Everyone’s opinion on Bitcoin’s value is different. Some people think it’s zero, some think it’s a million dollars per bitcoin. The reality, however, can be seen in the chart, which, as it currently stands is around $23,300. Four years ago, it was $5,000. But what is the full potential Bitcoin valuation in the future?

Let’s define Bitcoin first

Lawmakers get confused often by cryptocurrencies. Sometimes they call Bitcoin a currency, then a commodity. It’s really hard to define Bitcoin by only using the old methods. Instead, they could simply accept Bitcoin for what it is – a cryptocurrency.

Related article: Stablecoins’ usage will explode with adoption of other fiat currencies

Moreover, Bitcoin has been named “digital gold,” because it’s also a store of value like gold, it is just more volatile in the short run. However, Bitcoin successfully solves gold’s weaknesses. And it is not competing with fiat currencies. Bitcoin is a competitor of assets that serve as a store of value.

Bitcoin’s competition

As a culture, we don’t usually consider markets for things like savings accounts and other forms of liquid assets since we associate markets with places where corporations compete. So, we need to take a step back from trying to fit Bitcoin into a specific industry in order to see that the market for storing value is distinct from the markets in which various types of businesses compete.

In most cases, the economy creates profits that are spent, but some of that value also has to be stored somewhere- in value assets. It’s possible that these assets generate income, but they could also be highly prized for other reasons, such as their practicality, appeal, or scarcity.

