Raving inflation worldwide is causing many headaches, mainly among people from the low-income class. So why is the cost of living getting so out of hand?

You may also read: From $7.8 to $2 555 in 17 days – the story of AMTD

The root of all problems

It all started when coronavirus started spreading throughout all the nations. The world’s economy was ready to collapse, and central banks decided to “save the world” by printing unprecedented amount of money so the stock markets could keep going and businesses continue to grow. This plan worked well until the giant sleeping inflation woke up. The long-term goal of central banks is to keep it at 2%.

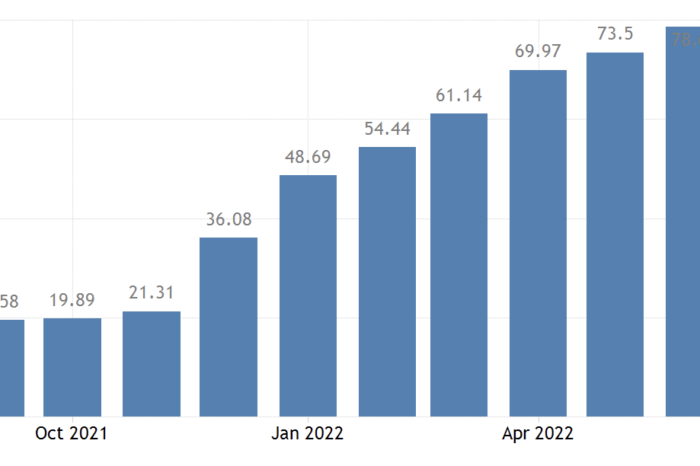

But, for example, the US recorded a 9.1% inflation in June 2022 and 8.9% in Euro Area in July. However, developing countries were hit with rising inflation the hardest. For instance, in Turkey, the inflation rate jumped from 19.89% in October 2021 to 79.6% in July 2022, and Zimbabwe’s inflation skyrocketed from 50.2% in August 2021 all the way to 256.9% in July 2022.

Almost zero interest rates, massive money printing combined with high consumer spending, and other similar factors caused the inflation rate to rise to unprecedented levels all over the world. First, commodities started to rise, and so did groceries, services, and products. Now there is dangerously high inflation worldwide. So what are central banks doing to stop this?

We also analyzed: Are oil and gas in a tricky position?

The hawkish policy is the answer

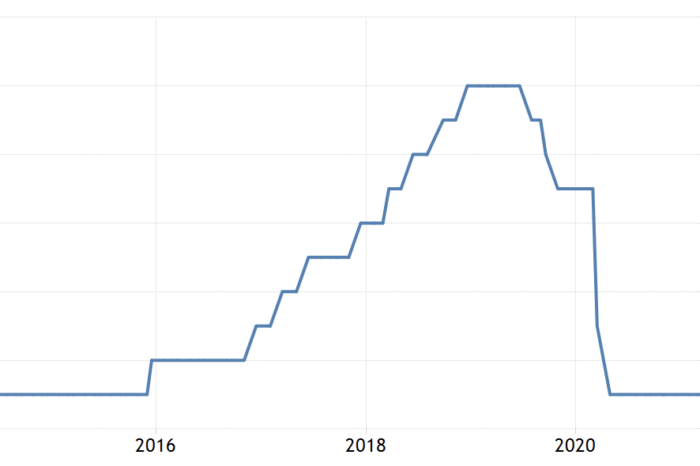

Central banks worldwide started increasing interest rates to combat inflation, which was spiraling out of control. For example, the Federal Reserve increased its interest rate gradually from 0.25% to 2.5% in July 2022, with the fourth consecutive rate hike. European Central Bank also joined and raised years-long 0% rates to 0.5% in July. Other central banks in the world are doing the same with a clear vision; to bring inflation back down.

Although all inflation data are already high, many experts and even civilians agree that inflation is much higher than official data claims. This survey states that 1 in 7 people in the UK cannot afford to eat every day, which is a drastic 57% increase since January 2022. Approximately two-thirds of Turks claim the cost of living in their country is ‘quite’ or ‘very’ difficult as they experience one of the highest inflation rates in the world, so both developed and developing countries suffer.

