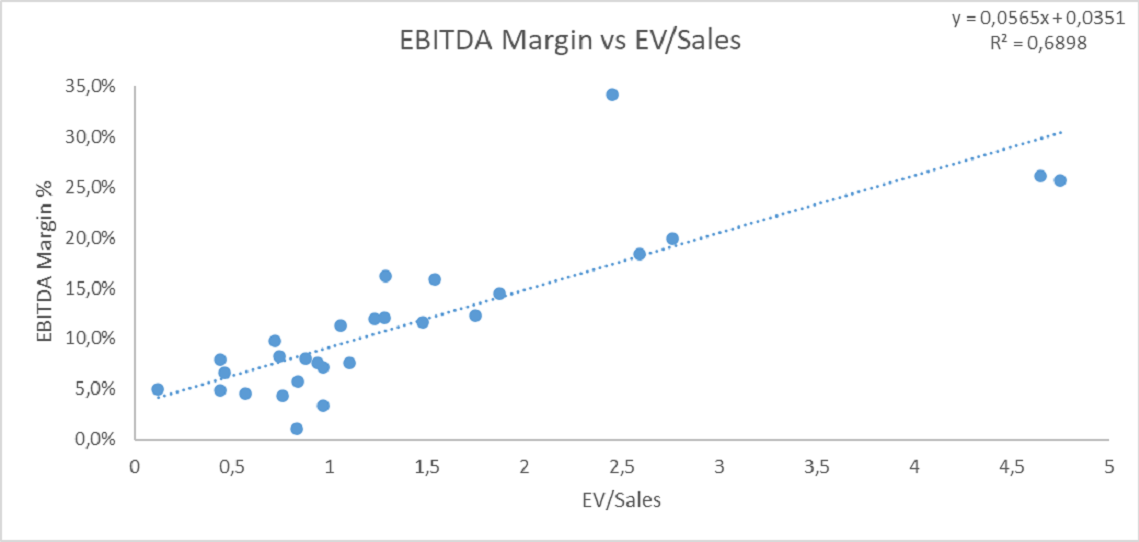

The chart below is excellent. It compares the relationship between EV/Sales (great valuation multiple) and EBITDA Margin among the companies in a selected industry (Construction Machinery and Heavy Truck Stocks).

The chart implies that there is a linear relationship between EBITDA margin and EV/Sales valuation. In other words, the higher the EBITDA margin, the higher the multiple (EV/Sales) for the company.

However, keep in mind that the trend will be similar in every sector, so it can be considered as general knowledge. On the other hand, the real results of calculations and regressions will be different in each sector. This chart could help us in more detail if we compared some of the stocks from the selected industry.

Industry: Construction Machinery and Heavy Trucks Stocks

Source: Author´s calculations (as of 03/2022)

The next step is to calculate or search for the median or average valuation (multiple) in the sector. Do your own research, download the multiple datasets (Finviz, Seeking Alpha) from many companies, and do some statistics. After this, you can set an average and median for such multiples in a sector or industry: P/E; One Year Forward P/E; Two Year Forward P/E; P/S; One Year Forward P/S (if possible); P/B; P/FCF

As we stated in the previous text in the Balance Sheet section, we highly recommend you do the same with balance sheet ratios as well as with profitability ratios (margins, ROA, ROE, ROI, ROIC, etc.). Always do a comparison. It is important to justify your results. You need to compare your results to find out if the company you analysed is under or overvalued over its peers, and why. Where is the advantage? Can we justify the higher valuation (based on profitability) and why? Did we find something great among the peers, something really cheap?

Here is a good point to compare ROA, ROE, and ROI. The higher the better. V, MA, and PYPL have very great metrics in these ratios. Let’s explain it deeper:

Comments

Post has no comment yet.