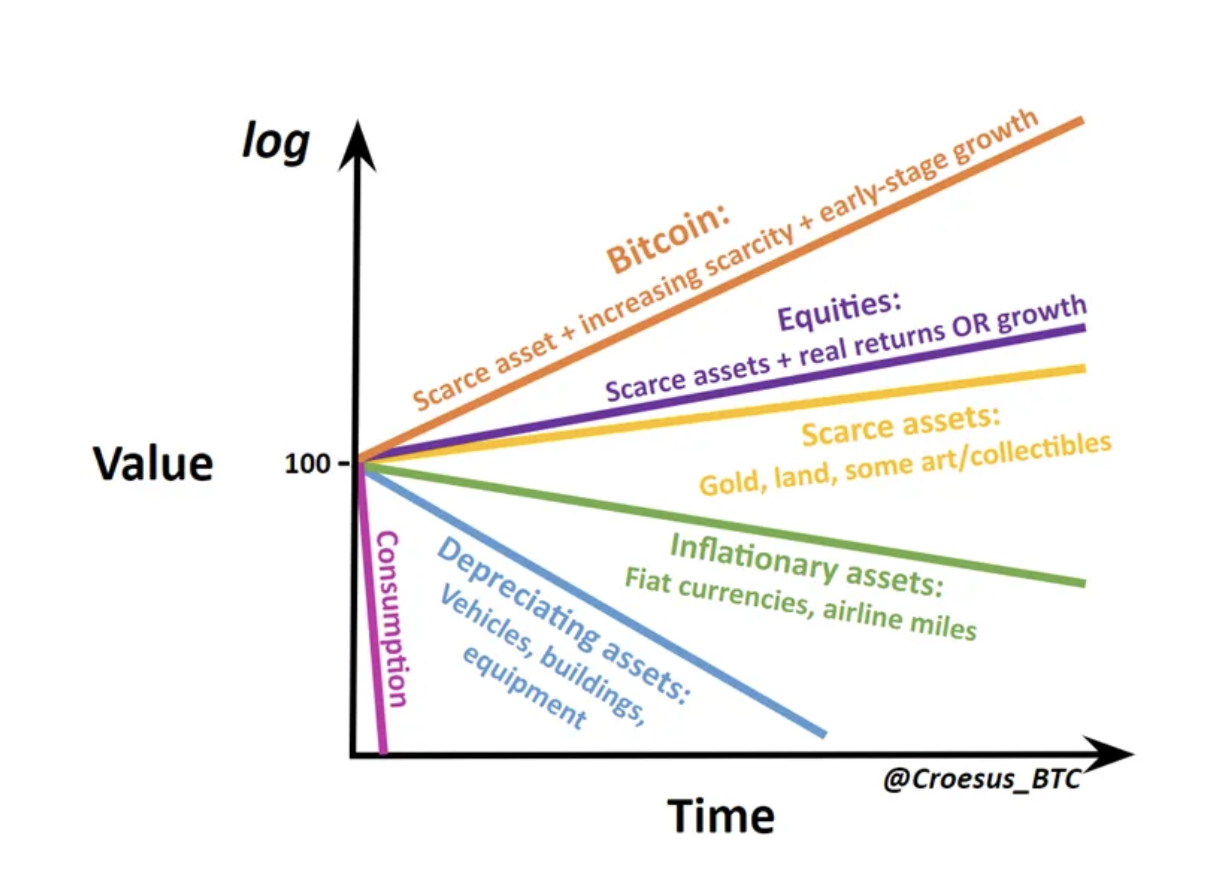

Values and the qualities that make an asset a good store of value depend on a wide variety of factors. The value of certain investments grows over time, while others stay stable or even decline. See the chart below to understand how the value of different assets develops over time.

The value of assets over time, source: jessemyers.substack.com

Gold mining vs Bitcoin mining

Gold mining allegedly adds about 2% per year to the total amount of the precious metal available to the public. For the last century, its supply has increased by 2% per year. This is because miners have long since mined the easiest-to-reach gold deposits, while new technologies have made it possible to reach previously inaccessible ones.

Also read: What do you need to know about crypto trading fees?

The current price of gold requires the world market to absorb roughly $240 billion in new supply annually, despite the fact that there is only $12 trillion worth of gold above ground. Gold’s value is controlled by supply and demand, hence the downward pressure on gold’s price operates like gravity.

