The Australian dollar traded notably higher on Tuesday as the greenback retreated once again, pushing the AUD/USD pair toward the 200-day moving average again.

Hawkish RBA minutes help the AUD

According to Reuters’s analysis of the RBA’s April 4 policy meeting minutes, released on Tuesday, the decision not to increase rates was narrow, with a surprising uptick in migration and pay raises for public workers adding to the case for greater action. Members ultimately decided to wait and see how the last sharp 350 basis points of tightening affected consumer demand.

You can also read: Copper sees extremely low level of stockpiles – what does it mean?

Before determining whether to modify the 3.6% cash rate at the May meeting, ‘the Board was interested in reviewing statistics on inflation, employment, consumption, and business conditions in April, coupled with the RBA staff’s revised economic predictions,’ according to the RBA.

Since then, RBA Governor Philip Lowe has emphasized that the pause did not imply the increases were over and that it might tighten further should inflation and consumer demand stay hot.

Chinese data surprise to the upside

The Chinese economy grew by 2.2% in the first quarter, above the consensus estimate of 2.0% expansion and up from Q4’s 0.0% growth. The outlook for consumer spending is particularly bright. The March increase in retail sales was 10.6% year over year. In spite of weaker growth than before the crisis, data show that the Chinese economy is back up and running after a lengthy period of lockdowns that ended at the start of the year.

Another interesting topic: Big banks navigated the banking crisis without any problems

While the results indicated that the economy was on the road to recovery, other indicators pointed to a more uneven improvement. For example, for the second month in a row, March industrial production fell short of expectations, illustrating that the country’s giant manufacturing sector is still struggling to bounce back from COVID-era lows.

The Empire State’s index far exceeds expectations.

Amid a lack of economic news, the Federal Reserve Bank of New York reported that regional industrial sector activity increased dramatically in April.

The Empire State index jumped sharply from March’s -24.6 to April’s 10.8, firmly above analysts’ expectations of a -18.0 point gain. Likewise, the company’s primary indicator for tracking new orders skyrocketed from -21.7 to 25.1.

In the meantime, the employment sub-index showed a modest month-over-month change, rising from -10.1 to -8.0. The businesses’ price-receiving sub-index also rose, from 22.9 to 23.7.

Dont miss: 5 best platinum stocks in 2023

Thomas Barkin, president of the Federal Reserve Bank of Richmond, said on Monday that he wants to see further evidence of inflation falling down to goal after the release of the figures. However, the official also noted that recent developments in the financial industry had given him cause for optimism.

“With the market conditions continuing to settle a little … it seems likely now that the Federal Reserve will deliver one last 25bp hike in May and then hit the pause button to wait on the effects of tighter credit conditions caused by the March banking turmoil,” said analysts at ING, in a note.

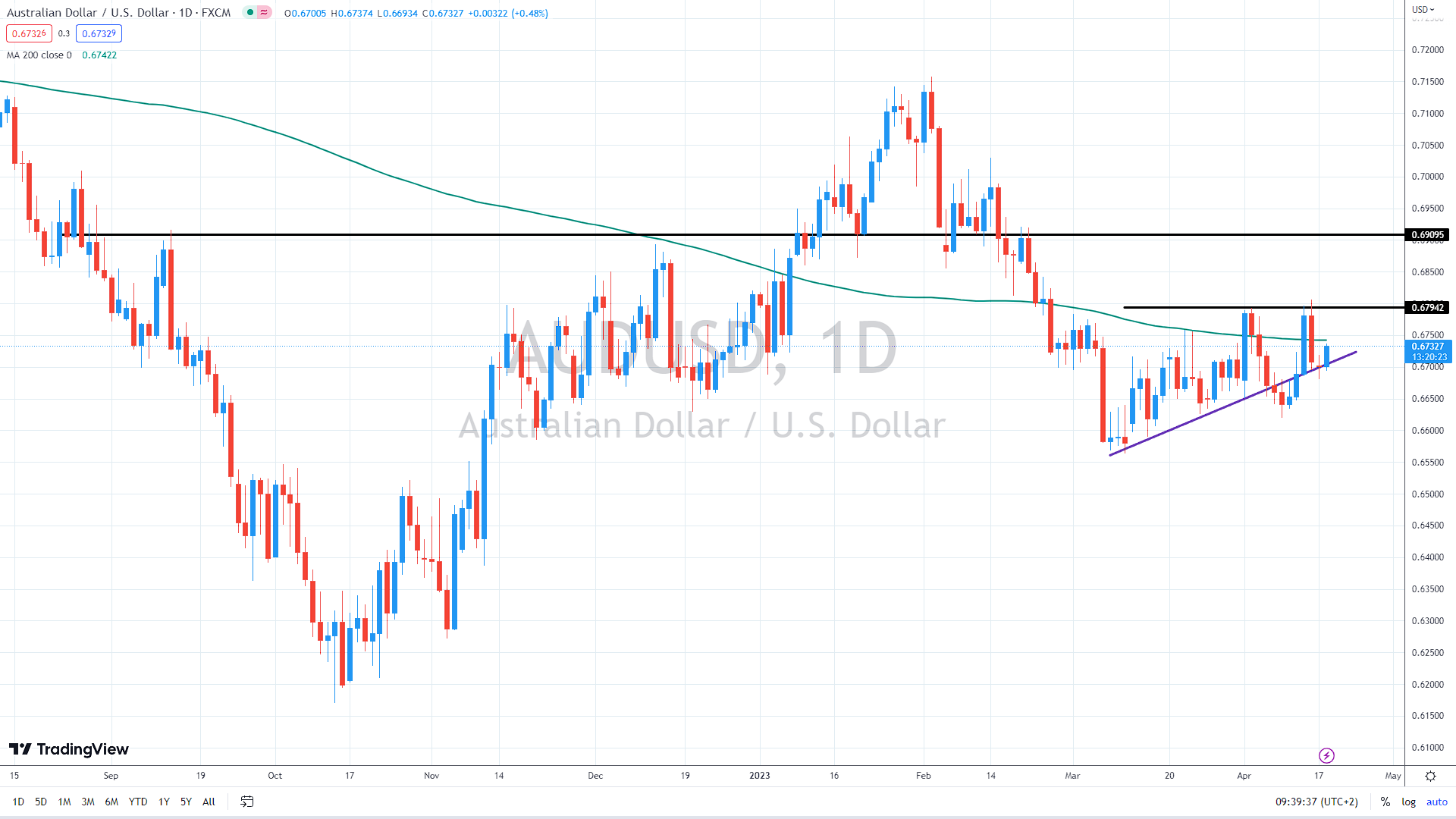

The technical situation is sketchy as the pair jumps up and down. However, the immediate resistance is at previous highs near 0.68, and if broken to the upside, the medium-term uptrend is likely confirmed, targeting 0.69. On the downside, if today’s rally fades, bears could aim at 0.67 and April lows of 0.6640.

AUD/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.