EBITDA is net income (or profit) adjusted for interest, taxes, depreciation, and amortization. Because it excludes the impacts of financing and capital expenditures, EBITDA may be used to examine and compare profitability across organizations and sectors. EBITDA is frequently used in valuation ratios, bank also is very crucial for banks.

Interest payments are added back to net income. This cancels out the cost of debt and the taxation effect on the company´s profitability. When a company’s net income isn’t very outstanding (or even positive), subjects tend to focus on its EBITDA performance. It’s not usually a sign that the market is being manipulated on purpose, but it can be used to distract investors from the fact that they aren’t making any real money.

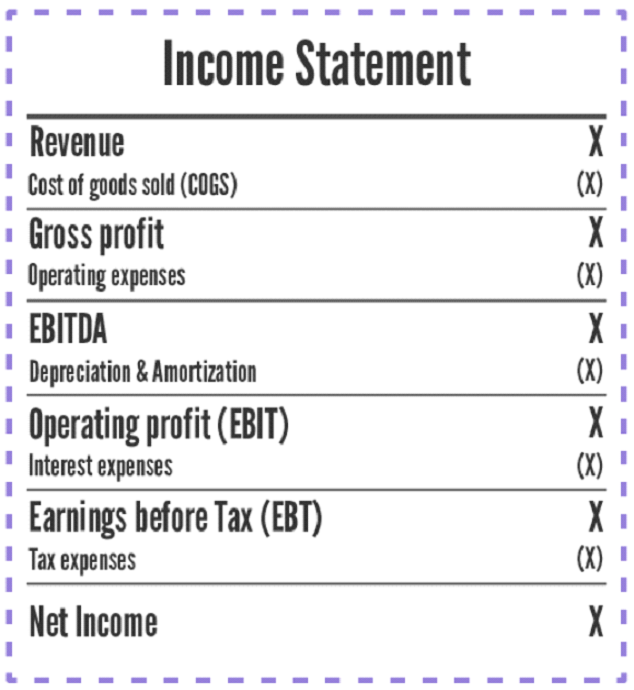

EBITDA is defined as operating profit plus depreciation and amortization. It’s simple to figure out: Revenues-COGS-Operating Expenses (Variable Costs) + D&A = EBITDA. However, also depends on accounting standards. Many times is calculated as Revenue – COGS -Service costs and – Labour costs.

EBITDA is an important metric for any subject, including banks (EBITDA/Debt) and investors. It is one of the most important ways to judge a new company or a startup in its early stages. If you want to calculate Cash Flows, you’ll also need to have an EBITDA. The EBITDA margin is easily computed as EBITDA/Revenues.

Furthermore, the EBITDA margin is critical for valuation. The higher the margin, the higher the valuation premium investors are able to accept. We’ll go over it in further detail in the valuation section (in the next course), but there is a strong link between EBITDA margin and valuation or transaction in private equity or venture capital. In the financial market, the same idea can be implemented. Companies with higher EBITDA margins tend to trade at a higher multiples (valuation) than those with tiny margins.

Source: 365 finance

Comments

Post has no comment yet.