Sentiment has improved modestly this week, benefiting risk assets such as stocks. At the same time, the USD has retreated, pushing many currency pairs to their respective multi-week highs.

“Markets are seemingly becoming more comfortable with the idea that authorities have probably done enough to prevent a systemic banking crisis,” said Rodrigo Catril, a senior currency strategist at National Australia Bank in Sydney.

UK inflation reaccelerates

The UK Office for National Statistics (ONS) announced that the headline CPI grew by more than expected in February, by 1.1% compared to the 0.6% fall recorded in January. In addition, the annual rate unexpectedly increased to 10.4% in February from 10.1% in January, again above consensus predictions.

Another exciting topic: Banks cool down even more before Fed – another green day for stocks

On Thursday, the Bank of England will likely raise interest rates by another 25 basis points to 4.25%, but Governor Andrew Bailey has hinted he may be willing to stop rate hikes.

US central bank to deliver the last rate hike?

Later today, the Fed is projected to increase interest rates by 25 basis points; nevertheless, there are demands for no change or even a rate cut. As a result, analysts will closely monitor the decision, predictions, announcement, and Powell’s statements. Traders should thus anticipate substantial volatility during the American session.

The Fed had a significant role in the Federal Deposit Insurance Corporation’s (FDIC) bailout of Silicon Valley Bank (SVB). In addition, Fed officials participated in the attempts to support the First Republic, another regional bank, along with other regional bank authorities. The central bank is aware of commercial bank activity.

In light of this, the crisis might prompt banks to tighten their lending standards, so cooling the economy and reducing inflation – essentially performing the Fed’s duties. That suggests a decreased need to increase interest rates further.

You can also read: Gold respects $2,000 resistance for now – can it smash through?

On the other hand, by responding to the upheaval with a freeze on interest rate hikes, despite still elevated inflation, some may assume that the Federal Reserve knows something that no one else does, therefore exacerbating the fear further.

On Tuesday, existing house sales in the United States increased by 14.5% in February, above the 5% market expected to reach 4.58 million units per month, the highest monthly gain since December 2015, excluding the volatile pandemic period. In March, the Philadelphia Fed Non-Manufacturing Index plummeted to -12.8.

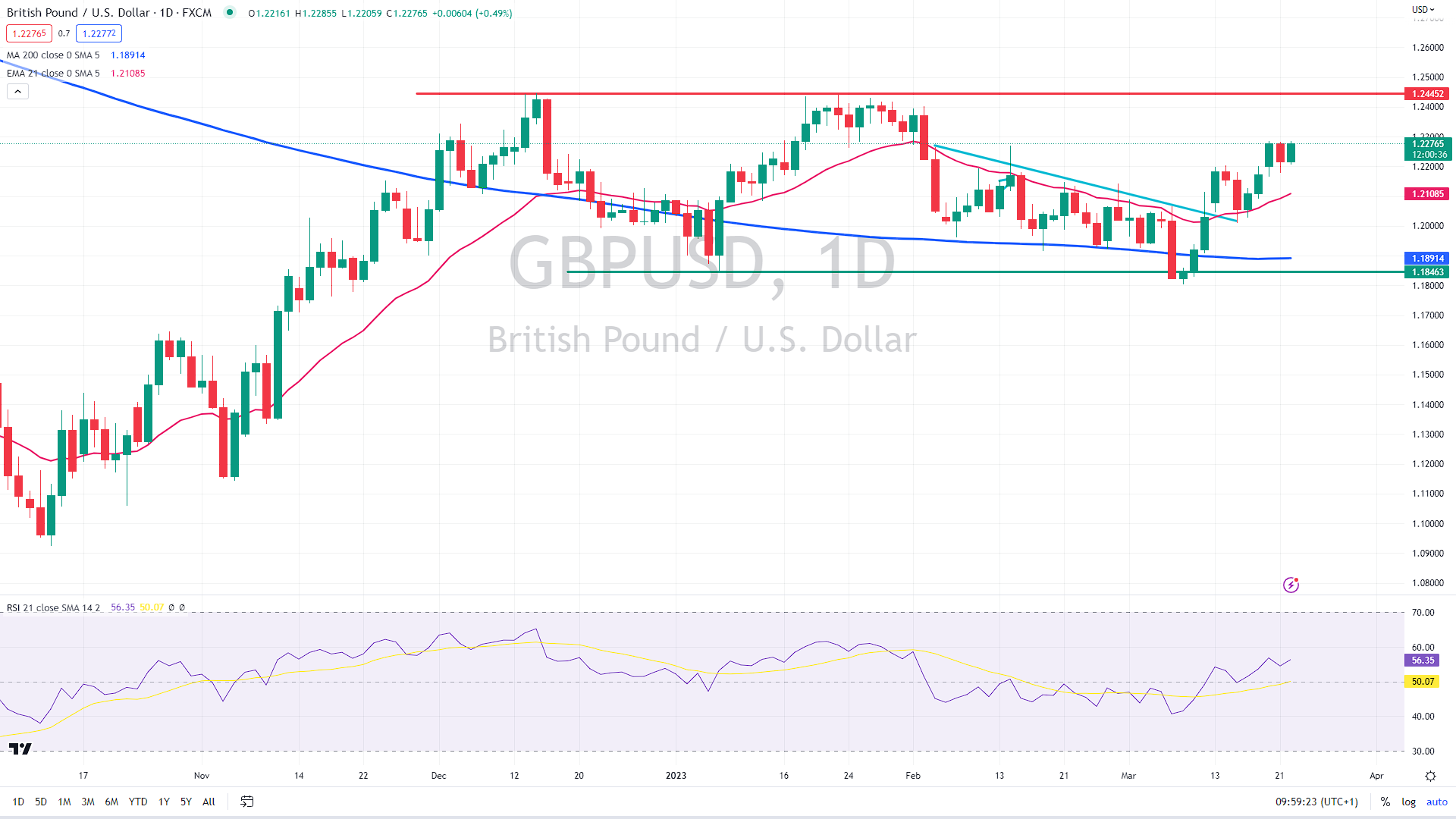

Technically speaking, the next target for bulls is at the previous swing highs (and the double top formation) near 1.2450. On the other hand, if today’s FOMC decision sparks a USD rally, the support is seen at 1.22, followed by the next demand zone at around 1.20.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.