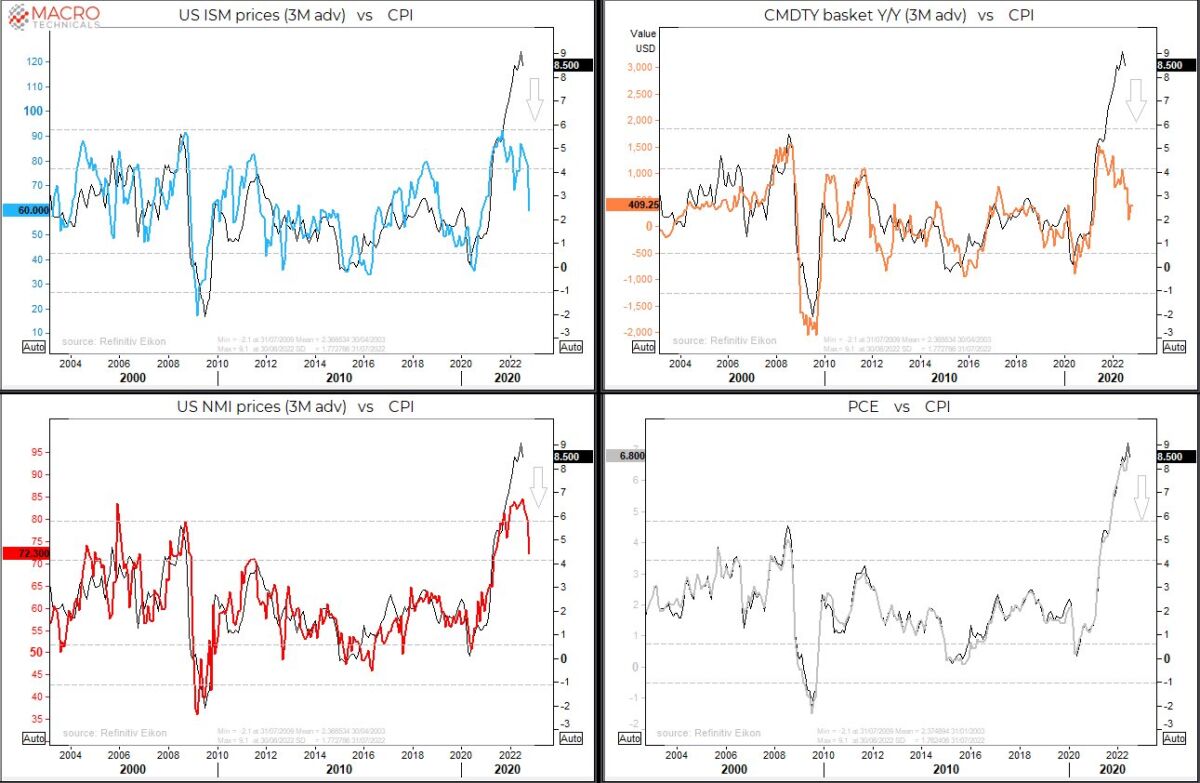

The scenario we mentioned many times in the previous months is that we will see an inflation peak in July–August. It was strongly supported by a massive drawdown in commodities as well as tremendously high inventories of many companies. All these outputs will lead to „selling with a discount” at some point. The moment is still not here, but we are closer.

Let’s dive into inflation numbers a little bit deeper:

Many leading indicators (on inflation) are screaming that inflation will fall, which is, in our view, very likely. The key note here is that the Fed should not stop or significantly ease if they want to be successful in bringing inflation down.

Inflation leading indicators and why it should drop, Source: Twitter via @MacroTechnicals

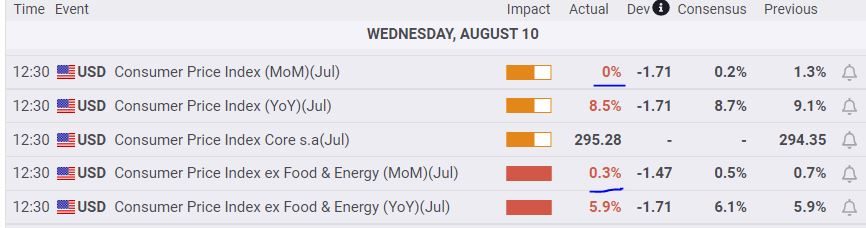

Firstly, the key focus needs to be on MoM inflation changes and not on YoY. YoY is impacted by the “base effect” – a rolling effect that compares Year-On-Year and thus causes the inflation deceleration naturally. So, from this point of view, it will surely decline. However, a stabilization/deceleration or decline trend on MoM is required to confirm that the Fed will ease. Nevertheless, we saw great data, where CPI (MoM) rose 0% and Core CPI “only by 0.3%”.