The real cost of this crisis

People with a lot of cash on their hands suffer as the value of money decreases, but individuals from the middle and lower classes have it even worse. According to UNDP, 71 million individuals in the developing world have plunged into poverty directly due to rising food and energy prices globally in the past few months. That is approximately 1% of the world’s population, and this shock is faster than the arrival of the COVID-19 pandemic.

Russia’s war in Ukraine caused a whopping 40% price increase in wheat and an even higher price increase in sunflower and seed oil as it could not export its products. Moreover, it caused oil and gas prices to skyrocket, so all lines of food items became more expensive. But just a few days ago, the first shipment of grain left Ukraine since the invasion began. So this could be an early sign of the end of the war.

However, there are still fights to be fought. In Kenya, the price of vegetables reportedly got more expensive, sending sellers to a loss as the wholesale market doubled and customers cannot afford it. Many people worldwide report the food got so expensive that they either had to start fasting regularly or start eating something cheaper. So what are nations doing to stop this misery?

Hope for a better tomorrow

Some ongoing measures by governments and central banks should ease the situation worldwide. First of all, the already-mentioned rising interest rates are probably one of the most critical steps in taming inflation. In addition, governments are also introducing tax cuts on fuel or food, raising the monthly minimum wage, and giving out money to low-income households.

Although countries try to make the situation better, it will take time until these measures take effect. It reportedly takes at least one year for interest rates to kick in and change the economic situation while it has an immediate impact on the stock market. Now finally, Fed got into the area of 2-5% interest rates that should keep the economy healthy. If central banks succeed and the inflation rate really goes down, everything is fine.

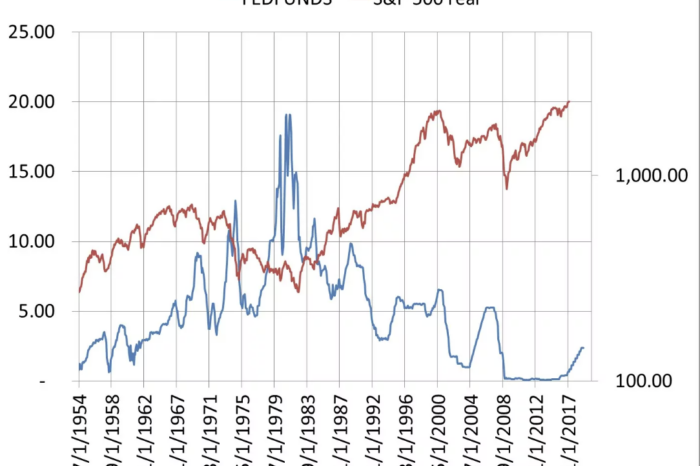

However, the situation in the early 2020s is similar to the 1970s. This was when inflation jumped rapidly, and Fed had to increase the interest rate to a stunning 20%. That act could severely damage the economy, and people might have serious trouble paying their loans. But while high-interest rates negatively affect earnings and stock prices most of the time, lately, companies report well or above expectation earnings.

Financial markets when interest rates are high

1. Stocks

For companies, the cost to raise capital increases when interest rates rise, and making capital raising more expensive can hinder future growth potential and short-term earnings. As rates rise, the expectations for profits in a company also decrease. The expected amount of future cash flows will fall if a company is perceived as slowing down its growth or is less profitable—either due to higher debt expenses or lower revenue. This will result in a decrease in the stock price of the corporation.

All the major stock indices, such as the Dow Jones Industrial Average, S&P 500, or Nasdaq, that many people connect with the market will fall if enough companies see a reduction in the value of their stocks. Likewise, investors will not see as much increase from stock price rise if they have lower expectations for a company’s expansion and future cash flows.

stocks vs interest rates, source: https://www.selectionsandtiming.com/fed-funds-and-stock-relationships/

Owning stocks may become less appealing as a result. Furthermore, compared to other assets, investing in stocks can be seen as being too risky. However, some industries could profit from an increase in interest rates. For example, the banking sector is the one that typically reaps the most benefits because they may charge more for lending. As a result, banks, brokerages, mortgage lenders, and insurance providers frequently see profit increases as interest rates rise.

