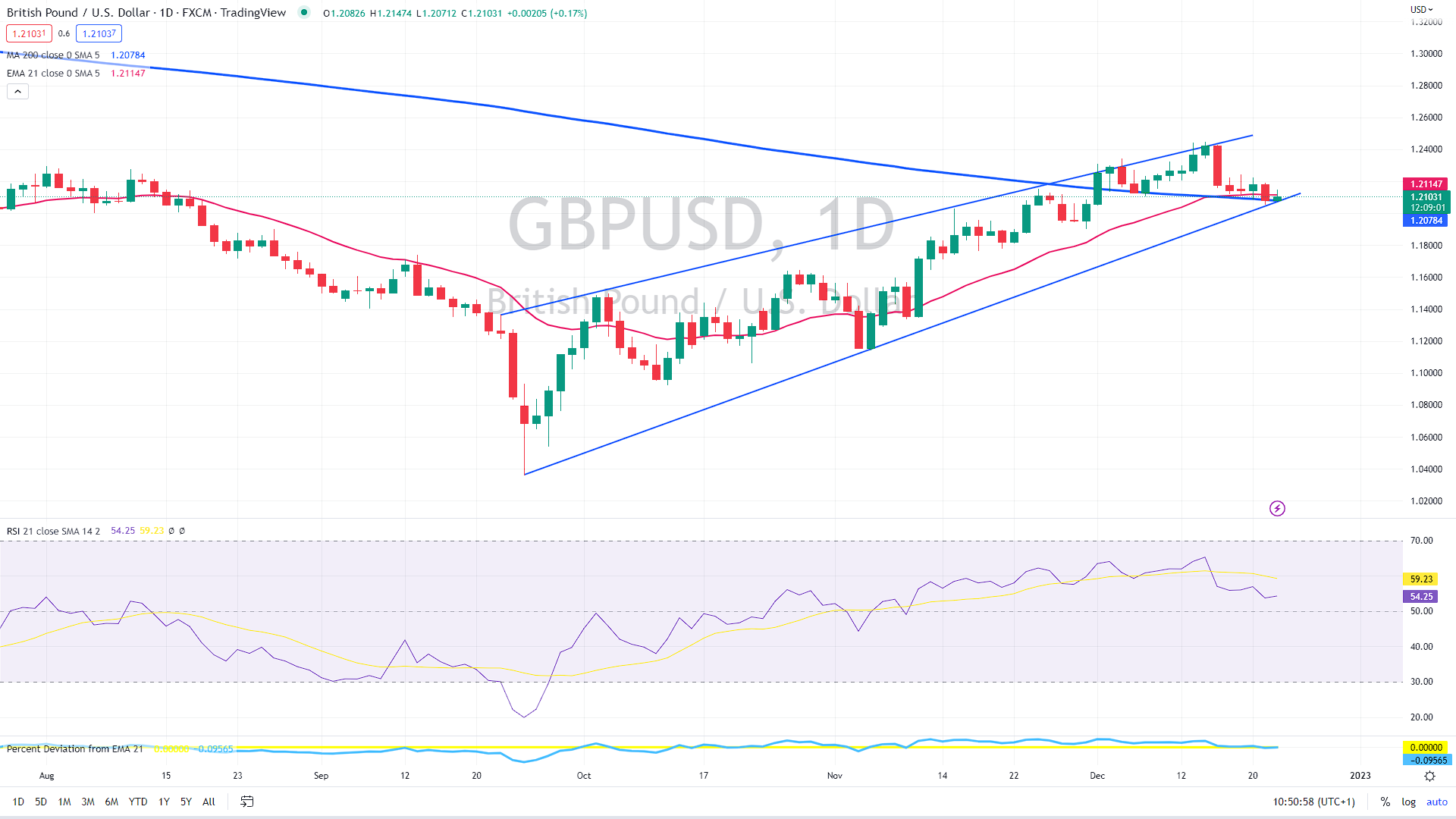

It looks like the recent strong uptrend in the Pound might be over as GBP/USD pair tests a critical technical level heading into the holiday period.

Negative GDP revisions

The final revisions showed on Thursday that the British economy fell by 0.3% in the quarter in the three months leading up to September 2022, as opposed to -0.2% before. The market anticipated a reading of -0.2% for the period in question.

The annualized growth rate of the British economy in the third quarter was 1.9%, compared to 2.4% in the initial estimate and 2.4% in line with predictions.

You can also read: WTI crude oil hints short term bullish run

In the third quarter, the UK Current Account came in at £-19.402 billion compared to £-33.224 billion predicted and £-35.086 billion in the second quarter.

The country’s Q3 statistics for Total Business Investment was 1.3% QoQ and -2.5% YoY.

However, a dovish conclusion from last week’s Bank of England (BoE) meeting might discourage traders from putting strong bullish wagers on the GBP/USD pair. Two of the nine members of the Bank of England’s Monetary Policy Committee voted to leave interest rates steady, signaling that the central bank is nearing the completion of its current policy tightening cycle.

However, while tightening monetary policy, the central bank warned that the United Kingdom was at risk of falling into its deepest recession in a century.

“We continue to see mostly downside risks for the pound in the new year, as a recessionary environment and sensitivity to market instability may cause a return to the 1.15-1.18 range in cable,” ING said.

US data eyed

The US Bureau of Economic Analysis will finalize Gross Domestic Product (GDP) growth for the third quarter. In addition, the US economic agenda will also include the weekly Initial Jobless Claims data and the November National Activity Index from the Federal Reserve Bank of Chicago.

Moreover, Friday’s release of the US Core PCE Price Index (the Fed’s favored inflation indicator) could significantly determine the USD’s direction throughout the Christmas season.

Another interesting topic: New victim of crypto winter – Core Scientific goes bankrupt

The massive rising wedge pattern has formed in the daily chart, usually a bearish reversal formation. If the pair drops below the 1.2080 level, where both the 200-day moving average and the pattern’s upper trend line are converged, the trend could quickly change to bearish, targeting 1.20 in the initial reaction.

However, a more significant decline could occur in that scenario, likely targeting 1.16 – 1.15.

GBPUSD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.