Whether to own or rent a home is one of the most important financial choices among young adults’. This is a difficult call, including several aspects, such as financial stability, lifestyle choices, and future ambitions. Traditionally, house ownership has been viewed as a sign of achievement and security. Nevertheless, younger generations are increasingly preferring to rent.

Owning a house versus renting a house

Homeownership is a substantial financial commitment. It involves a substantial down payment, consistent mortgage payments, property taxes, and upkeep fees. Yet, house ownership also has some advantages.

Over time, homeownership develops equity, which can be utilized as collateral for loans or as a retirement fund. Also, it gives stability and a sense of ownership, which may be advantageous for families and individuals, who intend to settle down in one location permanently.

You may also like: What is a REIT?

On the other side, renting allows greater flexibility and independence. For example, tenants are able to relocate without having to sell a home or be concerned about property values.

In addition, they have fewer maintenance obligations and may rely on landlords to manage repairs and maintenance. Nevertheless, renting does not develop equity, and renters are at the whim of landlords who can increase rent at any moment or cancel contracts at will.

Renting vs. owning calculator

There are internet tools available for comparing the prices of buying vs. renting to aid with this decision. These calculators account for a wide range of factors, including the down payment, mortgage interest rates, property taxes, insurance, and maintenance expenses.

Also, they weigh the possibility of house value increase and investment returns. Using a calculator to compare renting versus buying, helps consumers evaluate which choice is more financially feasible for them.

The stance of the young generation

72% of millennials (born between 1981 and 1996) and 76% of Generation Z (born between 1997 and 2012) favor renting over house ownership, according to a recent Apartment List poll. Many things can be linked to this mindset change.

Don’t miss: What is a 60/40 investment portfolio?

Initially, younger generations tend to value travel and experiences above homes. As opposed to being tied down to a particular area, they favor mobility and the opportunity to move around freely. This is particularly true for young professionals just beginning their careers and may be required to relocate frequently.

Second, the growing cost of housing has made it challenging for younger generations to purchase a home. In recent years, property values have soared, but incomes have remained flat. As a result, homeownership has become unattainable for many young individuals, particularly those in pricey cities.

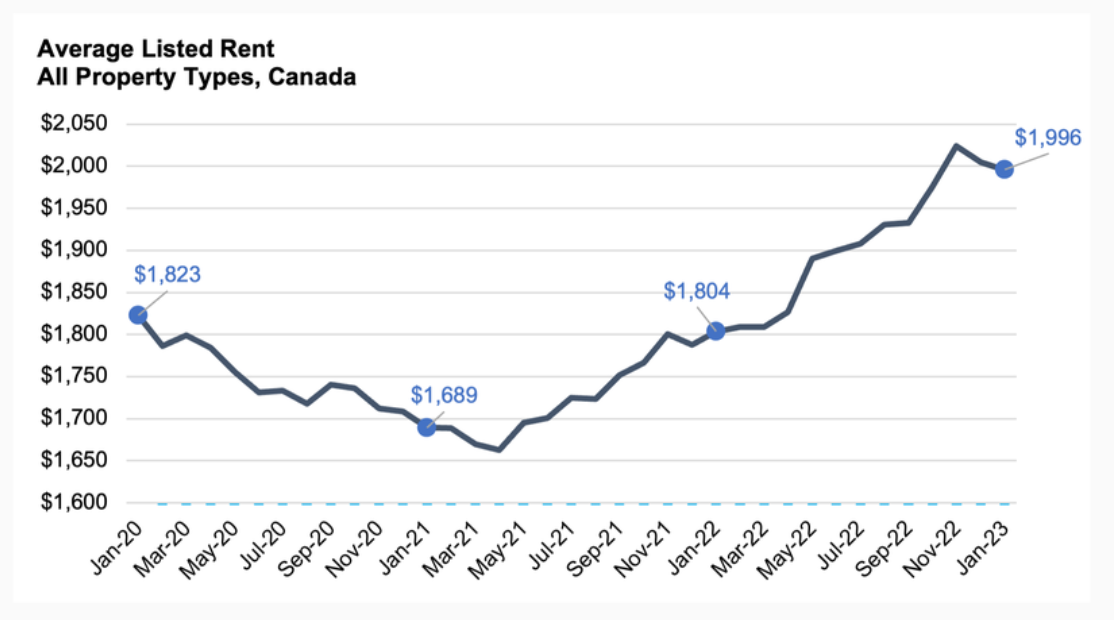

Canadian rent average chart, source: rentals.ca

Lastly, younger generations are increasingly ecologically sensitive and may want to rent in eco-friendly, low-carbon-footprint buildings. Common features of these structures include green roofs, solar panels, and energy-efficient appliances, which minimize energy usage and utility costs.

Conclusion

In conclusion, the choice to purchase or rent a house is personal and influenced by various circumstances. While house ownership brings security and equity, renting provides greater freedom and less financial obligations. In addition, due to lifestyle choices, worries about price, and environmental awareness, younger generations increasingly prefer renting rather than owning. Ultimately, the decision between renting and buying should be based on an individual’s situation and objectives.

Comments

Post has no comment yet.