While everyone knows fiat currencies like Euro or US dollar, not everyone knows what forex is. Simply put, forex is a financial market on a global scale where people exchange or trade currencies. Investors and traders can also profit in the forex market. Discover how it works in this article.

What is forex market?

The process of changing one currency into another is known as foreign exchange. It typically occurs for commerce, trade, or tourism. Forex, or foreign exchange market, is also used for trading, speculating and hedging.

The best and simplest explanation of forex is that it is a currency market, also marked as FX. The forex market is the biggest in the world, reaching several trillion dollars in volume daily.

Related article: What is the difference between trading and investing?

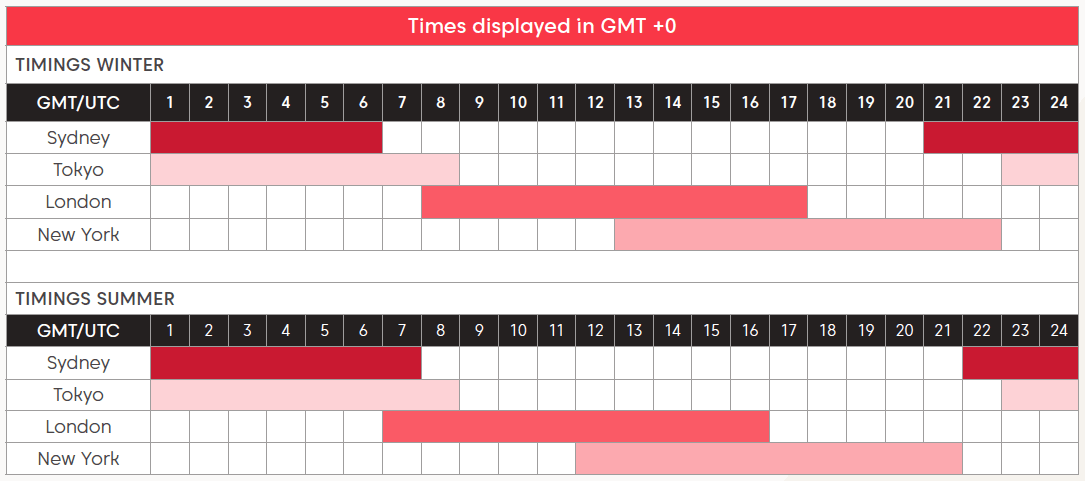

In contrast to trading stocks or commodities, forex trading occurs directly between two parties in an over-the-counter (OTC) market. A global network of banks runs the forex market. They are dispersed across four major forex trading hubs in various time zones—London, New York, Sydney, and Tokyo.

People can trade FX whenever they want, 24/5 throughout the working week, unlike the stock market, which is usually open for 8 hours from Monday to Friday. Forex is made out of tens of currency pairs like EUR/USD, USD/JPY, or EUR/SEK. A base currency is the first currency listed in a forex pair, and the second currency is called the quote currency.

Main trading hours in forex centers, source: axi.com

In the case of EUR/USD, EUR is the base, and USD is the quote currency. When the euro surges, EUR/USD goes up. However, when the USD gains strength, EUR/USD decreases as currency pairs have a negative correlation relationship. So traders are basically buying euro, the base currency when entering a long position at EUR/USD and selling USD, the quote currency.

What is forex trading?

Forex can be defined as a network of buyers and sellers who exchange currencies at a set rate. Those who have ever been abroad had probably engaged in some type of forex transaction. It is the process through which people, businesses, as well as central banks convert one currency into another.

Listen to our podcast about trading: #2: What is the secret to trading with Tom Basso

While a lot of currency conversion is done for practical reasons, the great majority is done with the intention of making a profit. As a result, some currencies’ price swings might be particularly erratic due to the volume of currency converted daily. This volatility, which increases both the danger and the potential for huge returns, can make forex trading so alluring to traders.

Trading size and leverage explained

Forex traders use three main sizes when trading:

- Microlot – one microlot is $1,000 worth of a traded currency

- Minilot – one minilot is $10,000 worth of a traded currency

- Lot – one lot is $100,000 worth of a traded currency

Some people may ask “how can I trade forex if I need at least $1,000 to start?” It’s very simple. Brokers offer leverage to traders of up to 1:1000, but it is recommended to use a max of 1:100 to don’t over-leverage.

Also read: How to control emotions in trading and protect your capital

Most traders fail because they use too much leverage, which results in destroying their trading accounts. So, if a trader has a $1,000 account and leverage of 1:100, they may trade one whole lot with a size of $100,000.

4 categories of currency pairs

There are also four main categories of currency pairs:

1. Majors pairs: these FX pairs are typically the most traded currencies because they are paired with the USD. The major pairs include USD, the most actively traded forex pairs with the highest liquidity and lowest spreads. For example, EUR/USD, USD/JPY, USD/CHF, USD/CAD, etc.

2. Minors pairs: These currency pairs refer to any of the remaining non-USD forex pairs. These pairs are a little less popular and have less liquidity, which often results in bigger market movements. As a result, their spreads are higher than in major pairs. For instance, EUR/GBP, GBP/JPY, EUR/CHF, etc.

