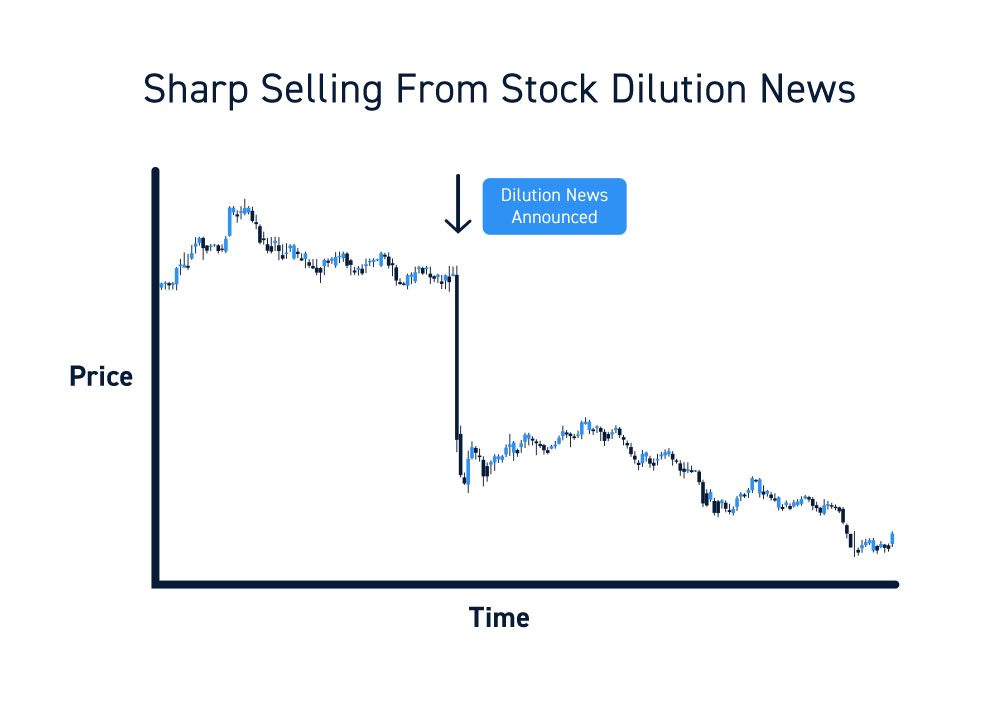

Next, we have the term “stock dilution,” which, in translation, is related to the secondary offering. In practice, this represents a decrease in the value of an individual share due to increase in total number of shares. It occurs when a company issues additional new shares through a public offering or via convertible bonds. Dilution is a very negative step for shareholders.

If someone owns 1000 shares out of a total of 2000 shares, it owns 50%. However, the company decides to issue new shares for a total of 3,000 shares, and the investor still owns 1,000 shares. In this case, its ownership share decreased, and the stock’s market value dropped significantly by issuing new shares. Firms are trying to avoid such actions, as they significantly harm shareholders. In addition, companies with a wrong balance sheet have a more significant probability of such management step.

Source: Stock Dilution – How it Works and What to Be Aware Of (centerpointsecurities.com)

Other Sources: What is Stock Dilution? – 2020 – Robinhood

Comments

Post has no comment yet.