The USD/JPY pair continued to advance today, rising half a percent during the Frankfurt session and jumping to two-month highs.

Japanese macro update

Earlier in the day, Uchida, the Bank of Japan’s vice-governor candidate, indicated that modifying the 2% inflation target is impossible, saying that it is too early to seek an exit from monetary stimulus now.

Investors also paid attention to Japanese data today. Japan’s industrial production decreased by 4.6% in January, compared to -the 2.6% predicted and 0.3% previous gain. On the other hand, seasonally adjusted MoM Retail Trade growth was 1.9%, compared to 1.1% before and -0.2% market projections.

You may also read: Is gold going to hold a crucial $1,800 level?

Investors now anticipate the February Conference Board consumer confidence survey, due later in the day. In addition, the US economic agenda will also include the Trade Balance for January.

The US Census Bureau said on Monday that Durable Goods Orders fell 4.5% on a monthly basis in January, contrary to market expectations of a 4% decrease. In addition, further US statistics reported that Pending House Sales increased by 8.1% in January.

Fed’s expectations shifted

Indications for more Fed policy tightening continue to support rising US Treasury bond rates and boost the US dollar. As a result of persistently strong inflation, the markets are confident that the US central bank would maintain its hawkish position for an extended period of time.

The higher US PCE Price Index reported last Friday confirmed the expectations, indicating that inflation is not decreasing as quickly as anticipated. For example, a month ago, investors had expected two rate cuts in H2 of 2023, which is not the case anymore.

Another interesting topic: What should happen for Bitcoin to reach $10 million per coin?

Moreover, the Governor of the Federal Reserve, Philip Jefferson, stated on Monday that it is essential to return inflation to 2% in order to allow for sustained economic growth. Reuters also presented hawkish Fed fears by saying that economic statistics this month revealed continued tight job markets and persistent inflation, encouraging Fed funds futures traders to speculate on higher rates, expected to peak in the United States in September at 5.4%, up from 4.58% currently.

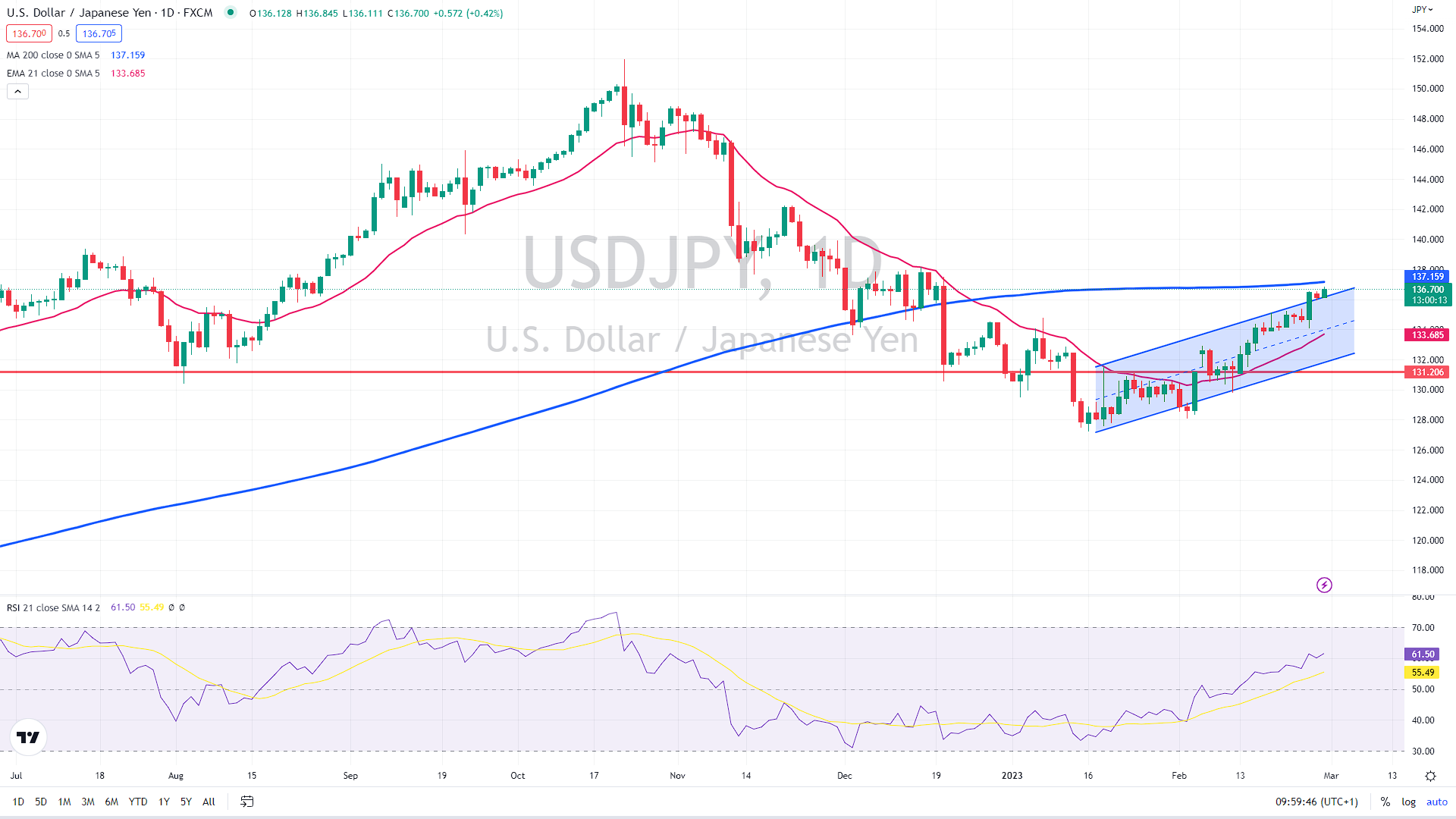

Technically speaking, the dollar is now trading above its uptrend channel, likely targeting the 200-day moving average (the blue line) near 137.20. At that level, bulls could start taking profits, possibly causing a reversal in the short-term direction of the pair. In that scenario, the correction’s target could be in the middle of the channel at around 134.65.

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.