Hawks strike again

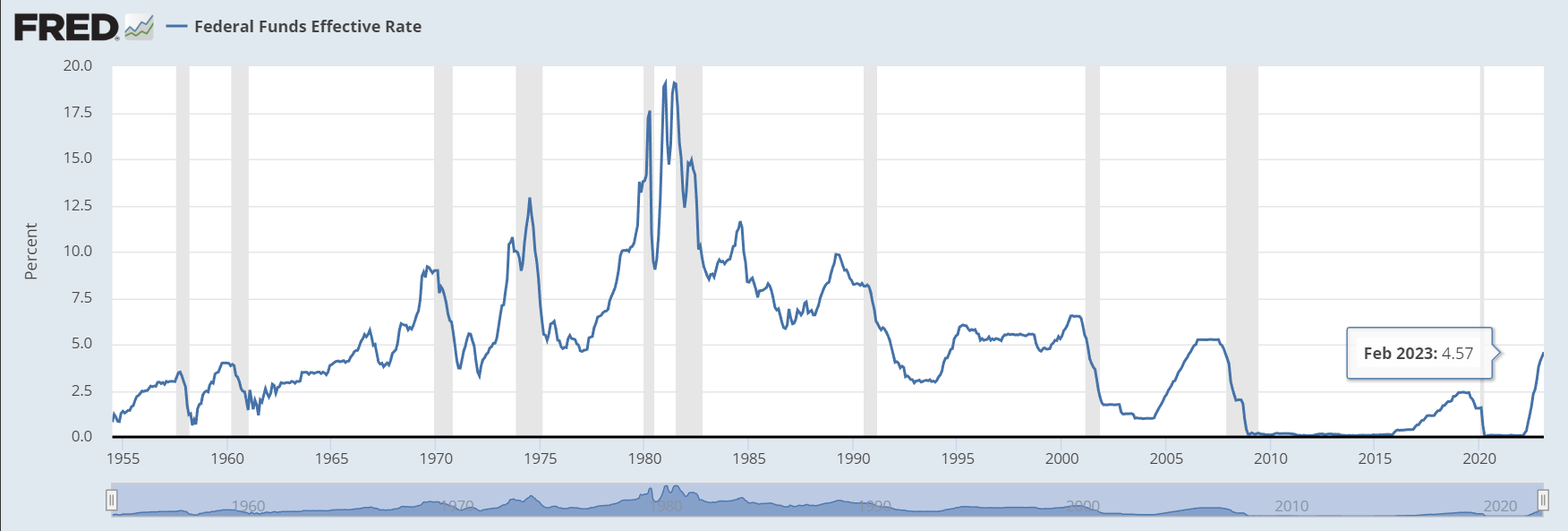

On Tuesday, US market indexes declined after Fed chair Jerome Powell testified before congress. He expressed, that the reserve bank will ultimately have to increase its interest rate by a greater amount than anticipated in order to combat persistently rising inflation.

Immediately upon the release of Powell’s prepared statements, equities lost momentum and continued to decline as the session progressed. Powell told US legislators the Fed is willing to act in greater increments if economic data shows firmer measures are required to restrain rising prices.

“the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” Said Powell

Fed rate chart, source: FRED

The statements were his first since January inflation data showed an unexpected uptick and the US government recorded a big gain in payroll jobs. Traders are back to the 50bps rate rise at the next meeting assumption.

More to read: What caused the stock market crash of 1929?

The Dow Jones slid 1.67%, the S&P 500 closed 1.53% in the red, and Nasdaq declined 1.17%, to 11,538.88. As a reaction, the yield on the US 10-year treasury Bonds note surged near 4% before dropping down to 3.96% again, maintaining just below the 3 month high of 4.07% set on March 2nd due to Fed.

US dollar is the only benefactor of the hawks

All the Fed talks and hawkish stances provided the US dollar a lift. The US dollar index, a gauge of the greenback against a currency group of 6 currencies, carried up till 105.435.

As a result of the Fed’s chairman’s ultra-hawkish testimony before Congress on Tuesday, the EUR/USD exchange rate continues its maximum decline. EUR/USD sank more than 1% to 1.55 ranges, a level last seen two months ago.

You may also like: What is a REIT?

The Yen was unable to hold the 137 resistance level and broke through with the US dollar’s massive pressure. USD/JPY closed 0.92% in the green at 137.15

The sterling also fell, with an iron boot. GBP/USD closed the session with a 1.6% decline, marking a level not far from 1.80 at 1.829

Commodities drop into the abyss

WTI marked the session end at $77.38 a barrel down $3.08, or 3.84%, on the day. The last time the benchmark for US crude fell more in a single session was on January 3rd, when it lost 4.2%. This marked the end of a 6 day long recovery above $80 for WTI.

Brent crude closed at $83.12, down $3.08, or 3.56%. The only time the benchmark crude oil price dropped more was on January 3rd, when it plunged 4.4%. Tuesday’s slump also occurred after Brent settled over $86 on Monday, the first time after three weeks.

Gold is still holding above $1800 at $1818, however almost 2% down. Silver futures are touching the $20 mark at $20.148 with a 4.67% deep in the red for today.

Comments

Post has no comment yet.