It’s no secret that 2022 is one of the worst years in the history of crypto. A lot of newcomers to the crypto space suffer while thinking this might be it. The end of cryptocurrencies. However, experienced investors know this kind of meltdown is nothing new and actually embrace it. Let’s have look at some of the most interesting data that confirm this.

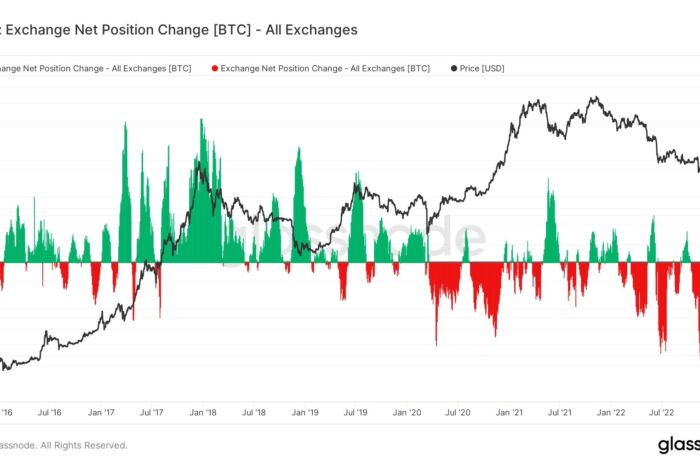

Massive crypto withdrawals

The FTX collapse brought enormous mistrust in the industry. Millions of people cannot access their funds on the bankrupt cryptocurrency exchange, leading many prominent exchanges to publish proof of reserves and got audited to prove they can be trusted.

Related article: Crypto outlook: Ethereum and Cardano heading south?

However, that didn’t stop investors from withdrawing their cryptos in record-breaking numbers. More than 137,000 bitcoins were taken off exchanges in just one month. This is a historic event despite the fact it has happened numerous times before because it’s the biggest drop in BTC balances ever. And this is not just Bitcoin, but other coins as well.

Bitcoin drawdowns

Every bear market has significant drawdowns, taking cryptocurrencies lower by 90% or even 99%, but not Bitcoin. In its beginnings, Bitcoin fell by more than 90%. However, it falls less with every bear market. As you can see from the chart that Dylan LeClair published, each drawdown is smaller while the price of Bitcoin rises in the long run.

Every time Bitcoin went through a halving, which decreases miners’ block rewards, it soared the following year. Although it dropped hard after each bull run, the drawdown is a little smaller in terms of percentage. That suggests the bottom might already be in as Bitcoin dropped by almost 80%.

Pack it up everyone… #Bitcoin is dead. pic.twitter.com/b40ktcr8LS

— Dylan LeClair 🟠 (@DylanLeClair_) November 22, 2022

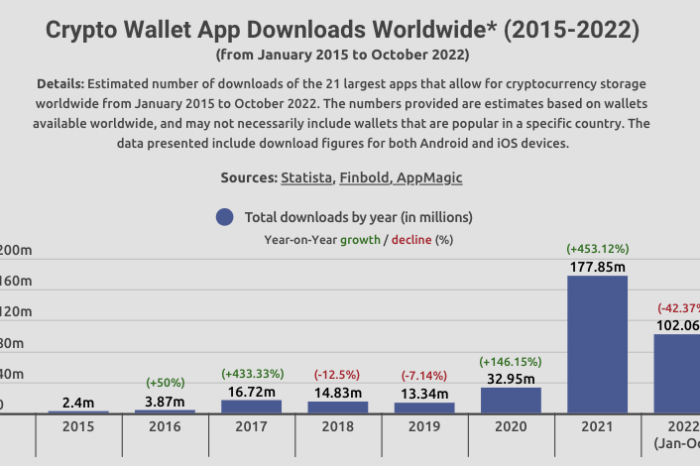

Record-breaking crypto wallet downloads

Crypto prices are not the only thing that skyrocketed in the previous years. The number of crypto wallets downloaded is growing regularly. But, of course, the most notable increase in downloaded wallets happened during bull markets in 2017 and 2021.

The number of downloads of cryptocurrency wallets last year was the largest ever as it increased by 453.12% to 177.85 million in 2021 from the 32.95 million downloads recorded in 2020. While the amount of crypto wallet apps downloaded decreased this year, it’s still a huge number considering this devastating bear market.

This is a good sign in all directions as the crypto mass adoption increases over time. Regardless of the complexity around the whole crypto sector, wallets are becoming increasingly popular each year. Moreover, they have other use cases besides cryptocurrency storage.

Investors didn’t lose interest in crypto

According to the recent Digital Assets survey by Coinbase, 62% of investors who are currently holding cryptocurrency investments raised their allocations during the last 12 months. On the other hand, 12% of investors lowered their allocations and 26% didn’t make adjustments.

140 institutional investors were surveyed to express their views on the present state of the market and their expectations for digital assets in the wake of the current crypto winter. These investors have assets totalling $2.6 trillion under management.

According to the survey, 59% of investors either currently employ or plan to utilize a buy-and-hold strategy. 58% of investors plan to increase their cryptocurrency holdings over the next three years and 72% think digital assets are not going anywhere.

Also read: US markets closed on a positive note

While the survey is more or less positive, 54% of investors said they expect crypto prices to fluctuate and 29% expect cryptocurrencies to fall more in the following year. Yet, 71% of surveyed investors agree that crypto valuations will increase in the long run.

Lessons from 2022

The fall of Terra Luna, Three Arrows Capital, FTX, and countless other large crypto firms caused a lot of pain. Investors think such events are great reminders of how risk management is actually important. For crypto companies to grow in the future, they will have to meet stringent criteria after what happened with FTX.

The collaboration of Alameda Research with FTX in action #ftx #ftt #alameda pic.twitter.com/6RBzCUmAXN

— Investro.com (@investrocom) November 21, 2022

In selecting a crypto partner, they highlighted the need for regulatory compliance, security, and trust as crucial factors. Companies will have a strict approach to how they select partners and investments after the recent painful bankruptcies, that’s for sure.

Bottom line

The year 2022 will certainly go down in history as one of the worst years for the crypto sector. However, as shown in the survey, a noticeable part of investors is optimistic about the future of cryptocurrencies. When the crypto market gets regulated and finds more use cases, it might attract a new wave of investors.

Comments

Post has no comment yet.