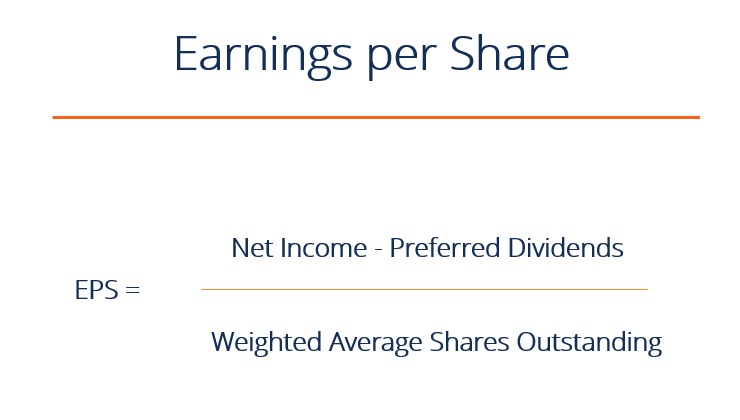

We will introduce many of these indicators in other chapters, where we will deal with them in great detail. Nevertheless, the abbreviation EPS means Earnings Per Share. It expresses the company’s net profit per number of shares. As we mentioned, EPS and P / E are calculated from outstanding shares, so by reducing the total number of outstanding shares for a given company, EPS will increase with the same profit. Let’s say a company is profitable.

Source: CFI

If we look purely at EPS statistics and see a clear positive, linear trend, this may indicate us the feeling that the company is becoming more and more profitable. On the other hand, if we look at Net Income in Income Statement, we can see that the profit can be the same or even less. At this point, there is a sobering up because we find that the company is not increasing its net profit as such, but the misconception of EPS growth indicates us the exact opposite. It may be caused because the firm prefers a stock buyback policy, and by reducing the total number of outstanding shares, the same gain is seen by a smaller number of shares, which causes it to be at least equal or larger. So this is also one of the reasons why companies like to use this strategy. This is a legal manipulation, respectively, deception for investors. That is why it is essential to always look at the balance sheet and income statement and monitor the company’s cash flow. Remember, the stock price is probably more correlated to EPS and margins that the net income.

Comments

Post has no comment yet.