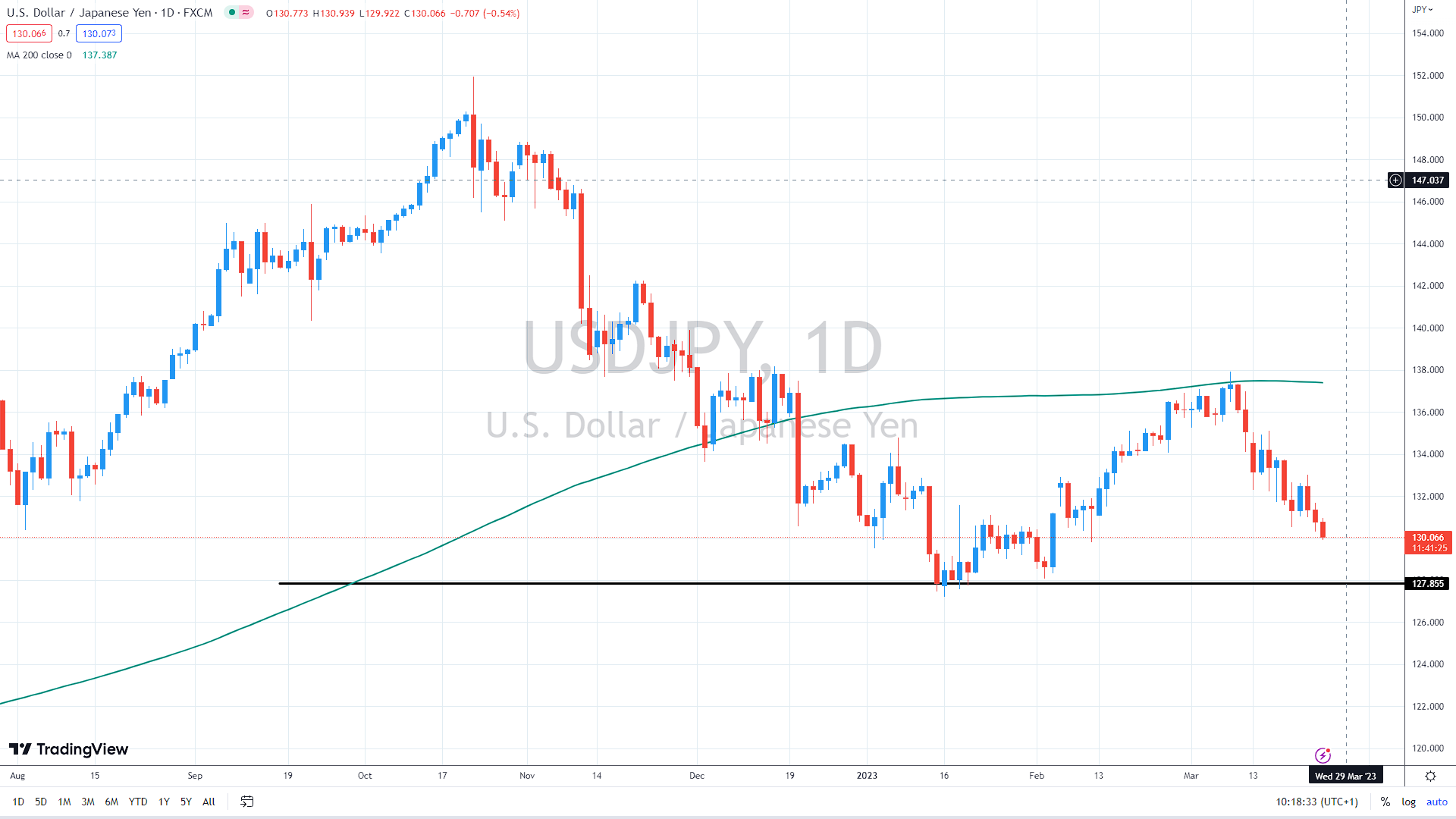

The anti-USD sentiment continued on Friday, pushing the USD/JPY pair toward the critical support of 130.

Mixed Japanese inflation data

In February, Japan’s National Consumer Price Index decreased to 3.3% YoY from 4.3% previously and 4.1% market expectations. Nevertheless, the National CPI excluding food and energy increased by 3.5% year-over-year compared to expert predictions of 3.4% and earlier readings of 3.2%. This was the biggest year-over-year increase in 41 years, increasing predictions that the Bank of Japan (BoJ) might adjust its bond yield control policy in the near future, which, in turn, favors the local currency and maintains downward pressure on the USD/JPY pair.

Another exciting topic: FTSE struggles after BoE hike – future movement uncertain

Furthermore, according to preliminary data, Japanese manufacturing activity remained in contraction territory through March. Deteriorating risk appetite has placed the yen on track to gain more than 1 percent this week.

Fed raised rates and is still helping commercial banks

This week, the Fed raised its borrowing rates as anticipated and stated that it would continue to combat excessive inflation. Yet, a tweak in the bank’s phrasing hinted at a possible pause in interest rate rises owing to banking sector pressure.

Reuters said, “Federal Reserve emergency lending to banks, which reached record levels in the previous week, remained high in the most recent week despite sustained large-scale extensions of credit to the financial system, which now include official foreign borrowing.”

The media also reported that the Fed’s entire balance sheet increased to $8.8 trillion from $8.7 trillion the previous week due to borrowing.

Attention to a batch of US data

On Thursday, the US Chicago Fed national activity index (CFNAI) fell to -0.19 in February, compared to 0.0 as anticipated and 0.23 in January. In addition, weekly initial jobless claims decreased to 191,000 for the week ending March 18, compared to 192,000 the previous week and 203,000 market expectations. Lastly, it should be noted that new home sales in the United States increased 1.1% in February, compared to the prior month’s 1.8% increase and analysts’ predictions of 1.6% growth.

You may also like: Mixed messages after the Fed – markets are in a waiting mode

Durable Goods Orders for February and S&P Global’s preliminary Manufacturing and Services PMI surveys for March are coming later today.

It looks like the USD/JPY pair will decline below the psychological 130 level, marking a 15% decline from its October highs. In that scenario, the next support is at the cycle lows at 128. On the upside, the pair must jump above 132 to stabilize short-term. However, if US yields continue to drop, the USD will likely deteriorate further.

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.