Tesla is up more than 9%. We provide detailed breakdown of Q4 2022, 2023 guidance, and year-end results. In the previous research we published a few days ago, we concentrated mostly on price reductions and Chinese demand as a result of a significant sales surge during the second week of January.

We expect that price reductions will boost global demand for Tesla’s products, resulting in exceptional Q1 performance. But now, let’s focus on the Q4 2022 and 2022, which were released during the earnings call on Wednesday.

Tesla stock price, source: tradingview.com, Investro analytics team

1.Q4 results beat the street´s EPS estimates

Tesla reported Q4 revenues of $24.32 billion, up 37% year-over-year and more than 13% quarter over quarter. Non-GAAP EPS of 1.19 USD surpassed market expectations by 0.08 USD. Despite a reduced gross margin on supplied goods, the most lucrative quarter ever occurred.

More about stocks: Hindenburg shorts Adani Group, firm of the third richest man on planet

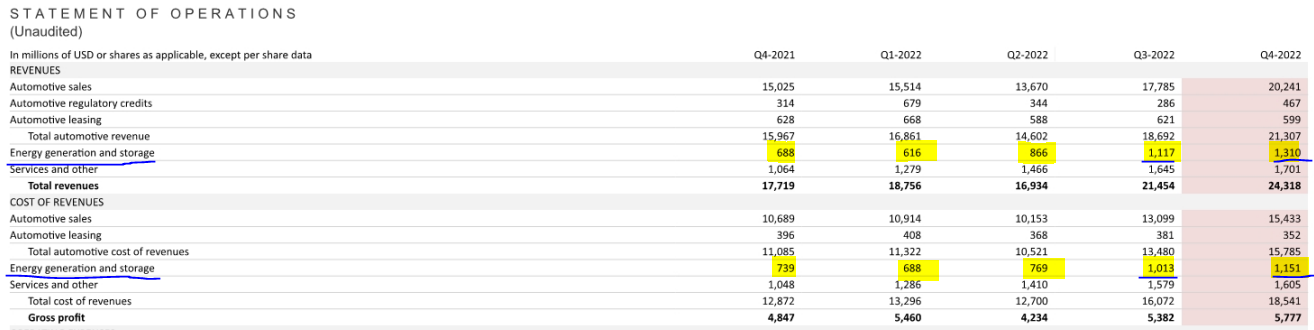

GAAP gross margin at 23.8%, the lowest this year, was probably impacted by slightly lower prices at year-end. The margin in the energy generation and storage segment is the highest ever.

Tesla – financial summary for Q4, source: Tesla fillings, SEC

Based on Tesla:

“Energy storage deployments increased by 152% YoY in the last quarter to 2.5 GWh. Demand for our storage products remains in excess of our ability to supply.”

Revenues from EG&S reached $1.31 billion, with 12% gross margin (highest in 2022).

