Bitcoin prices have been declining for more than a year, entering one of the longest downtrends in the history of cryptocurrencies. This caused BTC miners to dump their holdings as the business turned unprofitable in the short term.

Bitcoin miners in trouble

⛏️ #Bitcoin mining in 2022 be like… pic.twitter.com/QO4ISkB20V

— Investro.com (@investrocom) November 17, 2022

Bitcoin is the oldest and most favourite cryptocurrency of miners. Its mining operations have proven profitable over time, and investors who hold this cryptocurrency are known as the long term holders. When the bull market is raging, mining operations are the most profitable.

Related article: How to mine cryptocurrencies in a bear market

However, the cash flow of numerous mining companies has fallen as cryptocurrency prices continue to drop for one of the longest periods in their existence. Bitcoin is actually falling for 53 weeks, which made most investors pessimistic about the future of this digital asset, and the FTX crash just made things worse.

Since the Terra Luna collapse in May, bitcoin miners have become increasingly reliant on selling off their BTC holdings in order to survive. As a result, the number of bitcoins that miners have had to sell has risen significantly over the past few months.

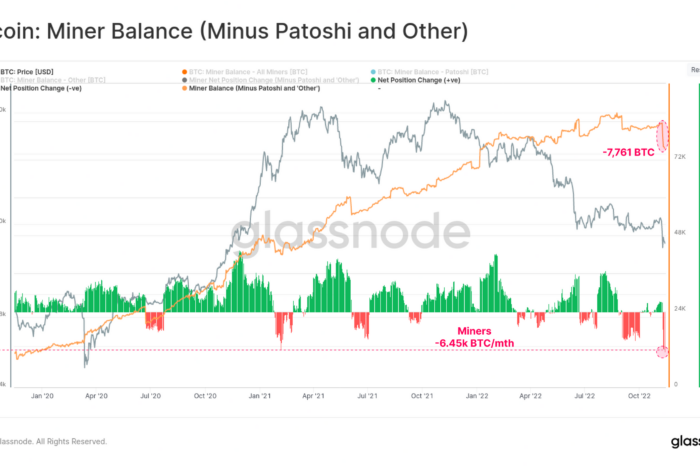

According to a Glassnode report, miners have allegedly sold more than 7,761 BTC over the course of the most recent crypto market fall. This corresponds to miners taking the biggest dump in four years, which causes their balances to drop precipitously.

The fundamental cause of these miners’ selloffs is the fall in the price of Bitcoin. Low BTC prices have an impact on their mining equipment’s profit margins as well as investor sentiment at this time. Many dominos have fallen this year, contributing to more selloffs, which makes investors wonder if the bear market will ever end.

Comments

Post has no comment yet.