Sticky inflation does not help the stocks

The majority of European stocks declined on Wednesday, while Wall Street indices were neutral. With the announcement of the US ISM Manufacturing PMI, the market reached its lowest point before recovering.

The February index increased to 47.7, indicating that the sector is still in contraction zone. The Price Paid Index’s unexpected increase of 6.8 points to 51.3 prompted a sell-off in bonds and a short lived rebound of the US dollar.

More to read: Target sets stage for continuous expansion; beats earnings estimates

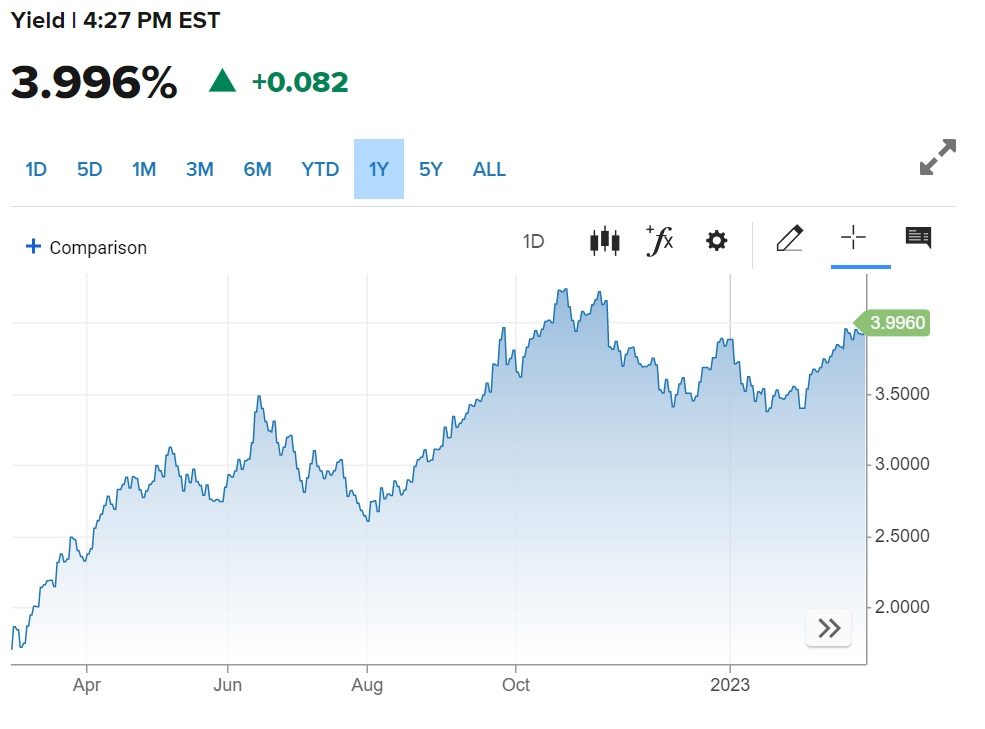

Equities were somewhat more optimistic than currencies. Treasury rates continued to rise despite indications that the goods deflation had lost steam. The S&P 500 plummeted 0.57%, while the Dow Jones slid 0.17%, and the Nasdaq fell 0.77%.

10 year US Treasury yield chart, source: CNBC.com

Greenback lost today despite risk aversion

Wednesday saw a decline across the board for the US dollar, despite a rise in US rates. The US dollar index closed 0.43% lower the first trading day of March.

Powered by higher-than-anticipated German inflation figures and hawkish ECB forecasts, the euro was one of the best scorers across the FX board. EUR/USD reached weekly peaks above 1.0700 before retreating.

You may also like: Target sets stage for continuous expansion; beats earnings estimates

GBP/USD approached levels below 1.2000 as the pound trailed. Wednesday’s USD/JPY close was unchanged despite increased government bond rates.

The AUD/USD recovered from monthly lows and was able to hold onto the 0.6700 level. Wednesday was the strongest day for the New Zealand dollar, with NZD/USD reaching its top point in 2 weeks at 0.6275. The USD/CAD exchange rate declined marginally and is sitting around 1.3600.

Commodities prosper as US dollar weakens

Despite increased bond yields, gold climbed for the second consecutive day. The April contract for the yellow metal ended up 0.42% at $1844. The gold’s silver sibling closed flat with a 0.08% move to the green. Silver managed to stay above $21. Copper seems to have caught a great tailwind. The price of the May contract shot up almost 2% to keep the shiny metal above $4.17

The US benchmark crude WTI managed to climb again, this time 0.83%, almost touching $78 at $77.7. The UK traded Brent oil futures posted a similar green result with a 1/03% gain with 35 cents above the $84 mark.

Comments

Post has no comment yet.