Tesla – statement of operations for Q4, source: Tesla fillings

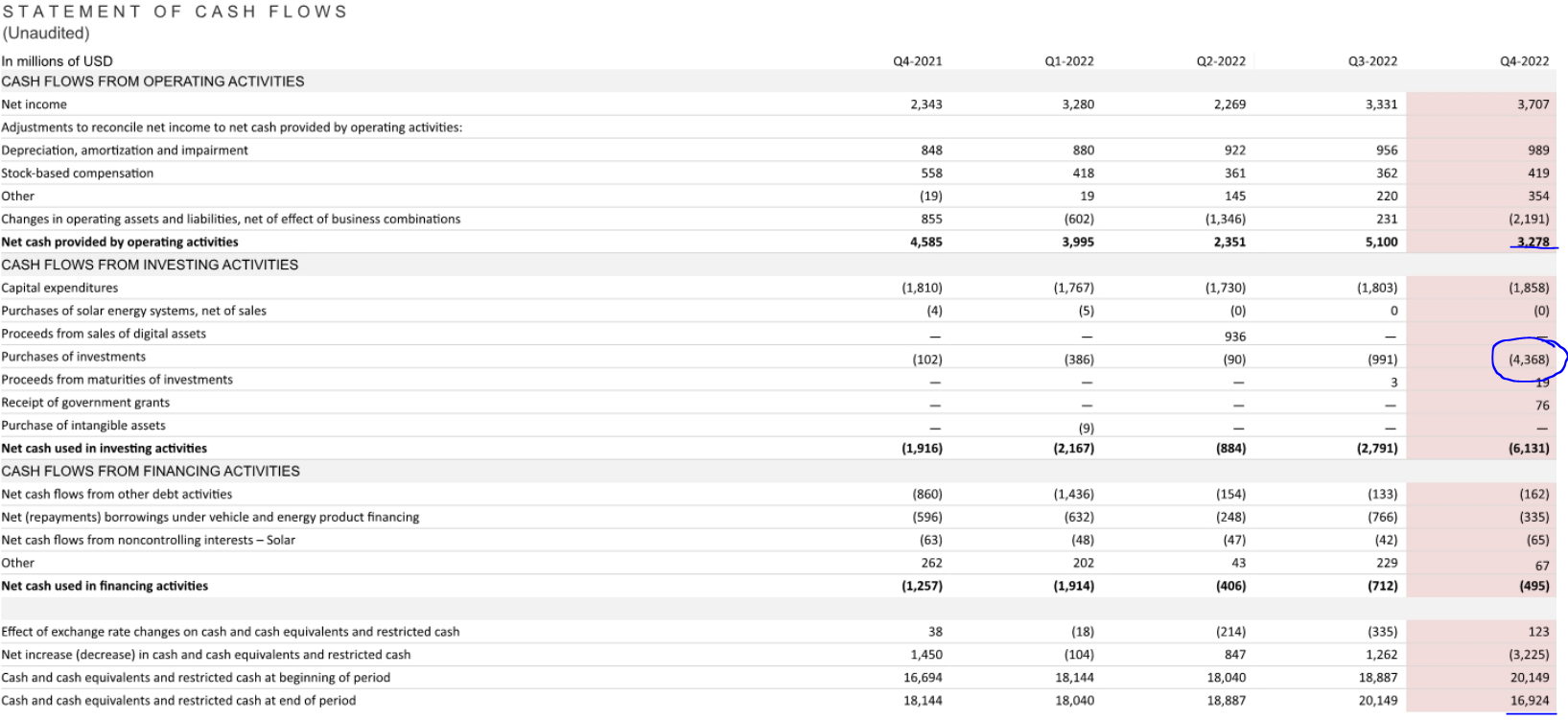

The FCF creation in Q4 was probably a tad underwhelming, totalling $1.42 billion, which is extremely respectable overall, but a weakness compared to prior quarters as well as lower than wall street´s estimates.

Looking at the CF statement for the fourth quarter, however, we observed exceptional investing activity of $4.36 billion. Compared to past quarters, this is a tremendous increase. According to some reports, it reflects bond purchases, although we cannot verify this.

Tesla – statement of cash flows for Q4, source: Tesla fillings

Mitigating factor are debt repayments and related operations of $495 million. As a result, cash position ended at $16.9 billion USD, down from $20.1 billion in the third quarter. To summarize the quarter’s results, it ended positively, but FCF expectations were higher.

2.Fiscal year 2022 with phenomenal end

The overall 2022 result gave much better confidence and perspective to assume that Tesla had a great year. Total revenues increased 51% year on year to $81.4 billion ($53.8 billion), with the highest GAAP gross margin of 25.6%.

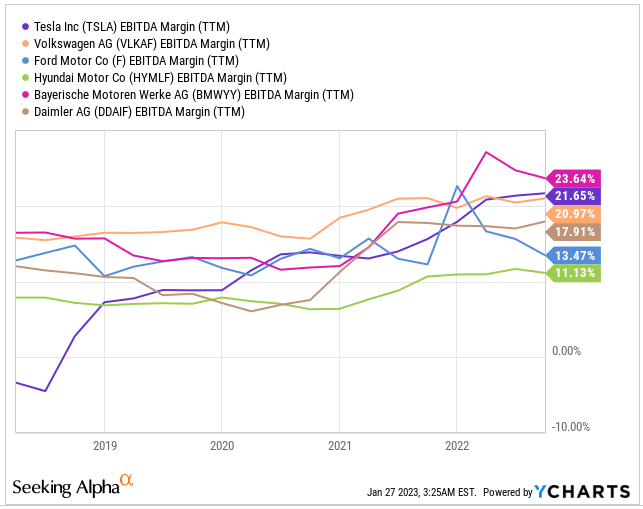

Adjusted EBITDA margin increased to a record 23.6% (21.6%) with a 65% YoY increase at $19.2 billion. We believe it is the highest among the other competitors, confirming that the valuation premium is justified.

