A great investment principle is to invest in companies where is a lack of competition, because such companies can generate great cash flows as well as have great margins. As a reward, the market evaluates these companies with higher trading multiples (P/E, P/S, and P/B). Do not lose your mind just in case the company trades with a deviated multiple. There can be reasons for that, f.e. great business, high margins, lack of competition, and others. However, always compare a company with its peers. I will do it with margins:

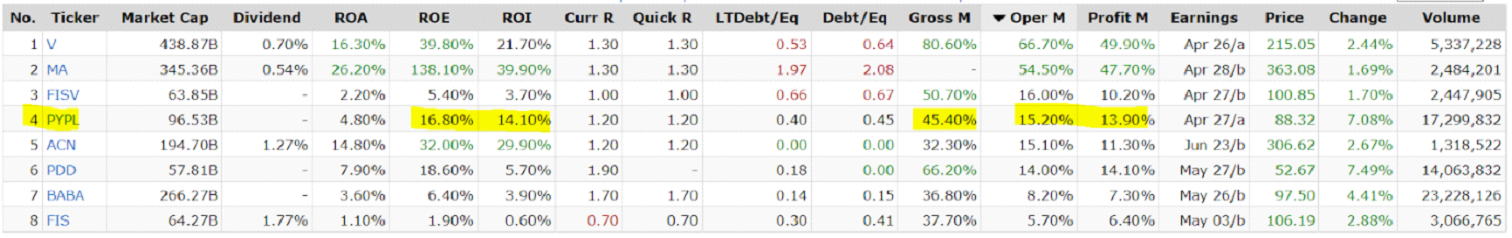

You can see here main Paypal’s competitors and its indicators/data:

Source: Finviz (Balance sheet data as a Current Ratio, Quick Ratio can differ because we concluded from previous data. Current statistics refer to the most current data.

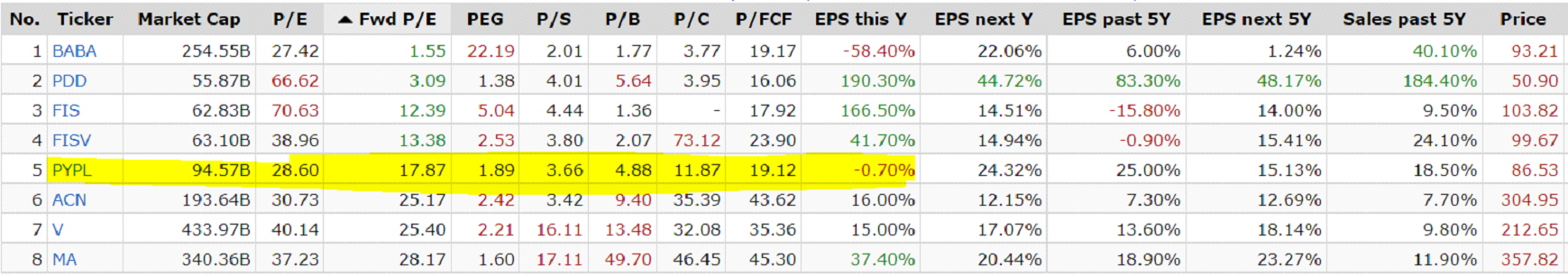

From a profitability point of view, Visa (V) and Mastercard (MA) are clear winners from this comparison. Look at its great ROA/ROE/ROI and operating margin, which are so significant (V and MA). They will trade with higher multiples such as P/E, P/S, P/B, etc. Check it here:

Source: Finviz (Balance sheet data as a Current Ratio, Quick Ratio can differ because we concluded from previous quarter data. Current statistics refer to the most current data.

It is as simple as that. Check the details below. Compare the operating margin and valuations. As we have said, companies with higher margins tend to trade with higher multiples (higher valuations). It is really unbelievable that Visa (V) and Mastercard (MA) have 67% and 55% operating margin, respectively. Without considering the other factors, check the company’s multiples. These companies have very high multiples:

- For Visa (V), the gross margin is 80%, the operating margin is 67%, and the net profit margin is 50%.

- P/E = 40

- Forward P/E = 25

- P/S = 16

- P/B = 13 (It isn’t accurate to evaluate companies in selected industry with P/B).

- In summary, all these multiples are deviated from normal or industry average so far, but it is logical as the market justifies it as a cash cow and fast & stable growers.

- It’s a great company to add to the watch list and for further research.

- For Mastercard (MA): GM = unknown (check SEC 10K); OPM = 55% and NPM = 48%.

- P/E = 37

- Forward P/E = 28

- P/S = 17

- P/B = 49 (It isn’t accurate to evaluate companies in selected industry with P/B).

- In summary, all these multiples are deviated from industry average so far, but it is logical as the market justifies it as the cash cow.

- Great company to add to the watch list and for further research.

- For Paypal (PYPL): GM = 45%; OPM = 15%; NPM = 14%.

- Margins are generous despite it is not an industry leader.

- P/E = 28

- Forward P/E = 17,8 (Great for such company)

- P/S = 3,6

- P/B = 4,8.

- Multiples are down due to macroeconomic events, high company´s beta and turbulence inside the company (revised growth guidance downwards). However, the company is still great and should grow significantly.

- As the company’s shares dropped 60-70%, there could be a great opportunity, but seek further research.

- For Alibaba (BABA): GM = 87% ; OPM = 8% ; NPM = 7%

- Nevertheless, Alibaba is not a similar company (but will provide financial services). These margins are absolutely wonderful for companies operating in similar sectors (internet and direct marketing retail).

- First look valuations are amazing:

- P/E = 27 (high).

- Forward P/E = 1.5 (there will be an issue and seek further research). Despite this, this number will be low as big incomes are expected in 2023.

- P/S = 2 (great).

- P/B = 1,7 (great).

- Great “first look” data for further research.

This is not a valuation for selected companies. We can consider it a “first look” and decide whether we want to analyse the company deeper or not. Whether we want to add it to our watchlist or not, we just wanted to show you the relationship between trading multiples and the margins. On the next chart, we will show you the linear relationship between EBITDA margin and valuations in a random sector. We really recommend doing a similar analysis each time you want to invest in the company, to find the fair value or the difference between the company’s multiples and industry ones. To understand the relationship, I will briefly explain enterprise value from a valuation point of view.

Comments

Post has no comment yet.