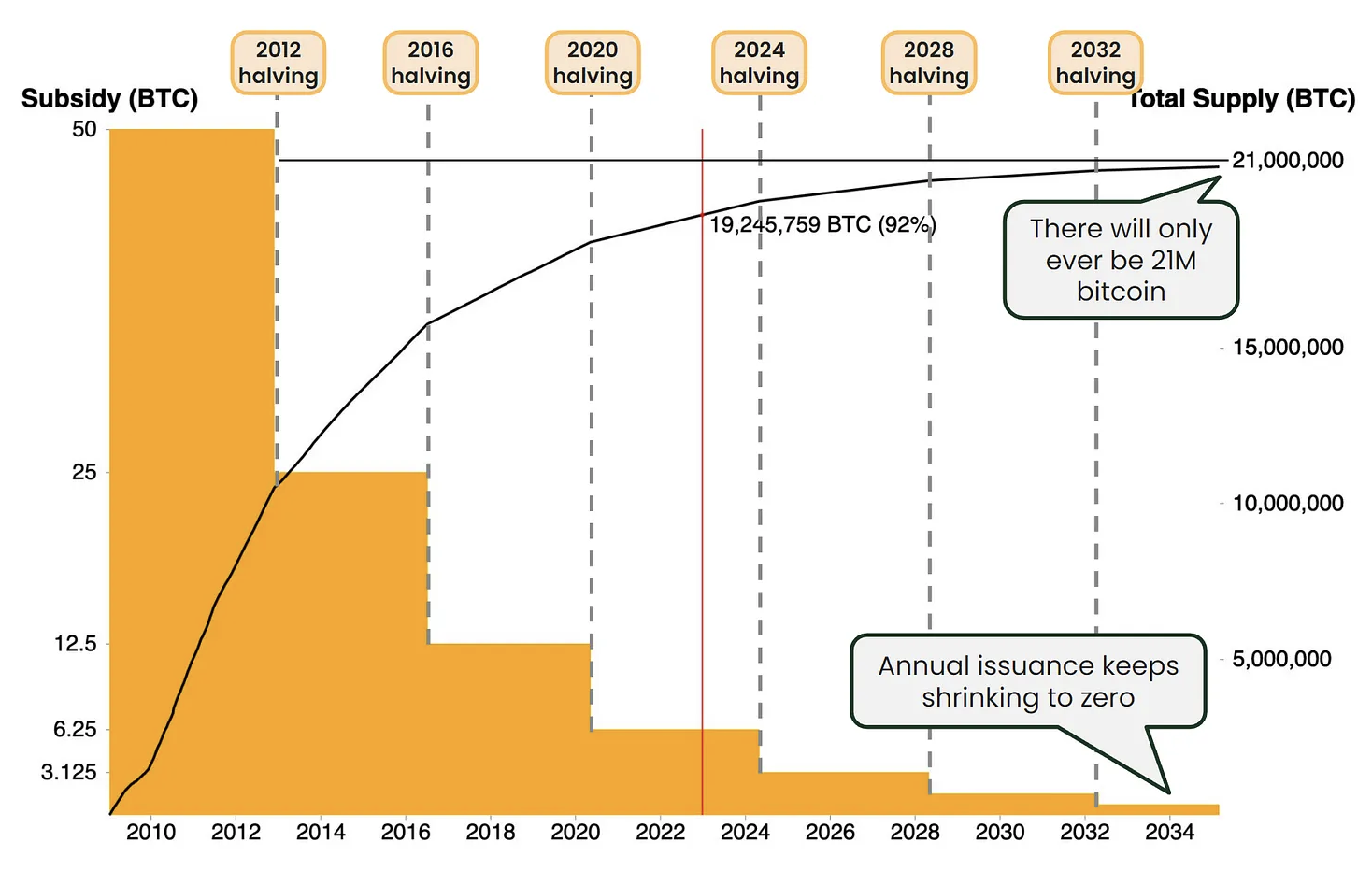

Bitcoin is unique in that every four years, the market can “mine” half as many new coins as it did before due to halving. Growth in 2016 supply was 3.6% per year, nowadays it’s 1.8%, and in 2024, it will be 0.9%. This will go on until all bitcoins are mined, with no one to stop this halving process.

Peter Schiff is a heavy critic of #Bitcoin and for good reason. It's not a store of value like gold is… @PeterSchiff pic.twitter.com/XB2JH4csJX

— Investro.com (@investrocom) January 25, 2023

When it comes to Bitcoin, every four years is like having half of the gravity reduced. As a result, Bitcoin’s price is limited not by the creation of new supply (as is the case with most commodities), but by Bitcoin’s relative attractiveness as a store of value to other assets. Plus, Bitcoin mining is also possible through sustainable energy, which is even more environmentally friendly than gold mining.

Bitcoin’s uniqueness as a store of value

Bitcoin wouldn’t be possible without the internet. When people question the existence of Bitcoin and other cryptocurrencies, they have every right to do so. Society doesn’t yet realize we are currently in the middle of the Digital Revolution – the time when cash is slowly but surely dying, and the future is digital. Stablecoins, CBDCs, or cryptocurrencies – all of them will play a major role in the economy.

In the digital world, copying and pasting has always been possible, even before Bitcoin. Ultimately, it’s just data. With Bitcoin’s digital scarcity, nobody can generate more than 21 million of these coins, making it the system’s central innovation. That’s how other cryptocurrencies or even non-fungible tokens (NFTs) display scarcity as well.

Bitcoin’s fundamental principle is that there will always be a maximum of 21 million coins in circulation (absolute scarcity). Moreover, they will be issued into circulation at an ever-decreasing rate (increasing scarcity).

Bitcoin’s halving, supply, and other calculations, source: jessemyers.substack.com

Bitcoin is an increasing store of value while gold is good for storing it. Bitcoin’s concept of rising scarcity makes Bitcoin’s stored value more precious over time; all that has to be done is surviving Bitcoin’s painful volatility.

This runs counter to the dollar’s intended function, as the currency’s supply can rise exponentially via money printing only to erode the savings even more rapidly in the future. The dollar’s architecture makes it a poor store of value, which is why most people put their money into the stock market or real estate instead.

