Stocks enjoyed an energy rally

The S&P 500 was marginally higher in turbulent trade on Monday, as a rally in energy-related equities was tempered by volatility in technology. The S&P 500 increased by 0.2%, while the Dow Jones gained 1%, and the tech-heavy Nasdaq declined by 0.6%.

After OPEC+, suddenly reduced oil production by 1.7 million barrels daily, energy stocks rose. APA Corporation, Marathon Oil Corporation, and ConocoPhillips were among the top gainers, with Marathon increasing by more than 9%.

More to read: Bitcoin outperforms all assets in Q1 – 1st strong quarter since 2021

The technology sector, which gained roughly 20% in the first quarter, took some time off as Microsoft and semiconductor stocks fell. Tesla meanwhile, suffered a blow after declining more than 6% as the electric vehicle manufacturer reported a total number of deliveries of 422,900 for the first quarter, exceeding expectations of 422,500 as recent price cuts boosted demand.

The US dollar moves to the background

The ISM Manufacturing PMI decreased to 46.3 in March from 47.7 the previous month, and the prices paid index decreased to 49.2 from 51.3, indicating that the disinflationary trajectory in the consumer goods segment remains intact. The Employment Index decreased to 46.9 from 49.0 before the NFP.

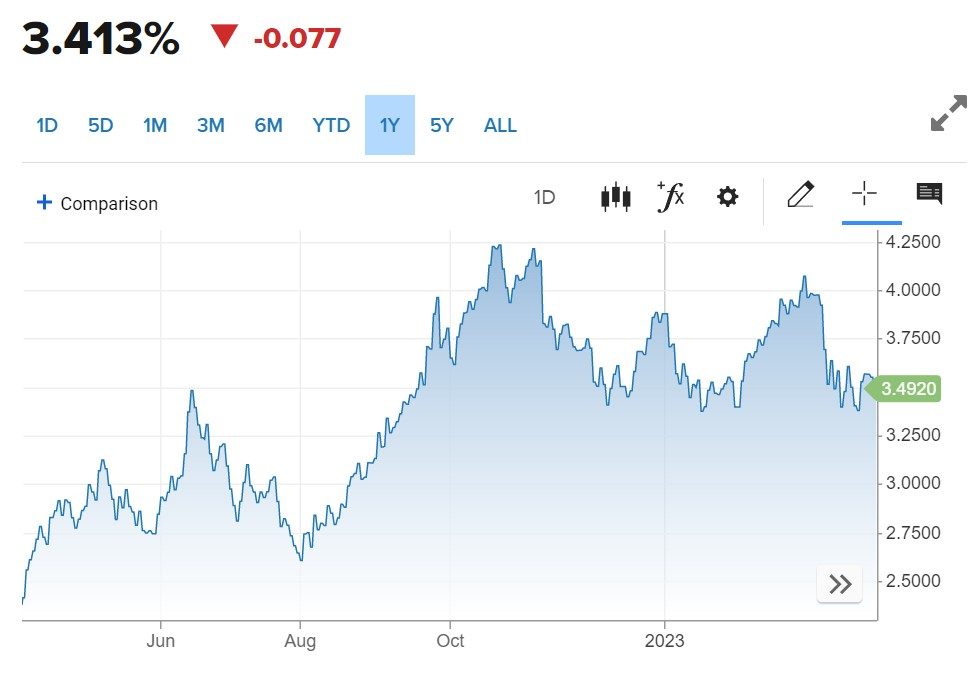

The EUR/USD reached a new daily peak of 1.0916 following the publication of US economic data. The price then retreated to 1.0885. The US dollar is under assault due to falling yields and increased risk aversion. Yields on 10-Year Treasury notes decreased by 6.7 basis points to 3.4%.

The US Dollar Index has dropped by 0.50% and is approaching the lows of last week near 102.00. The 10-year US yield fell to 3.41%, which is the worst in 7 days. According to HSBC economists, prolonged US dollar rises would need hawkish US data shocks or concrete indications of financial sector fragility. Both interest rates and risk appetite are likely to point to a weakening US dollar shortly.

US 10-year yield chart, source: CNBC

With the weakening of the US dollar, USD/CAD posted additional lows. The pair has been declining for several days, reaching prices not seen since February. The USD/CAD ended the day at 1.3417, down 0.8% on the day, marking a 7th consecutive red day.

Crude oil mixed up the game for the day

With the latest oil production reduction, OPEC+ appears to have nailed a goal to regain $80 and above per barrel. After the OPEC+ virtual meeting on April 3rd, the world’s oil producers reintroduced the narrative of a constrained supply to the market. Also aiding oil’s recovery following the financial crisis.

The additional decline now amounts to roughly 1.7 million barrels per day, bringing the daily global output to 3.7 million barrels. On Monday, crude oil prices registered their greatest one-day increase in a year.

Also interesting: Bloomberg joins the AI race: Welcome BloombergGPT

After reaching a session high of $81.58 on Monday, WTI crude closed at $80.42, up $4.75, or 6.3%. Since reaching 15-month lows of $64.12 on March 20th, the US benchmark has increased by 25%, more than compensating for a 13% weekly loss three weeks ago.

Brent crude closed at $84.93, up $5.04, or 6.3% after reaching a session high of $86.44. On March 20th, Brent reached an intraday low of $70.06.

It appears that traders buried their heads in the sand by also simply hitting the buy button on gold. Gold’s June contract closed the first trading day of April at $2,000.40, an increase of 0.8%. The session high was at $2,008. Many speculate that gold will surpass $2,100 in the near future to reach all-time highs, but its return to $2,000 on Monday came sooner than anticipated.

Comments

Post has no comment yet.