The banking threat remains as the headline

US shares ended a little higher over the field as a result of a crisis that has impacted market sentiment, with Deutsche Bank in the limelight. S&P Global reported that economic activity in the US increased in March, above expectations and the previous month’s figures. At 49.3, the Global Manufacturing PMI fell short of growth zone, but it exceeded expectations and February’s figures.

The S&P 500 recovered from declines on Friday, but trader confidence stayed fragile as a Deutsche Bank selloff weighed on banks. Investors ran to seek safety in conservative market segments. The stock price of the German bank fell 14%.

More to read: People made millions on Arbitrum airdrop – so why is ARB collapsing?

The S&P 500 increased 0.1%, while the Dow Jones increased 0.1%. The Nasdaq rose 0.3%. State Street Corp and Morgan Stanley along with Citigroup led the declines in the banking sector on top of the German bank sentiment. German bank regained some losses after ECB chair Christine Lagarde offered support to the European banking sector. German Chancellor Olaf Scholz also claimed there was “nothing to worry about” because the bank is quite lucrative.

The US dollar ends mixed again

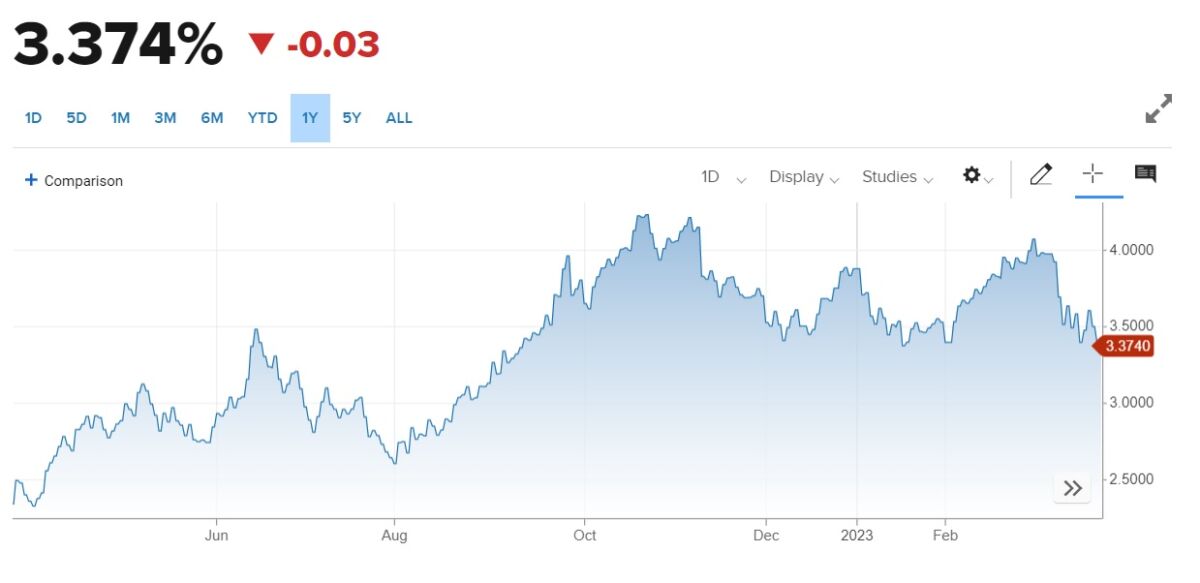

Despite dropping US Treasury bond rates, the US Dollar Index gained 0.53% to reach 103.13. The yield on the 10-year US Treasury note dropped six basis points to 3.372%, placing a cap on dollar gains. The EUR/USD pair closed the week in the green, however, the momentum rapidly faded towards the close. The pair fell from the 1.0930 region to settle at 1.0750.

US 10-year Treasury yield chart, source: CNBC

The GBP/USD pair closed the week largely unchanged at 1.2220 after failing to maintain a position above 1.2300. The BoE lifted the benchmark rate to 4.25% as anticipated. If March CPI will not turn to the downside, the ECB may raise rates further. Q4 GDP results will be the focus next Friday.

The Japanese Yen outperformed the majority of its G10 counterparts due to the fall in US rates. The USD/JPY pair declined for the fourth straight week, closing above 130.00, a level that is likely to be retested in the coming sessions.

Commodities kept their value with the week’s end

Oil prices finished down on Friday after European banking stocks declined. US energy chief Jennifer Granholm also added to the pull as she stated that replenishing the the nation’s strategic reserves might take many years, with depressing demand expectations.

Brent crude finished at $74.99, 1.2%. Futures for West Texas Intermediate crude slipped 1%, to $69.26 a barrel, ending the week below the psychological $70 mark.

Also interesting: Is copper on track for a massive rally?

As turbulence in the banking sector somewhat subsided this week, both benchmarks climbed overall. Brent prices increased by 2.8% throughout the week, and US crude futures increased by 3.0%.

Gold, as the main conservative asset for safe havens, had a great week. The yellow metal rose above $2,000 a few times during the week. The Friday’s close ended at $1,979 with a 0.8% decline, however ending the week in the green. Silver futures also remained strong, closing at $23.300, up 0.2%.

Comments

Post has no comment yet.