Risk appetite returned

The S&P 500 surged after trimming losses on Thursday as Treasury yields retreated from previous highs. Atlanta Fed’s president Raphael Bostic ruled out supporting a comeback to more vigorous Fed rate rises and predicted a central bank pause by mid-to late-summer.

„Right now, I’m still very firmly in the quarter-point move camp,” Bostic said, in a roundtable with reporters on Thursday.

Initial Jobless Claims fell to 190K, but Unit Labor Cost for the fourth quarter was revised up from 1.6% to 3.0%. By demonstrating prolonged labor market tightness, the data contributed to the likelihood of a more strict monetary strategy than was previously believed. Friday will provide service sector figures.

More to read: What does market cap mean in stocks?

The S&P 500 increased 0.75%, and Nasdaq closed 0.73% in the green. The Dow Jones rose more than 1%. These gains hapened late during the US session.

In other stories, Tesla disclosed efforts to reduce expenses at its investor day on Wednesday. However, the EV giant did not provide an update on its intentions to deliver a more inexpensive electric vehicle, resulting in a more than 6% decline in its stock price.

US dollar resumed its rise

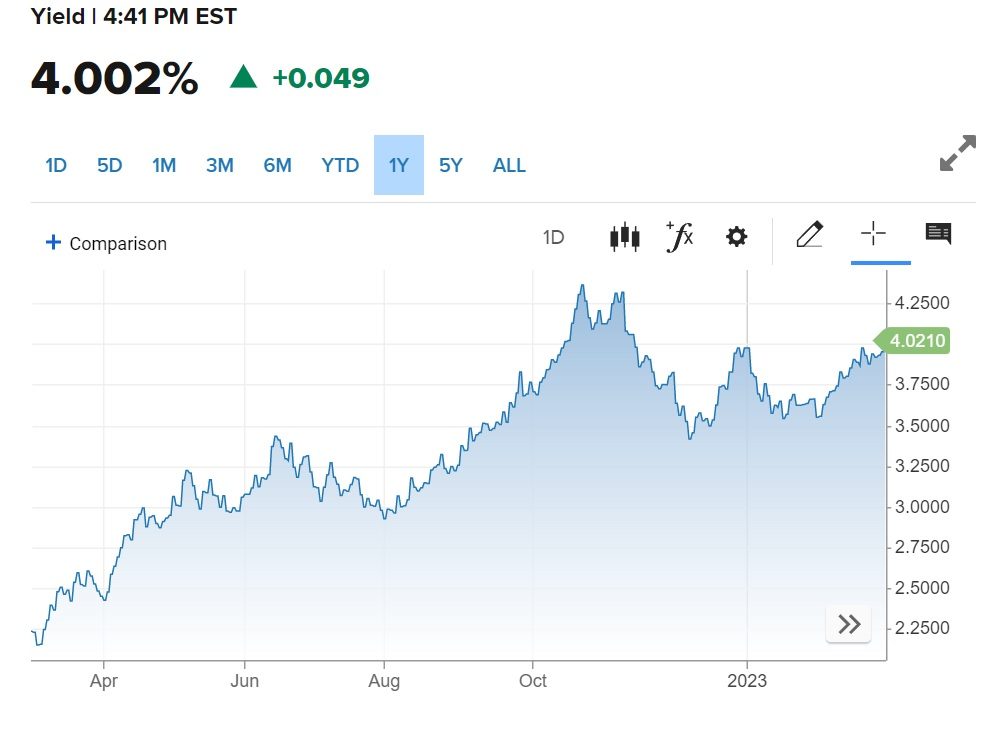

US economic statistics and rising US rates led to a reversal of previous losses and a strengthening of the dollar. Even with Wall Street’s late rise, the dollar maintained its gains. US yields reached all-time highs, on 30-year yield above 4% and the 2-year yield surpassing 4.90%.

30 year US Treasury yield chart, source: CNBC.com

The US dollar index increased by more than 0.50% before settling at 105.00. EUR/USD reversed course and retreated to 1.0570, while the EUR/GBP stabilized at 0.8670.

Supported by rising rates, the USD/JPY reached levels above the crucial 137.00 zone, its highest point in 2 months, before pulling down. Next in traders’ crosshairs is Japan’s inflation data. GBP/USD tested weekly lows around 1.1920, a level that has grown into a significant zone of short-term support.

Oil seems to be having a strong week

Crude trading was fairly volatile jumping between $1 gains and losses. However, risk appetite sent the US benchmark WTI 0.3% higher to $77.92 with the third consecutive green day.

You may also like: Silvergate tanks almost 50% amid bankruptcy concerns

UK traded Brent crude also posted a green end, marking a third gaining day as well. The UK black gold is up 0.2%. Brent has gained $4.50 so far this week.

After an earlier rally, natural gas posted a red trading day. The commodity declined 1%, to close below the $2.8 mark.

Comments

Post has no comment yet.