Regarding profitability, there are many things to consider to make your analysis proper. We will make it simple in our case studies (Paypal and Alibaba), but first, we need to point out our crucial drivers theoretically.

Profitability analysis will help you understand how a business grows and what opportunities are available. Companies (management) and investors must evaluate the ability to stay competitive and make money. And maybe to take lessons from the past and transform them into the future.

Profitability comes from generating a profit. As absolute terms are essential for investors, relative terms are too. So, as we have said in other chapters, we strongly suggest keeping an eye on the trend for every ratio we look at. However, the important note here is that many ratios will differ and change during the many phases of the business cycle in a company.

Here are the most common and essential ratios, which we will analyse:

- Return on Total Assets (ROA)

- Return on stockholders’ equity (ROE)

- Return on Invested Capital (ROIC)

- Earnings Per Share (EPS)

- Dividend per Share

For margin ratios, we will apply the calculation of these:

- Gross Margin

- EBITDA Margin

- EBIT Margin

- EBT Margin

- Net Income Margin

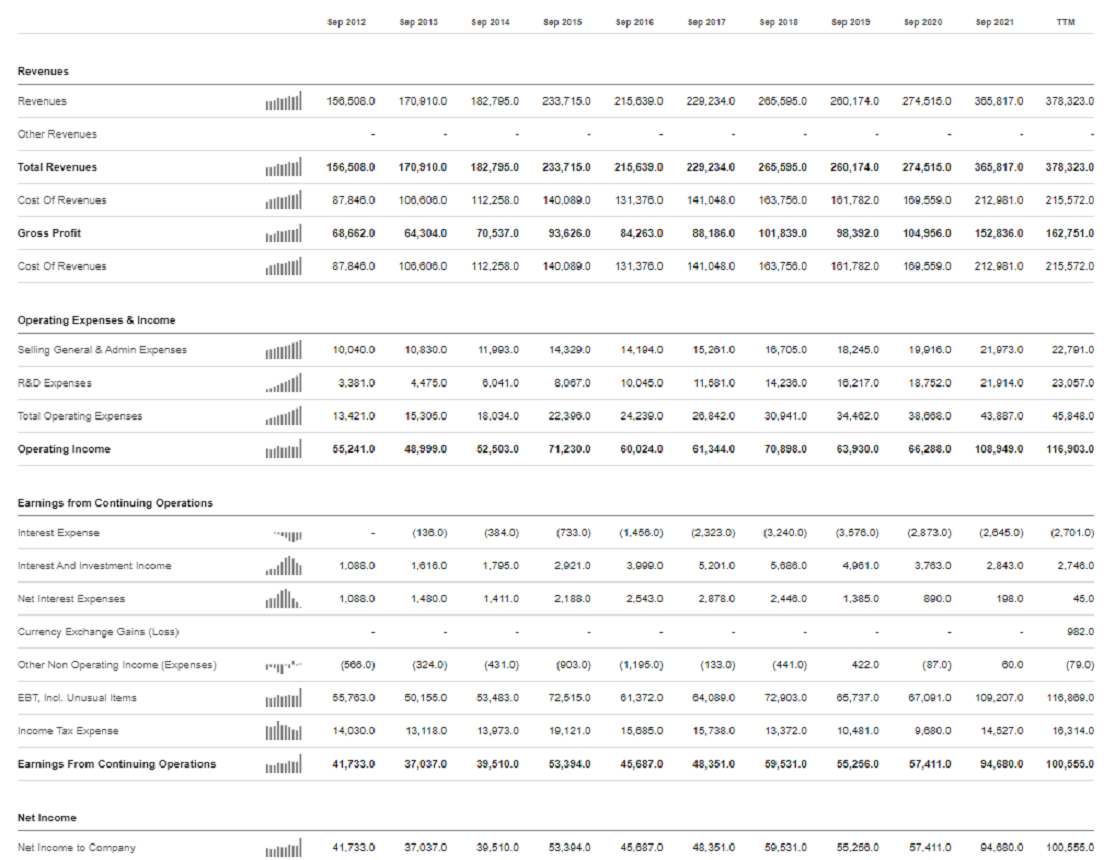

To achieve logical steps and simplify all the processes, we would like to start with margins. Margins are probably considered the most critical ratios, which will reveal the profitability point of view of the analysed business at first glance. The best way is to start with a P&L Statement (entirely random from Seeking Alpha) to analyse all the margins and with the following steps.

Source: Apple Inc. (AAPL) Financials: Income Statement | Seeking Alpha

The table above represents Apple’s P&L Statement. Let’s start with gross profit and gross margin. What is gross margin? According to Investopedia: “Gross margin is net sales less the cost of goods sold (COGS). In other words, it’s the amount of money a company retains after incurring the direct costs associated with producing the goods it sells and the services it provides. The higher the gross margin, the more capital a company retains, which it can then use to pay other costs or satisfy debt obligations. The net sales figure is gross revenue, less the returns, allowances, and discounts. ”

The best scenario for every business is achieving as high as possible sustainable margins. To start with gross margin, we first need to calculate gross profit. We can quickly calculate it as Gross Profit = Total Revenue – COGS (Cost of Goods Sold) or, in this case, Cost of Revenue. The sense of Cost of Revenues and COGS are the same in this case, just replaced with other words. When we calculate the gross profit, we can easily calculate the gross profit margin expressed as a percentage of revenue. Gross Profit Margin = Gross Profit / Total Revenues.

Comments

Post has no comment yet.