Economic calendar, Source: Fxstreet

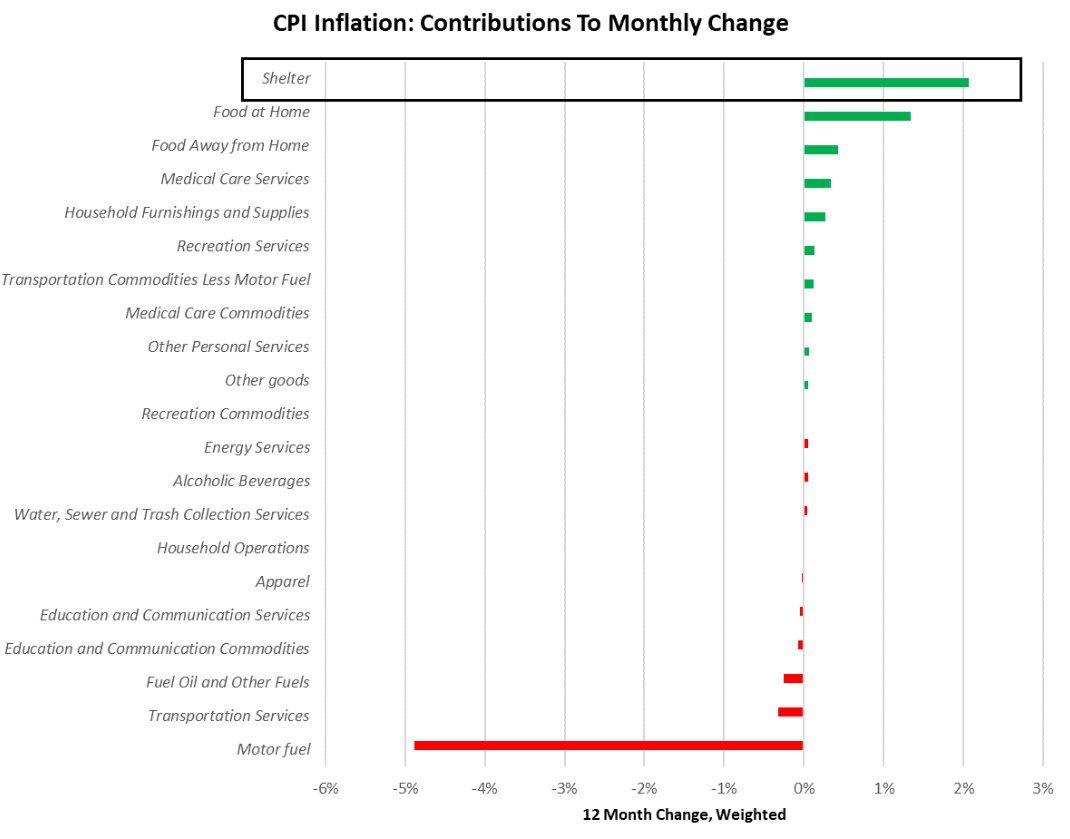

The much more important thing is core inflation, because energy and other volatile products such as food are excluded. Here are the biggest contributors to MoM CPI:

Contributors to Monthly CPI, Source: @MacroAlf

Soft landing?

Motor fuel contributed the most in the negative way, but the inflation spiral can be merely seen in the sections “shelter“, “food” and others, which are the most lagged CPI parts. These are the main contributors that the Fed wants to influence via rate hikes. As they are rising significantly, we are far away from cutting rates (if nothing breaks). We want to mention that the market is expecting a 1x 25bps rate cut (vs. a 2x 25bps rate 2-3 weeks ago) in 2023. Following this report, we can see what one of the Fed’s members, Kashkari, has said:

“The idea that we´re going to start cutting rates early next year, when inflation is very likely going to be well in excess of our target – I just think it´s unrealistic. I think a much more likely scenario is we will raise rates to some point and then we will sit there until we get convinced that inflation is well on its way back down to 2% before I would think about easing back on interest rates.”

