Each crypto winter has its victims, and the current one caused the majority of Bitcoin holders a loss on their investments. Bitcoin is currently down by approximately 77% from its all-time high (ATH) level a year back, bringing enormous pressure on investors.

Most investors at a loss

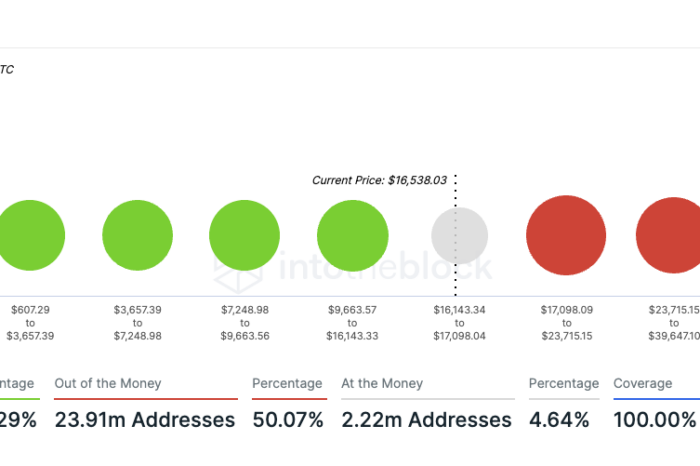

Bitcoin rises in the long run as stocks do. That’s a fact. However, it is much more volatile, which causes colossal price swings. The current downward move caused a little over 50%, or 23.91 million addresses to be at loss.

Related article: Mt. Gox whale moves 10,000 BTC – where were they sent?

According to the data from IntoTheBlock, around 24 million addresses out of 48 million are under purchase price on their Bitcoin investments. Approximately 45% are in the money, meaning they hold unrealized profits. The rest is either in red or at break even.

Data from IntoTheblock suggest that Bitcoin is currently oversold and previous bear markets ended with the most of addresses being out of the money, or at loss. This may be a very similar situation we are in right now.

Around 55% of addresses were out of the money as of January 2019. Around the same time, Bitcoin hit a low of about $3,200 and three months later started its bull run. In 2015, at the height of the bear market, even 62% of addresses were out of the money.

Comments

Post has no comment yet.