2. Bonds

Bond prices are also impacted by interest rates. Bond prices and interest rates have an inverse relationship, which means that as interest rates rise, bond prices fall, and vice versa. Actually, the explanation behind this is relatively simple. Consider a bond with a $100,000 value that accrues interest at a set rate of 7% per year ($7,000 per year). It is released when market interest rates are also 7%. Imagine that interest rates reach 10% a year from now. An investor in bonds might now purchase a brand-new bond for $100,000 and receive $10,000 yearly for holding it.

Due to the fact that the old bond, which only pays $7,000 annually, must be worth less, the only option for someone to purchase the 7% bond would be at a discount. Imagine that interest rates now drop to 1%. Bondholders of a new $100,000 bond would receive only a $1,000 annual payment. The market will bid this up such that it trades at a premium in the market because the old one that pays $7,000 is currently highly enticing.

3. Commodities

Times with high inflation are often associated with rising prices of commodities. This is why Crude Oil WTI skyrocketed from just $50 at the beginning of 2021 to $130 in March 2022. That is also why natural gas surged from $2.5 at the start of 2022 to $10 in June 2022. Other commodities such as wheat or sugar followed. However, it is also well-known that commodities are cyclical and do not rise in the long run.

Moreover, commodities are considered relatively cheap compared to the last few decades, the cheapest since the early 1970s. Inflation is a real kicker in pushing the commodities higher. The inflation rate got out of hand in the late 1970s, and commodities exploded. The same is happening now.

4. Cryptocurrencies

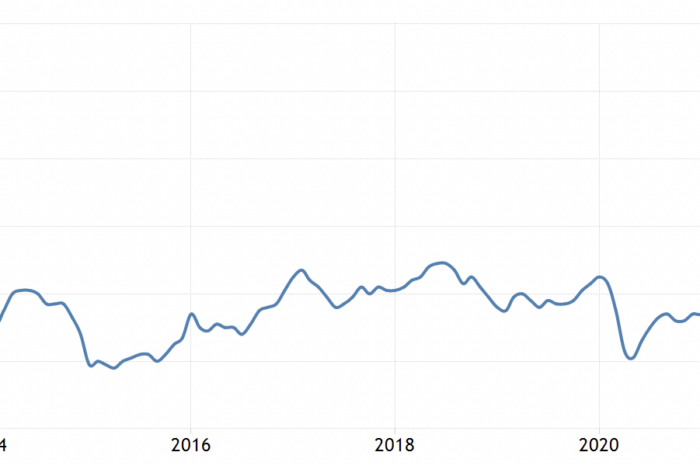

Cryptocurrencies have only existed since 2009, and they have been mainstream for just several years. Cryptos are considered the most speculative asset class in the world of finance, and they have never gone through a period of high inflation rates and rising interest rates. Low interest rates allowed the flow of capital into risky assets, thus creating the big boom in crypto markets in 2020 and 2021 shown in the chart.

The arrival of dangerous inflation rates and the need to raise interest rates worldwide made people withdraw their capital from the riskiest assets and caused one of the strongest selloffs in the history of crypto markets. However, as this is the first time these digital assets have experienced a recession, their lifetime is still questionable.

The bottom line

It is essential to recognize that there is typically a 12-month lag in the economy, which means that it will take at least that time for the effects of the increase in interest rates to be felt. Interest rates have an impact on stocks, bonds, cryptocurrencies, consumer and business spending, inflation, and recessions. As you can see, the Fed contributes to long-term economic stability by altering the federal funds rate.

Investors who comprehend the connection between interest rates and the American economy will be able to see the broad picture and make wiser investment choices. As a general rule, the stock market rises when the Federal Reserve lowers interest rates, and the stock market declines when the Fed raises interest rates. However, there is no assurance as to how the market will respond to any particular adjustment in interest rates.

Comments

Post has no comment yet.