The single currency corrected some of its yesterday’s gains. Still, it traded above 1.06 ahead of today’s crucial inflation data.

All eyes on EU inflation

The preliminary European consumer price index for February will be released later today. The annualized Harmonised Index of Consumer Prices in the Eurozone is projected to decrease to 8.2% in February from 8.6% in January. Nevertheless, the core HICP is anticipated to remain unchanged at 5.3% yearly for the reporting period.

Nevertheless, the attention will likely be on the monthly numbers, with the HICP in the old continent expected to have decreased by 0.3% last month compared to 0.2% the month before. The core HICP is projected to remain unchanged at 0% in February, compared to -0.8% in January.

However, early statistics from Germany, France, and Spain were all higher than projected, indicating a potential upside for the Eurozone report.

ECB to be more hawkish than previously expected

Goldman Sachs analysts have updated their forecast for ECB interest rates upward. The investment banking firm expects the ECB rates to peak at 3.75% in June, up from the earlier estimate of 3.50%.

The markets have entirely priced in a 50 basis point boost by the European Central Bank in the middle of March and are considering a further 50 basis point hike in May.

According to Reuters, European Central Bank (ECB) policymaker Joachim Nagel reaffirmed on Wednesday that more major rate rises may be required beyond March, further adding that rate cut talk is a non-starter until sufficient evidence of underlying inflation drop towards targets.

US yields reached records

In the US, Tuesday’s announcement of the US ISM Manufacturing PMI was closely followed by traders. The February Index increased to 47.7, indicating that the sector continues to be in a contraction area. The Price Paid Index surged 6.8 points to 51.3, which was unexpected.

On Wednesday, President of the Minneapolis Federal Reserve (Fed), Neel Kashkari, reaffirmed his prior recommendations for higher interest rates, citing concerns about services inflation.

In this context, 10-year US Treasury bond rates soared to their highest levels since early November 2022 by surpassing the 4% barrier, while their two-year equivalent rallied to its highest levels since June 2007 by striking the 4.92% mark.

In the second half of the day, Initial Jobless Claims and fourth-quarter Unit Labor Costs will be on the agenda in the US economic calendar.

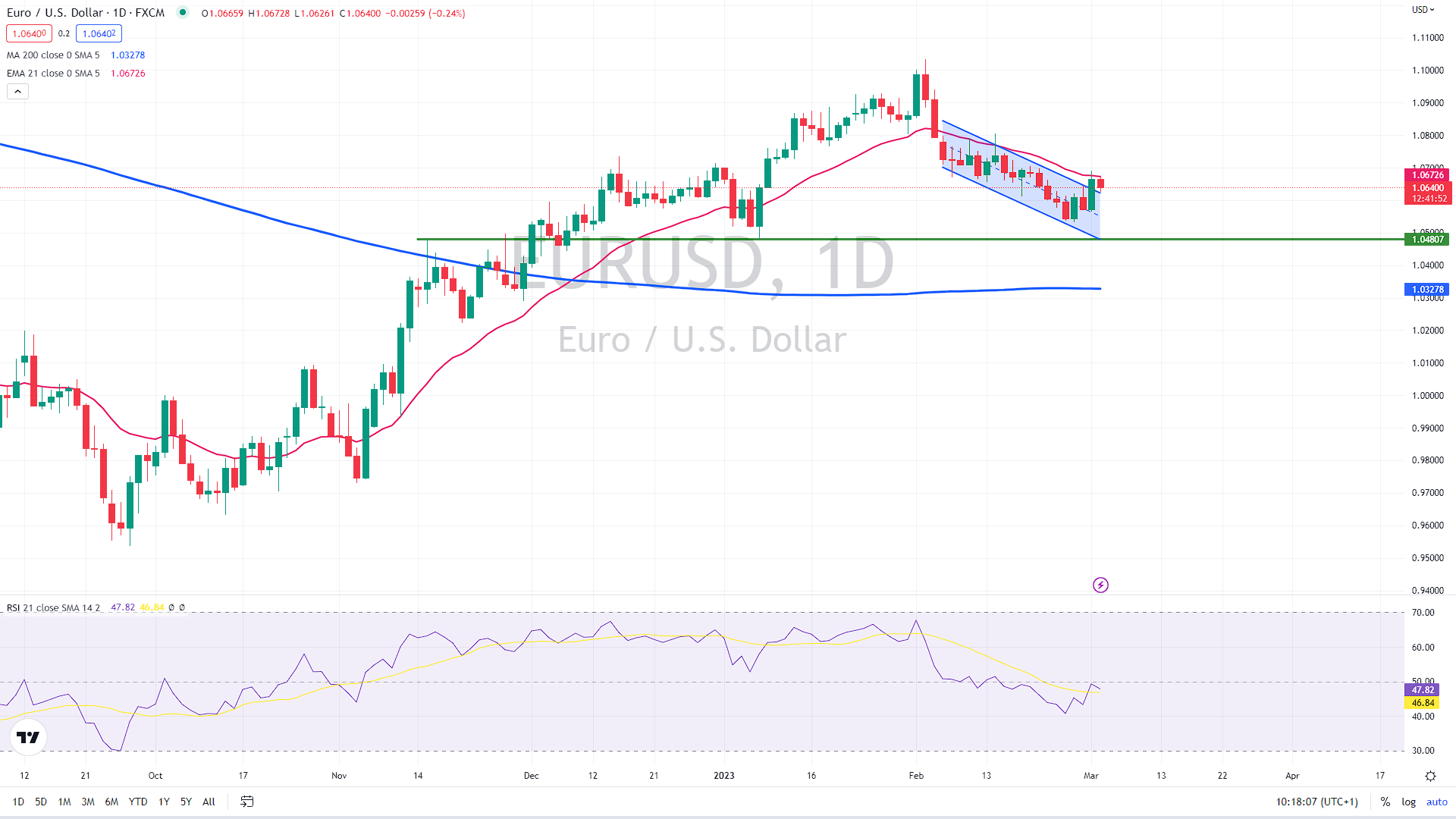

EUR/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.