There is certainly a reasonable view that buybacks cause the stock to appreciate. However, even in this case, timing can be crucial. In some cases, the company’s money used for this purpose can be thrown into the air. This is because buybacks do not always affect the share price, as management expects. There are situations where this can be ineffective (e.g. before negative results, or before the significant drop or as stock price developments has a positive trend and buybacks are bought “on top”). Especially in front of situations that the company cannot influence – e.g. negative macroenvironmental environment (economy, fiscal/monetary policy, etc.), or in the situations, in which the whole market reacts negatively. In such cases, otherwise called “tail events,” buybacks play no role if they took place before this collapse. They can help alleviate the downturn, but if the company makes a purchase strictly at these bad times.

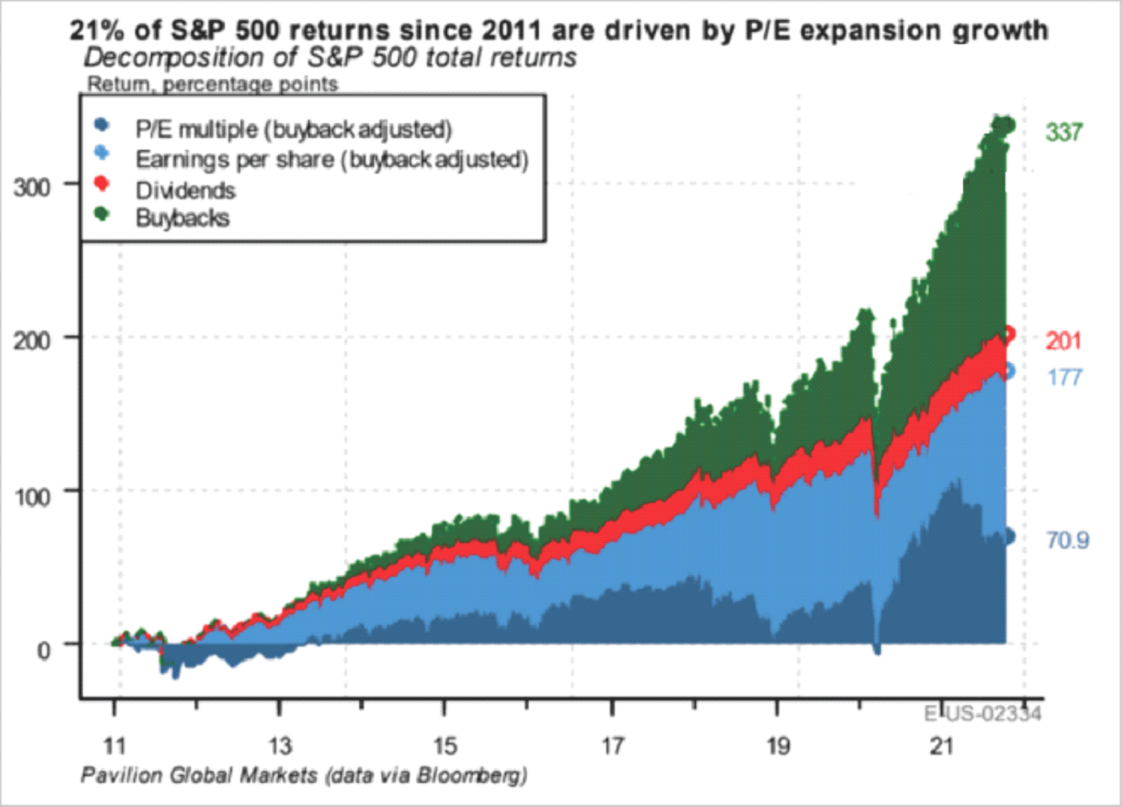

Regardless of when companies take this strategic step, buybacks make a significant contribution to the growth of the overall stock market. That is precisely by the large volumes of purchases from corporations that cause the stock to appreciate in the long run. “Pavilion Global Markets’ analysis says 40.5% of total growth is due to stocks buybacks, 21% due to multiple expansion, 31.4% due to earnings, and 7.1% due to dividends.” Only here can we see the real impact of share repurchases on overall growth.

Source: Pavilion Global Markets (data via Bloomberg) via Zerohedge

Comments

Post has no comment yet.