The greenback surged Monday, capitalizing on higher US yields as the recent OPEC+ production cut sent oil soaring, reinforcing global inflation worries.

Japanese macro news

The Bank of Japan’s (BoJ) carefully watched Tankan Large Manufacturing Index for the first quarter (Q1) of 2023 decreased to 1.0 from 7.0 before and 3.0 predicted. In contrast, Japan’s Jibun Bank Manufacturing PMI for March increased from 48.2 to 49.2. Nonetheless, a value below 50 indicates a decline in private industrial operations.

Another interesting topic: Forex trading for beginners – how can anyone start FX trading?

“Japan’s financial system is steady, but we must pay great attention to both home and international markets,” Prime Minister Fumio Kishida said Monday in a statement.

In contrast, the Fed’s favored measure of inflation, the US Core Personal Consumption Expenses (PCE) Price Index, fell to 4.6% yearly in February from 4.7% predicted and before. Core PCE inflation climbed 0.3% on a monthly basis, falling short of market expectations of 0.4% and a previously reported 0.5%.

“Since inflation is likely to remain the biggest driver of the Fed’s monetary policy, the market will be less likely to assume an early shift to lower rates or a faster pace of rate cuts,” said Hidehiro Joke, a strategist at Mizuho Securities.

US labor market updates

On Tuesday, the Labor Department will issue the February Job Openings and Labor Turnover Survey (JOLTS) report, which tracks the number of job vacancies, hires, quits, and separations. The number of job opportunities is predicted to have decreased to 10.8 million from 10.824 million in January. In an extremely competitive labor market, every jobless worker has approximately two job vacancies.

You may also read: What is leverage in trading?

In addition, On Wednesday, ADP will release its National Employment Report for March, which tracks private sector payrolls. The private sector likely added 200,000 jobs in March, a decrease from the 242,000 jobs gained in February.

This might set the tone for Friday’s nonfarm payrolls data from the Labor Department. Analysts predict that US companies created 240,000 jobs in March, compared to 311,000 in February. At a 50-year low, the jobless rate likely remained constant at 3.6%.

Moreover, in the first two months of 2023, the US economy has added a total of 815 000 jobs or an average of 407 500 per month. This number is somewhat higher than the average monthly increase of 400,000 in 2022, indicating that the job market remains robust despite the Federal Reserve’s efforts to calm inflation and the economy by increasing interest rates.

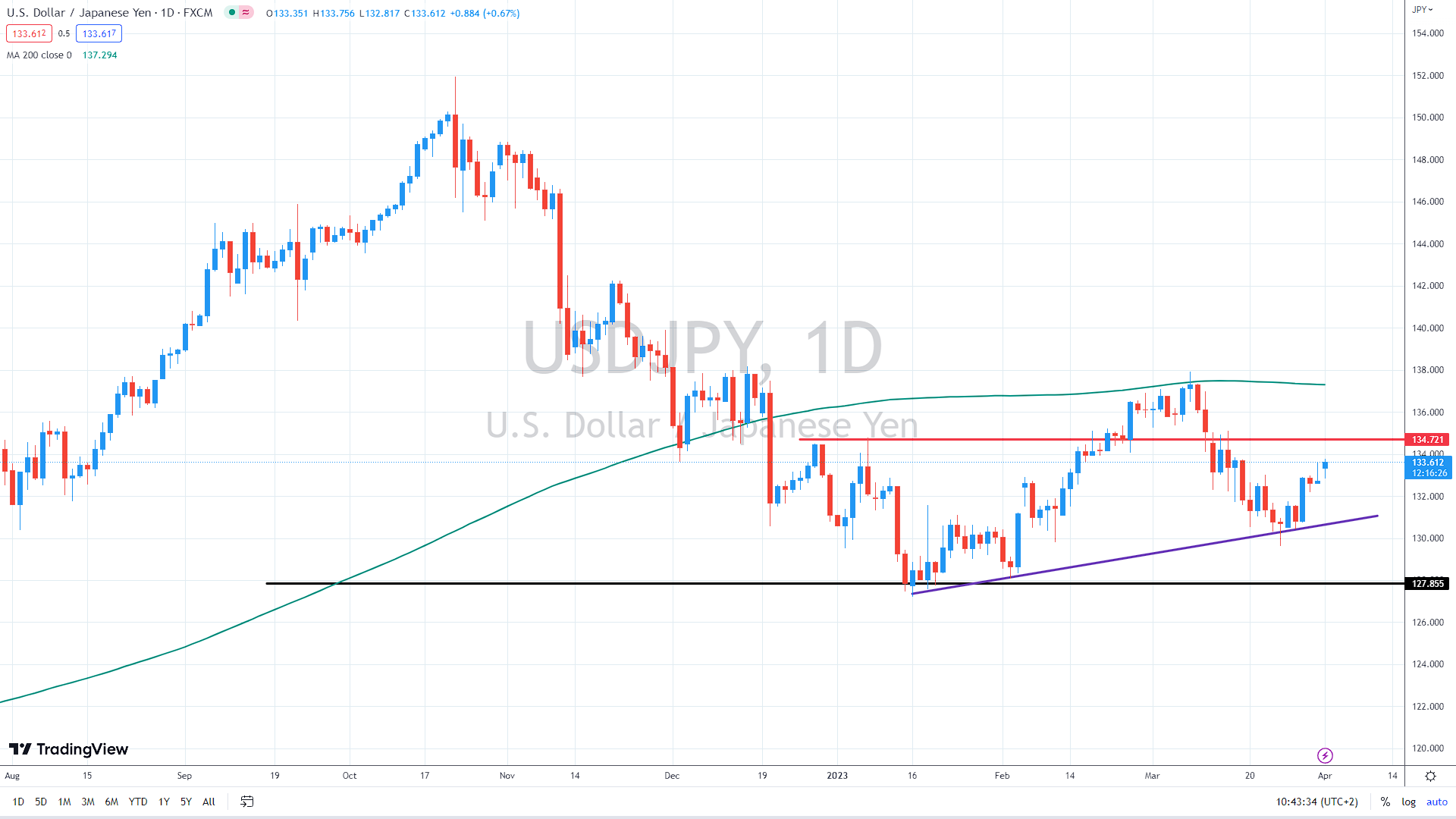

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.