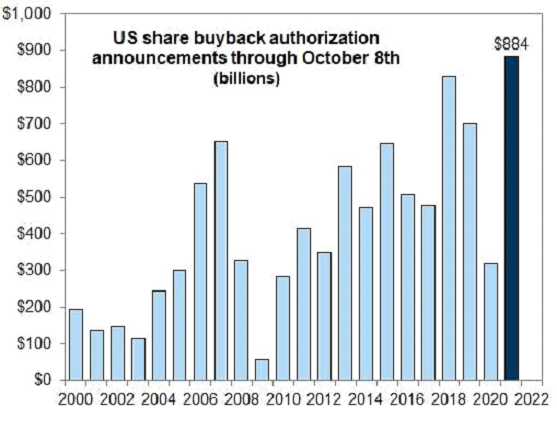

As the name implies, “stock buyback” is a situation where a company buys back its shares on the open market. Through this activity, the company buys its shares from the market and through purchases, it reduces the “total number of outstanding shares.” Stock buybacks predominate over technology companies and giants more than dividend aristocrats. Below we list the number of buybacks in billions in recent years (through 8th October). Note the year 2021, when companies have decided to apply this strategy extensively despite the pandemic.

Source: Goldman Sachs Investment Research Division

There are many reasons why companies prefer this strategy:

- By removing the total number of outstanding shares, the company increases the % ownership of other investors. If you own a certain number of shares or a certain share of shares in the company before the buyback, then after the buyback, you will own more from the % point of view because the total number of outstanding shares in the market has decreased.

- Companies should spend money on buybacks if they do not know where they would better allocate free cash. E.g., they could reinvest or invest in venture capital or repay their debt (if it pays off). However, this theory is long forgotten because many companies nowadays give tens of millions to buybacks just to “rise” in the eyes of shareholders or even to their advantage.

- Legal “manipulation” of EPS (we will discuss later).

The following reason is that the company’s management has bought millions of shares and wants to get even richer due to stock price appreciation.

- The ideal solution may be when the company has nowhere to allocate additional cash. At the same time, it does not have high debt servicing costs, while it can consider its shares to be significantly undervalued. In this case, buybacks can cause the stocks to appreciate.

- Stock buybacks should not be the prominent use of generated cash. In this case, the company should focus on restoring its balance sheet, reducing debt, and not making buybacks to just “fall in love” with the eyes of investors.

- An inefficient strategy is used when a firm has investment opportunities that could improve its growth potential in the future but prioritizes buybacks to support price appreciation.

In many cases, this strategy is more effective than paying dividends. In the previous text, we explained the importance of buybacks and when it is efficient and inefficient for a company to implement this policy. Nevertheless, we will discuss other pros and cons that will cover this topic in detail.

Comments

Post has no comment yet.