The 60/40 portfolio, which consists of a 60% allocation to stocks and a 40% allocation to bonds, has been a popular investment strategy for decades. The concept behind the 60/40 portfolio is to achieve a balance between growth and stability, as stocks have historically provided higher returns over the long term but are also more volatile than bonds. On the other hand, bonds have lower returns but offer more stability and can help reduce overall portfolio volatility.

Some examples of 60/40 portfolios

- 60% in a low-cost S&P 500 index fund and 40% in a US Treasury bond fund

- 60% in a total stock market index fund and 40% in a corporate bond fund

- 60% in a mix of US and international equity ETFs and 40% in a US Treasury bond ETF

However, in recent years, there has been some debate about whether the 60/40 portfolio is still relevant. A key concern is the low-interest rate environment, which has reduced the expected returns of bonds. Additionally, with interest rates at historic lows, there is a risk that rising rates could lead to significant losses for bond investors. This has led some investors to question whether bonds are still an effective way to balance a portfolio and reduce risk.

Read also: Key element of balance sheet – The Shareholders Equity

Markets change from time to time

Another factor to consider is the changing nature of the stock and bond markets. The stock market has become more correlated in recent years, with stocks from different regions and sectors moving in sync. This has reduced the diversification benefits of stocks and has made it more challenging for investors to achieve a balanced portfolio. Additionally, the bond market has become more complex with the rise of new financial products such as exchange-traded funds (ETFs) and corporate bonds.

Despite these challenges, the 60/40 portfolio is still widely used and can be an effective strategy for many investors. A vital advantage of the 60/40 portfolio is its simplicity, which makes it easy for investors to understand and implement. Additionally, by allocating a significant portion of their portfolio to bonds, investors can reduce their exposure to market risk and potentially minimize losses in down markets.

You may also read: Should gold be in your investment portfolio?

There are alternative approaches to the 60/40 portfolio that investors can consider, such as a barbell strategy, which involves investing in both long-term and high-yield bonds, or a balanced fund, which automatically adjusts the allocation between stocks and bonds based on market conditions.

Terrible results in 2022

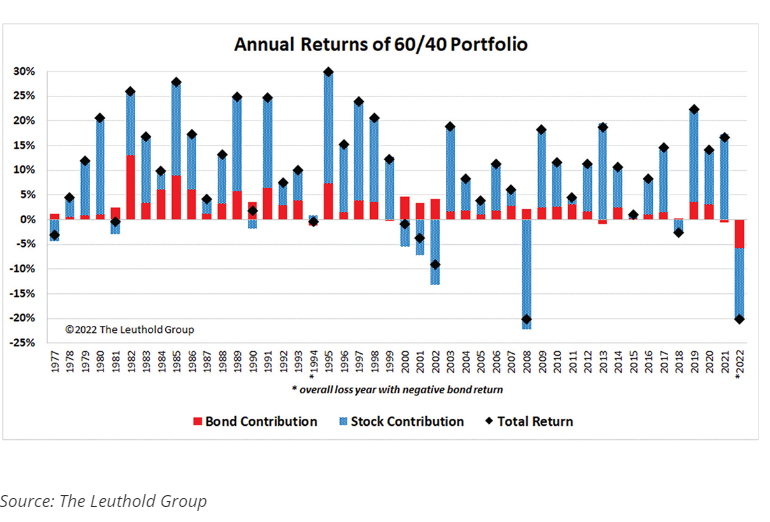

In 2022, a 60/40 mix between the S&P 500 index and the Bloomberg US Aggregate Bond Index would have suffered a 16% loss. According to Vanguard, it was the portfolio’s second-worst performance since 1976, behind 2008’s minus 21% performance. According to BlackRock, returns for 60/40 portfolios averaged roughly 7% between 1999 and 2022.

The Federal Reserve raised short-term interest rates seven times in 2022, from almost 0% to a target range of 4.25% to 4.50%, a phenomenon that has never occurred before. This resulted in a decline of 13% for the Bloomberg US Aggregate Bond Index, its worst performance since its creation in 1976 (yields move in the opposite direction of bond prices).

One more year of double-digit bond losses seems unlikely. As the Fed continues to raise interest rates, short-term interest rates might increase in the coming months. According to futures markets, though, rates should peak around 5% by summer. This should aid in the stabilization of bonds, enabling investors to redeem coupon payments without being pressured by declining prices. If inflation continues to decline until the end of 2023, rates may even decline, resulting in capital appreciation in bonds.

60/40 portfolio performance, source: planadviser.com

Conclusion

In conclusion, the 60/40 portfolio remains a popular investment strategy and can be a suitable option for many investors. However, it is essential to consider the current market environment and to reassess one’s portfolio regularly to ensure it is still aligned with their goals and risk tolerance. Additionally, investors can consider alternative strategies or seek the advice of a financial advisor to help them achieve their investment goals.

Comments

Post has no comment yet.