Fear sparks safe havens

Last week we wrote an article about how safe havens such as gold and silver work at a time when fear is all over markets. Even after 7 days, the markets were not calm and the crisis in the banking sector transferred to Europe. The Credit Suisse bank collapsed and trading ended under 1CHF, specifically at the level of 0.82CHF. The Swiss bank’s price declined despite the UBS bank buying this company in a historic deal.

Read also: Credit Suisse ends up being bought by UBS for a bargain price

As the fear in the finance and banking sector is slowly spreading in Europe, the fear factor persists and helps safe-havens. Gold appreciated more than 7% in the last 7 days and the price of futures contract went above the psychological magnet level of $2,000 per ounce. With the high at $2,014.9. The last week started at $1,877.1. The second famous precious metal, silver, had similar development and appreciated 10.30% from last week’s open $20.720 to this Monday’s high at $22.855.

The development of Silver and Gold futures in the last 7 days, source: author’s analysis

Fed’s possible policy change

This Wednesday will be announced the change of interest rates in the US. General consensus is a rate hike by 25bps, which is by the Bloomberg fully priced in the market. Fed has definitely a very tough decision ahead. The fact is that higher rates had a partial impact on the problems in the banking sector as we wrote earlier. But not the main one.

We have informed about this topic: Silicon Valley Bank: Bankruptcy as a result of poor management

The first and most important mission for Fed is the fight against inflation. That is the reason for hiking interest rates. On the other hand, the whole financial system gets used to low rates and “free money” from the central bank. Currently, in times of fighting against high inflation, this system is hurt by higher rates, and Powell’s hawkish comments about 50 bps rate hikes did not help either. The possibility of higher rates raised frustration in the markets which started to collapse. Especially in the banking sector.

After the sharp fall in prices, the Fed slightly changed their comments about future monetary policy to 25 bps. And maybe the end of rates hike at the end of this year, as an effort to calm the markets. Now the Fed is between two hard decisions. Fighting the inflation, which hurts the whole economy, or saving the collapsing markets?

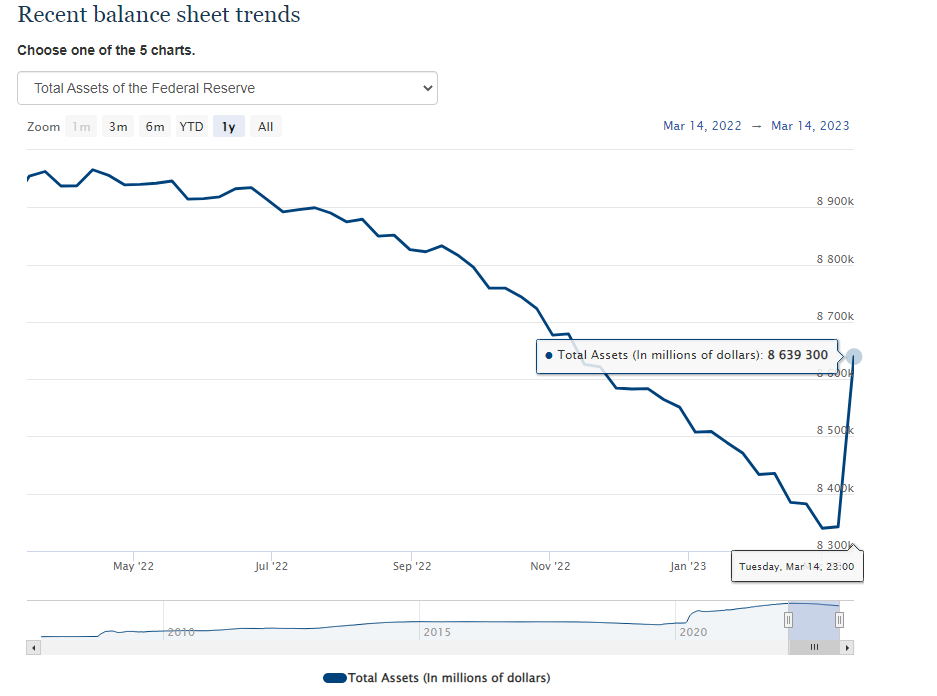

Fed’s balance sheet

Quantitative easing was one of the tools to support the economy after the crisis in 2008. After the inflation sparked and the possibility of ever-higher numbers the Fed stopped QE and started to taper the balance sheet to help to calm the situation. The tapering started a year ago.

Recent balance sheet trends, source: federalreserve.gov

Currently, it is clearly seen that the balance sheet is elevated thanks to the Fed’s help to the banking sector. Fed started saving markets first, but a higher balance sheet will be transferred into higher inflation, again. And the current problem of choices what to save will be here in the near future. Wednesday’s Fed monetary policy meeting and press conference will be very crucial for setting the development of markets.

Comments

Post has no comment yet.