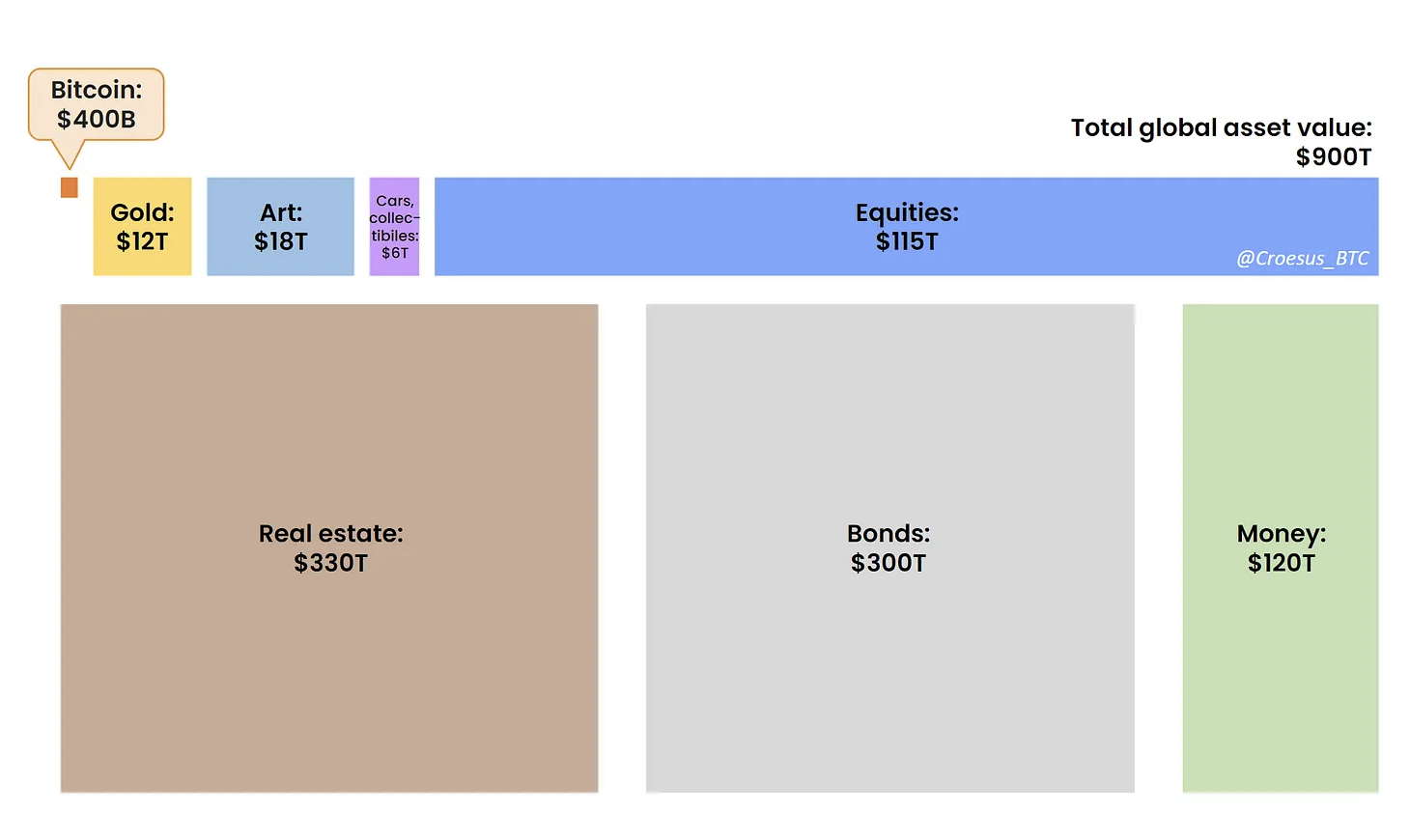

Bitcoin’s market cap vs other assets

Bitcoin’s market cap vs other assets, source: jessemyers.substack.com

The picture above depicts how much wealth there is in the world in different asset classes. As of now it is approximately $900 trillion. Bitcoin is obviously a tiny part of that, which could potentially increase by a lot in the future. But the question is how much? And when?

It would be possible to transfer all of the value now held in a non-Bitcoin asset into Bitcoin. People just need to come to the conclusion that Bitcoin is a better investment than their current ones. People will continue to prefer Bitcoin as a store of value asset as long as it offers the most appealing features among investable assets.

Also read: Seven simple investment strategies to make steady returns

In a rough calculation, as of right now, only 0.05% of all available capital is in Bitcoin – around $0.4 trillion out of $900 trillion. If Bitcoin jumped by 20x to almost $500,000 per bitcoin, it would still only be 1% of the market cap out of all assets. If the market continues to grow at a fast pace as it has been doing for the past few years, this is an achievable number.

Final thoughts

To assume that everyone will make the conscious decision to switch to Bitcoin is naïve. Expecting Bitcoin to retain a 0.05% allocation on the global balance sheet is also unreasonable. According to Croesus, Bitcoin’s price could reach up to $10 million per bitcoin in the upcoming decades, adjusted for inflation.

Then Bitcoin would make 25% of all asset’s value, while it is just 0.05% nowadays. In five years? That may sound like a joke. But in 50 or 100 years? It might actually happen if Bitcoin keeps running higher every couple of years.

Comments

Post has no comment yet.