According to Bloomberg, he is happy to see inflation’s surprise downside, but the Fed “is far away from declaring victory on inflation.” Kashkari wants Fed rate at 3.9% by year-end, 4.4% by end 2023.

Related: Stocks may fall further despite the inflation drop

This statement, as well as statements of other FOMC members, are very important and give the market a simple message. We WILL FOCUS ON INFLATION RIGHT NOW and there will not be any easing as soon as the market currently prices in.

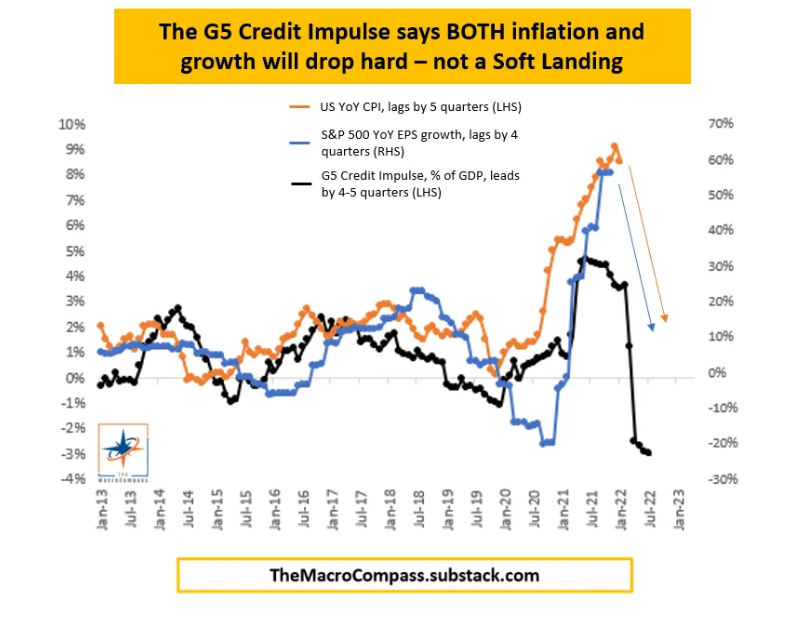

G5 Credit Impulse and impact on EPS and inflation, Source: @MacroAlf

S&P500 brief thesis

However, as the stunning @MacroAlf chart shows, there is a strong correlation between the leading G5 Credit Impulse and the slightly lagging S&P 500 EPS growth (lags by 4 quarters) and inflation (lags by 5 quarters), implying that more pain is on the way and the G5 Credit Impulse is stretched. EPS and inflation should follow, which also confirms our thesis and lowers the likelihood of soft-landing. The absolute opposite of what the market currently prices in.

We can also be wrong. This is a 0–2 month trading idea. However, we have been right on bonds as well as oil. We also focused on stock picking analysis such as MercadoLibre (which is up 30-40%) as well as another e-commerce player in Europe – Zalando (also up 30-40 %, since our analysis had been released). We were wrong at our DAX trade, hit the idea and the momentum, but SL had been activated.

