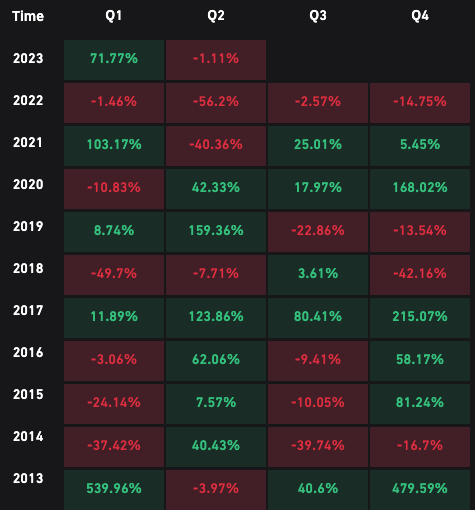

The last time Bitcoin was this strong was in the middle of the bull run in the third quarter of 2021, rising by approximately 25%. Since then, Bitcoin only had one positive quarter. It rose by 5.5% in Q4 2021. So is the bull market back?

Bitcoin is up 70% in Q1 of 2023

Bitcoin quarterly returns, source: coinglass.com

The last time Bitcoin had a stronger quarter than this one was two years ago, in Q1 of 2021, when it delivered a 103.17% gain. Some expected this, and some didn’t, but Bitcoin was able to rise at the fastest pace in two years despite the banking turmoil.

Related article: TOP 10 crypto podcasts for cryptocurrency enthusiasts

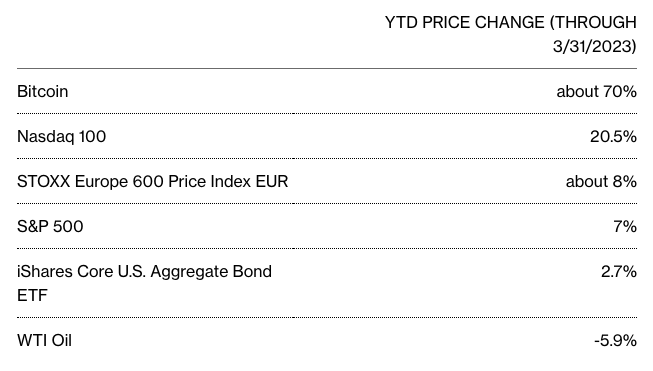

With gains of over 70% in Q1 2023, Bloomberg data shows that Bitcoin has emerged as the top-performing asset so far this year. While there is a strong correlation between the stock market and cryptocurrencies, Bitcoin outran stock indices by a significant amount.

YTD return for several asset classes, source: bloomberg.com

The S&P 500, the Nasdaq 100, and the iShares Core U.S. Aggregate Bond ETF have all underperformed digital gold during the past quarter. Bitcoin’s gains have been even larger than gold’s, which have only been around 9% so far in 2023.

Bitcoin as a safe haven

Since the failure of Silvergate Bank and Silicon Valley Bank, cryptocurrency investors have been looking for a safe haven amid the financial sector’s upheaval. It’s no surprise money flowed into a decentralized cryptocurrency that no single entity controls.

In this regard, Bitcoin’s strength can be linked to its unique function as a bearer asset during a period of rising mistrust of bank deposits and central bank bailouts. After all, Bitcoin has been created during similar times in 2009. Lucas Outumuro, head of research at IntoTheBlock, said “the amount of Bitcoin and Ether owned by hodlers continues to hit all-time highs.”

“Addresses holding assets for over a year have increased their holdings by $13.4 billion and $4.7 billion of Bitcoin and Ether respectively so far in 2023. If history from previous bull markets repeats, these addresses are unlikely to sell until we approach previous all-time highs,” he explained.

Prepare for Bitcoin halving

This suggests the worst might be behind us and that the crypto market may be slowly preparing for the upcoming halving event in 2024. The next Bitcoin halving should occur in April of 2024, after which the mining reward will decrease from 6.25 BTC to 3.125 BTC.

Listen to our podcast: #3: Organizing Bitcoin-only conference with Jordan Walker

The halving event usually kickstarts the bull market which can last anywhere from 12 to 24 months, always sending Bitcoin to a new all-time high level. Moreover, Bitcoin had 7 green April months out of 11, making it highly likely it will continue in its uptrend.

What’s even more interesting is the fact that the last two April months (in 2022 and 2021) were negative for Bitcoin. The last time this happened was in 2014 and 2015. There were never three red April months in a row, implying Bitcoin could have a green April this time.

#MicroStrategy buys 6,455 $BTC for $150 million – are they in profit? 🤷♂️🤔

➡ MicroStrategy's Michael #Saylor announced that the company went on a #Bitcoin shopping spree, increasing holdings to $4.1 billion.#crypto #cryptocurrency #btc #trading #trader https://t.co/4NntjSSzFr…

— Investro.com (@investrocom) March 27, 2023

Comments

Post has no comment yet.