Q1 bank results weigh down stocks

US equities fluctuated throughout Tuesday’s trading session due to yet another packed schedule of earnings. These came from banks including Goldman Sachs and Bank of America. Growth in stocks was also hampered by problems in big tech.

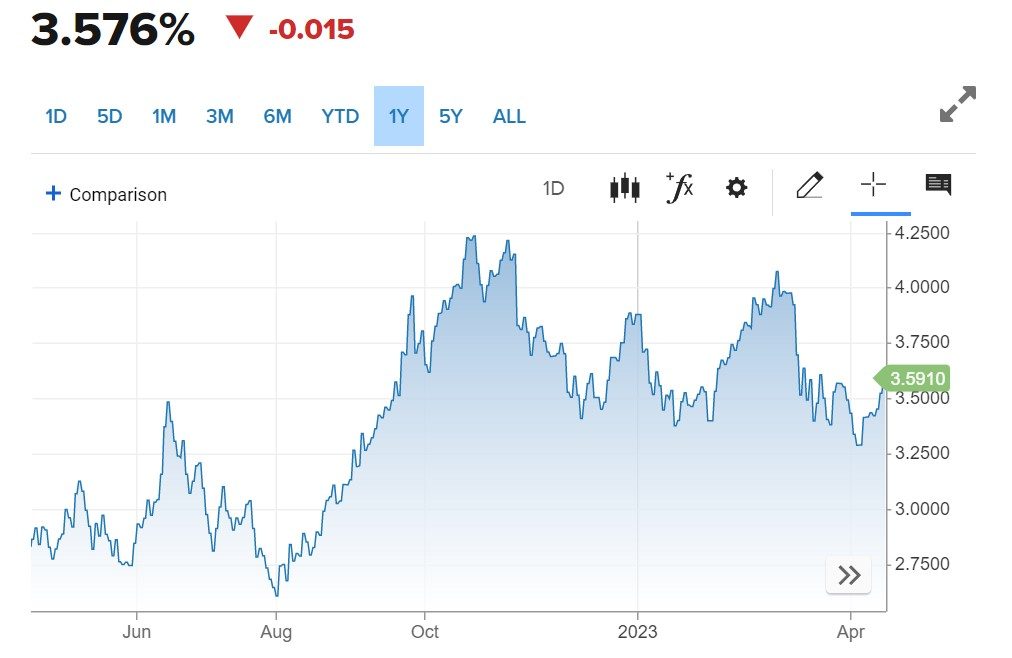

The Nasdaq concluded unchanged, the Dow Jones was unchanged or down 10 points, and the S&P 500 ended 0.1% higher. Government bonds came in mixed. On Tuesday, the yield on the 10-year note decreased to 3.579% while the yield on the 2-year note increased to 4.218%.

US 10-Y yield chart, source: CNBC

After the Wall Street behemoth revealed Q1 revenue that missed forecasts due to the sale of loans to consumers in its consumer company Marcus, Goldman Sachs saw a more than 1% decline. Due to a 25% increase in net interest income as a result of an increase in interest rates, Bank of America announced an improvement on equally the top and bottom numbers.

More to read: Apple marries Goldman Sachs to bring 4.15% to its users

While Wall Street downplayed the possibility that the search engine giant may lose Samsung as an associate, big tech gave up gains. Google led the loss for the second day in a row. According to a Monday New York Times article, Samsung was considering switching from Google to Microsoft’s Bing on its smartphones.

News from China sends the dollar lower

The US dollar is losing some of the gains it made after hitting a year-low. The greenback has lost ground after posting significant gains versus its key competitors over the previous two trading days.

Fears of a worldwide economic downturn appear to have diminished in light of China’s positive macro data reports. As a result, the US dollar is struggling to draw in buyers as a safe haven.

You can listen to: #4: How to trade earnings season with Andrew Aziz

After covid limits were lifted, the world’s second-largest economy had GDP growth of 4.5% year over year in the first three months of the year. These statistics indicated exceeding expert predictions of a 4% increase.

Despite closing over 102.00 on Monday, the US dollar Index started to decline and ended the day below 101.50. The euro had a 0.38% increase to $1.0968 following two days of more than 0.5% daily falls. With a daily gain of 0.43%, the latest price of sterling was $1.2427.

Oil holds the line as gold regains some value

Tuesday saw minimal movement in oil prices as positive economic statistics from China, the world’s second-largest oil consumer, countered worries that potential hikes in US interest rates may slow growth in the world’s largest oil user.

West Texas Intermediate crude futures ended the day up 3 cents, or 0.04%, at $80.86, while Brent crude ended up 1 cent, or 0.01%, higher at $85.25 a barrel.

You may also like: Do you need to be rich to invest in real estate?

Gold is attempting to maintain its $2,000 level. At $2,019.70, gold for June delivery finished up $12.70, or 0.6%. Comex’s most active gold contract reached a session top of $2,024.45. Some traders pay more attention to the spot price of gold than futures since it represents actual bullion trading and reached an intraday high of just under $2,012.

On the dot, silver futures for May delivery settled at $25.300. The price of the white metal increased by 0.85% at this point.

Comments

Post has no comment yet.