3. Exotic pairs: These currency pairs are one of the least traded as they include currencies from emerging countries or smaller countries like the Czech Republic. The spreads on these FX pairs are among the highest in the market and have the lowest liquidity, sometimes resulting in sharp moves—for instance, EUR/CZK, EUR/HUF, USD/MXN.

4. Currency crosses / regional pairs: Regional pairs are just an example of the minors where USD is no longer present. These currency pairs are similar to exotic pairs regarding spreads, liquidity, and volatility. For example, AUD/SGD, AUD/NZD, CAD/CHF.

3 types of forex market

1. Spot FX market: a currency pair is physically exchanged at the precise moment the trade is settled, or “on the spot,” or within a short amount of time.

2. Forward FX market: a contract is made to purchase or sell a predetermined amount of a currency at a predetermined price. The contract is settled at a predetermined future date or a range of future dates.

3. Futures FX market: A contract to buy or sell a specified quantity of a specified currency at a specified price and date in the future is made. A futures contract, in contrast to forwards, is legally binding.

What do I need to start forex trading?

Forex trading is so alluring to traders because it is relatively easy to start. All a trader needs is a laptop or a smartphone, an internet connection, capital as well as a trading account. It is possible to trade even with a couple hundred dollars. Opening an account at a broker is usually a simple and easy process.

Read more: 10 trading podcasts to help you stay ahead of the game

However, it is essential to keep in mind that forex trading is no “get-rich scheme,” but rather a tool for providing higher-than-average returns offered by banks or stock indices. That is why traders should not expect to make millions out of a $1,000 account.

What is a pip in forex?

The movement in a forex pair is measured in pips. A forex pip is typically equal to a one-digit change in a currency pair’s fourth decimal place. Therefore, if the EUR/USD pair changes from $1.0115 to $1.0114, it moves one pip.

The Japanese yen stands out as the most obvious exception to this rule since it is listed in significantly lower denominations. In this case, a change in the second decimal place is one pip. Therefore, if EUR/JPY changes from 131.655 to 131.645, it changes by one pip once again.

Forex trading strategies

There are four main trading styles: scalping, day trading, swing trading and position trading.

1. Scalping

A scalp trade involves holding positions for no longer than a few seconds or minutes, and the profit potential is constrained in terms of several pips. Such deals are meant to be cumulative, which means that tiny profits made in each trade add up to a respectable sum at the end of the day or period of time.

They are unable to tolerate high levels of volatility and depend on the predictability of price movements. As a result, traders sometimes limit their trades to the most liquid pairings and during the busiest trading periods of the day.

2. Day trading

Intraday trading, or day trading, involves holding and liquidating holdings on the same trading day. A day trade can last from few minutes to several hours. To optimize their profits, day traders need to be proficient in technical analysis and familiar with key technical indicators. Day trades depend on small gains throughout the day, just like scalp trades do.

3. Swing trading

Swing trading represents holding the position for several days or even weeks, rather than just a day. Swing trades can be helpful during significant government announcements or periods of economic turmoil when there is a long and strong trend. Swing trades don’t require regular daily market monitoring, because they have a larger time horizon.

Swing traders should be able to assess economic and political changes and their effects on currency movement in addition to technical analysis. Swing trading is known as the easiest form of trading as it is “slow and boring” but fruitful when done correctly.

4. Position trading

Position traders have the currency in their possession for several months or even years. Given that it offers a rational foundation for the trade, this kind of transaction necessitates greater proficiency in fundamental analysis.

You may also like: GBP/USD approaches critical resistance ahead of US inflation update

Position trading is mostly done with no leverage or with little leverage to withstand dangerous volatility. Traders can easily make a position trade by converting their euros to US dollars and holding them in a bank for a year if they think USD will strengthen.

Advantages of forex

- Forex is great because it has low barriers to entry and it is easy to start trading

- People can trade a lot of money with low capital thanks to leverage

- There is a very high trillion-dollar liquidity

- Endless possibilities for profits

- Many currency pairs available to trade

- Trade from anywhere in the world just by having an internet connection

- It’s open 24 hours a day, 5 days a week

- The forex market is more decentralized than stock or bond markets

Disadvantages of forex

- High volatility is needed to profit, but it can be a double-edged sword and cause losses

- Enormous leverage can lead to emotional stress and cause huge losses

- While it is easy to start trading, trading itself is challenging as it requires deep knowledge of trading psychology, technical analysis, fundamental analysis and indicators

- It is estimated that only a few percent of traders are profitable in forex, which statistically shows it is difficult to profit in the long-term

How to get started with forex trading

- Get a laptop or PC with a good internet connection

- Open a forex trading account

- Create a trading strategy and insert capital into your account

- Now you’re ready to trade

Conclusion

Now that you know all the basics of forex trading, you can try it out by paper trading without risking a single penny. Remember that trading itself is difficult and takes a lot of work along with the discipline to learn. It’s no wonder why most brokers report 80% of traders being at loss.

#Bitcoin: An extraordinary asset class defying traditional labels 🔥✊

➡ Discover how $BTC challenges traditional asset classes and reshapes the financial landscape with its unique attributes.#crypto #cryptocurrency #btc #trading #trader #investor https://t.co/0PUZg0Iz1S…

— Investro.com (@investrocom) March 21, 2023

Comments

Post has no comment yet.