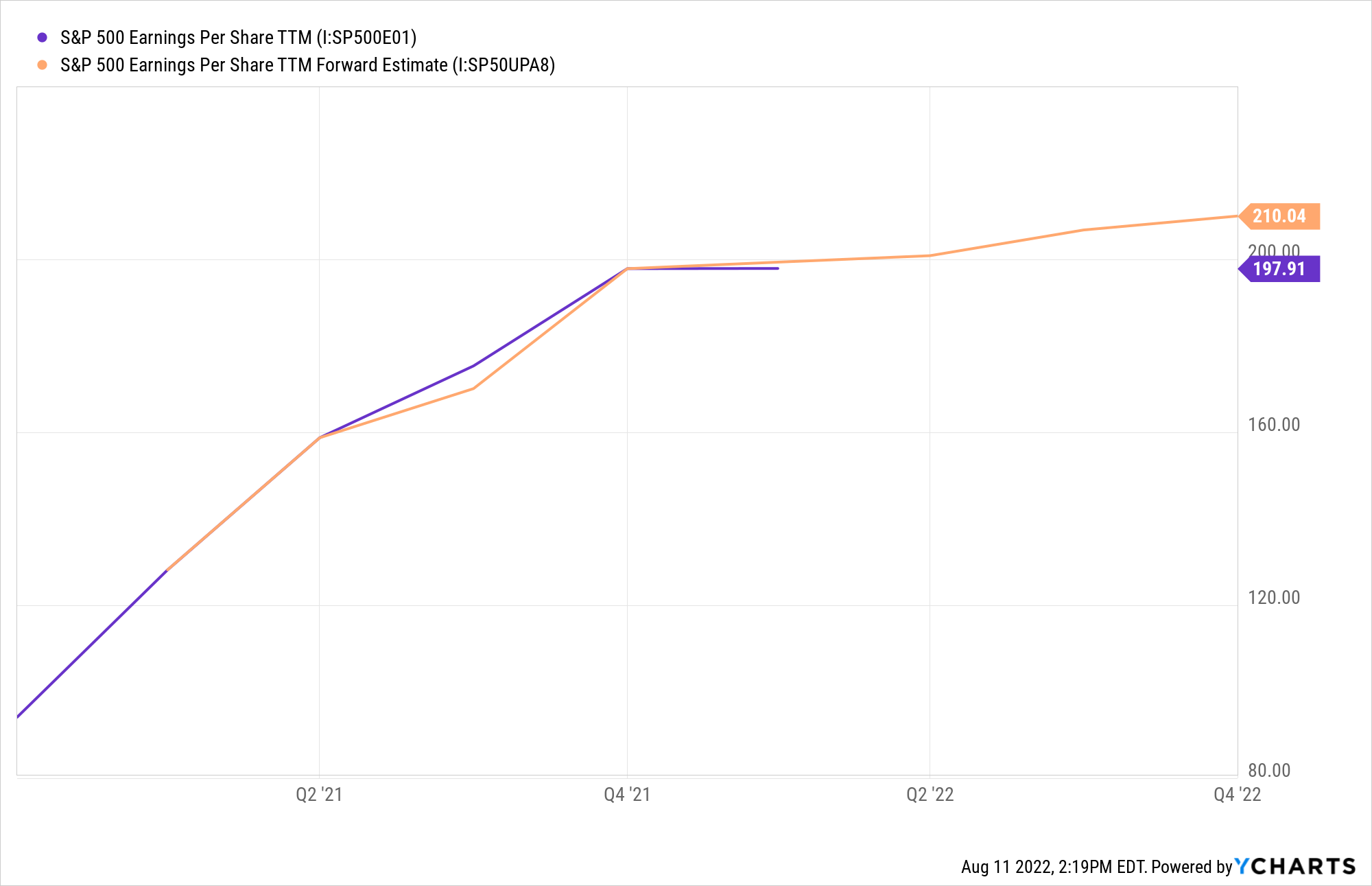

S&P 500 Earnings and Forward Earnings Per Share TTM, Source: YCHARTS

One of the key narratives is that current forward EPS projections are too bullish and expect quite a strong rise in 2022 and 2023. This is not the correct way, and in the case of strong consumer demand destruction as well as rate hikes, we firmly believe EPS could not rise significantly, but stagnate or even decline. Our thesis also confirms worsening macroeconomic indicators, which are not fully priced in.

You may also like: Crypto outlook: Ethereum, Litecoin, and Algorand

From a technical point of view, we believe it could be a good entry here. The S&P 500 tested the 50% Fibonacci retracement and reacted negatively. In the case of contrarians, the 40-day (mid-term) deviation from the EMA is near 5%, which is also historically quite strong resistance line, and the S&P tends to reverse in such areas. Also, VIX broke through the support and is unexpectedly low near 20. Under current circumstances, it gives us a better sense to be on the short side. It is better to go on this trade with SPY puts. However, if you do not have the opportunity to trade options, you can enter a simple short here, with a 3.5% SL from 4210 and TP at 3.5% – 5.0%. Profit should be taken near 3065-3995.

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.