A long-sleeping crypto wallet has just been awakened on November 23rd. The same wallet that is linked to the Mt. Gox hack just made its biggest transaction since 2017.

Bitcoin whale moves

In 2011, Mt. Gox became the first Bitcoin exchange to go live. It was compromised in February 2014 for more than 740,000 BTC. As a result, it has been shut down like FTX recently.

Related article: Is the crypto winter really that cold?

Ki Young Ju, a founder of CryptoQuant, claims that seven years old bitcoins were moved as shown in the tweet. Allegedly, 3,500 BTC were transferred to numerous wallets, and the other 6,500 bitcoins were moved to a single address.

7-year-old 10,000 $BTC moved today.

No surprise, it's from criminals, like most of the old Bitcoins. It's the BTC-e exchange wallet related to the 2014 Mt. Gox hack.

They sent 65 BTC to @hitbtc a few hours ago, so it's not a gov auction or something.https://t.co/6LnCxFAJfX https://t.co/YdPrvJafxY pic.twitter.com/Sp2higUqbq

— Ki Young Ju (@ki_young_ju) November 24, 2022

The bitcoins were reportedly sent to the HitBTC exchange, so it is clear it’s the government involved. Young Ju suggested the exchange suspended the account because of suspicious activity. The criminals could withdraw their bitcoins much sooner when Bitcoin cost more, but they don’t probably care as they acquired BTC at around $300, he said in a tweet.

“Well, they don’t care. It’s 55x profit for them anyway. They got these bitcoins when the price was $297 in Jan 2015, and the BTC price is $16,617 now, so approx. PnL is 5,594%.”

Old bitcoins come to life from time to time, but it’s really a rare event. The crypto market survived the crash of Mt. Gox, where 740,000 BTC were compromised. That’s more than 3% of the total supply, worth probably around $230 million at that time. Now it’s much more with Bitcoin’s price sitting at $16,500 and not $300.

Also read: Credit Suisse drops to cycle lows as wealthy clients exit

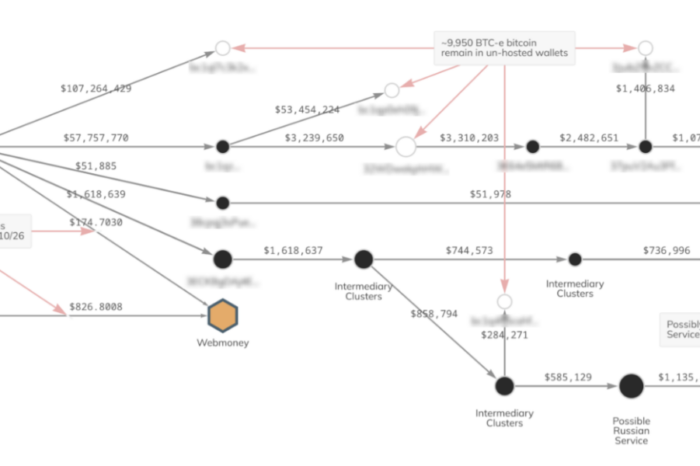

This withdrawal is allegedly the largest made by BTC-e since April 2018, a Chainalysis report on November 23rd suggested. It is believed that both former exchanges BTC-e and WEX sent small amounts of BTC to the Russian electronic payments service Webmoney throughout October and November.

Conclusion

Although the fall of Mt. Gox was catastrophic, the crypto market managed to move on. This means it should also get over the fall of FTX and old bitcoins being sold on exchanges from time to time.

Comments

Post has no comment yet.