The dip has been bought

The S&P 500 touched levels above 4,000 on Monday, aiming to leave its weakest week of 2023 behind. Growth companies like tech were snatched up by dip buyers even as suspicions of a hawkish Fed continue.

Tesla led consumer discretionary stocks higher as investors anticipated the electric vehicle manufacturer’s investor day on Wednesday. In other EV-related news, Fisker gained 30% as its maintained car production target for 2023 outweighed worse-than-expected quarterly earnings.

More to read: What does market cap mean in stocks?

Wall Street stocks gained on Monday, indicating possible bargain shopping. The Dow Jones increased 0.4% to 32,948.76, the S&P 500 jumped 0.5% to 3,990.25, and the Nasdaq advanced 0.85% to 11,4906. US two-year Treasury rates, which are the most sensitive to changes in interest-rate expectations, have increased by over 80 basis points since the Fed’s January meeting.

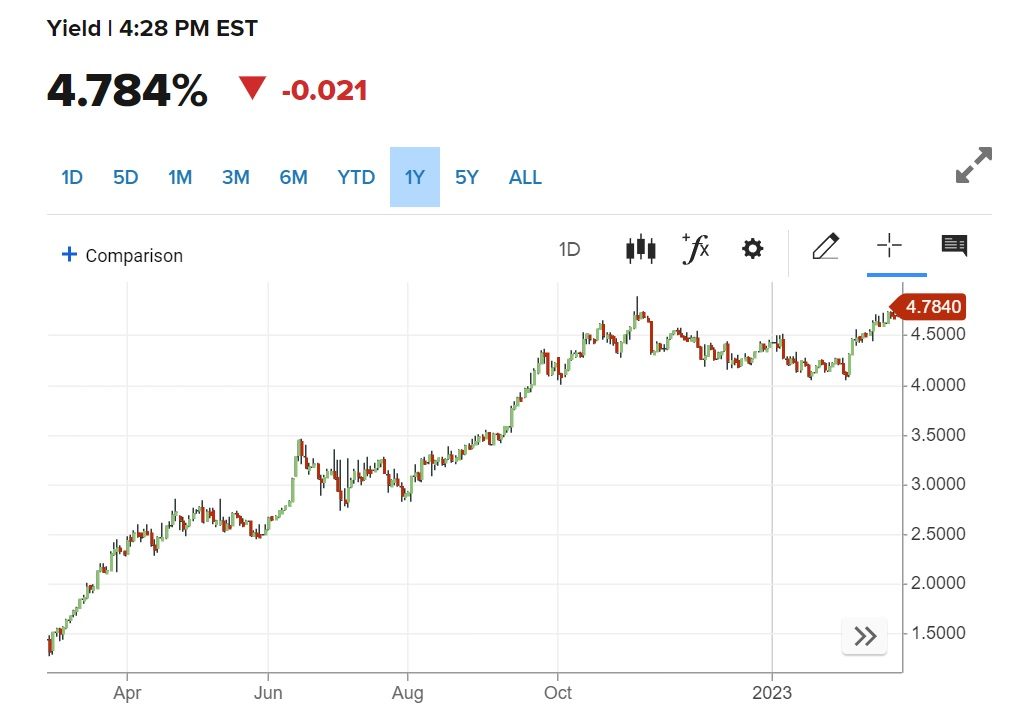

S&P 500 has dropped 6% of its value since reaching a five-month high on February 2nd. The yield on the two-year US bond decreased 1.8 bps to 4.784% on Monday, while the 10-year yield fell 3.1 bps to 3.918%.

US 2 year bond yield 1D chart, source: CNBC

Greenback finally eases the pressure on rivals

The US dollar began the week by maintaining its good momentum from the previous week. However a decline in desire for the American currency followed. Pending House Sales increased 8.1% exceeding forecasts. The US dollar index declined by 0.5% to 104.635.

The EUR/USD regained the 1.0600 level as Wall Street concluded the day with gains. The optimistic tone of equities impacted on the Greenback. AUD/USD toyed with 0.6700 before recovering to close the day at 0.7635, almost unchanged. Australian Retail Sales are due Tuesday. The USD/CAD dropped to 1.3580, and USD/JPY concluded the day with moderate losses around 136.20.

You may also like: Seven simple investment strategies to make steady returns

The stock-boosting US data had little effect on oil prices. The US crude inventory report from the EIA finally caught up as Brent futures for May delivery slid 0.9%, to close at $82.45 a barrel. WTI ended 0.8% in the red at $75.68.

Gold drops below $1,820 per troy ounce after plunging to a new low for 2023 of $1,806.52 per troy ounce. Silver futures for May delivery stayed below the $21 level at 20.707 with a 1.09% decline.

Comments

Post has no comment yet.