In the Q3 2022 Tesla EBITDA margin (TTM) reached 21.5%, Ford Motor at 13.47% and Hyundai Motor with 11.13%. The only one competitor with greater EBITDA margin is BMW, but its earnings are more related to the economic cycle.

Read also: Spotify’s stock price enjoys “the bye-bye” to 6% of employees

While in 2023 the auto-industry can be under the pressure due to lower demand, Tesla is set to break another records and is expected to deliver even bigger production, new products and gain more EPS. From this point of view we can say that Tesla will probably feel the demand disruptions just very slightly compared to its competitors.

EBITDA margin of Tesla and its competitors, source: YCHARTS

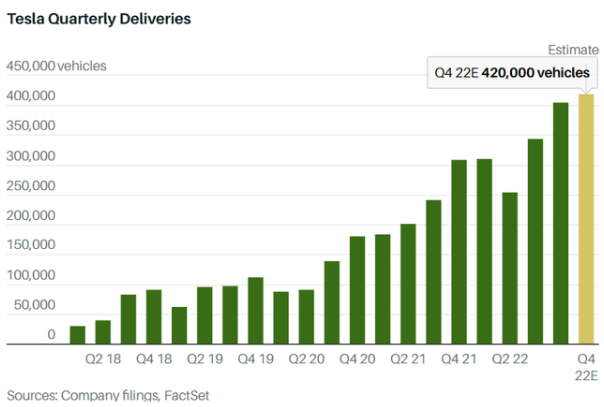

Production in Q4 2022 was 439.7k units (44% YoY), while deliveries were still at a record high of 405.2k units, but as was mentioned in the analysis above, it was below the consensus. Looking at the historical trend, it is really stunning.

Tesla quarterly deliveries, source: barrons.com

3.2023 Guidance & Outlook

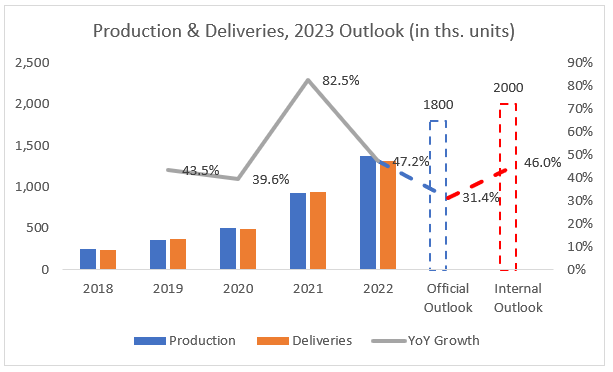

In 2022, total production increased to 1 369k units (up 47% YoY) and total deliveries increased to 1,313k (up 40% YoY). Both results are very solid, and the outlook for production in 2023 is set at 1.8 million units (conservative).

Elon Musk said on the earnings call:

“Well, okay. I mean, our internal production potential is actually closer to two million vehicles, but we were saying 1.8 million, because — I don’t know, it just always seems to be some force majeure thing that happened somewhere on earth. And we don’t control if there’s like earthquakes, tsunamis, wars, pandemics, et cetera.”

You can monitor the historical trend with the outlook below:

Production & Deliveries trend and 2023 outlook, source: Investro analytics team

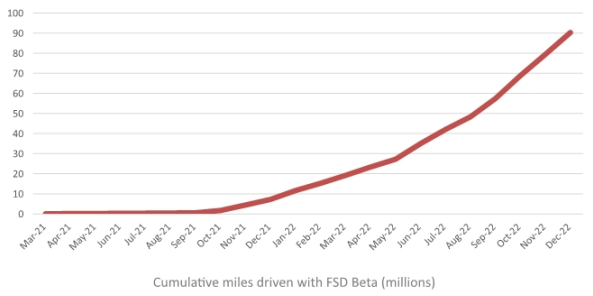

Tesla´s presentation on FSD (Full Self-Driving):

“We have now released FSD Beta to nearly all customers in the US and Canada wo bought FSD (appx 400k). Every customer in the US and Canada can now access FSD Beta functionality upon purchase/subscription.”

Cumulative miles driven with FSD Beta (mil.), source: Tesla Q4 2022

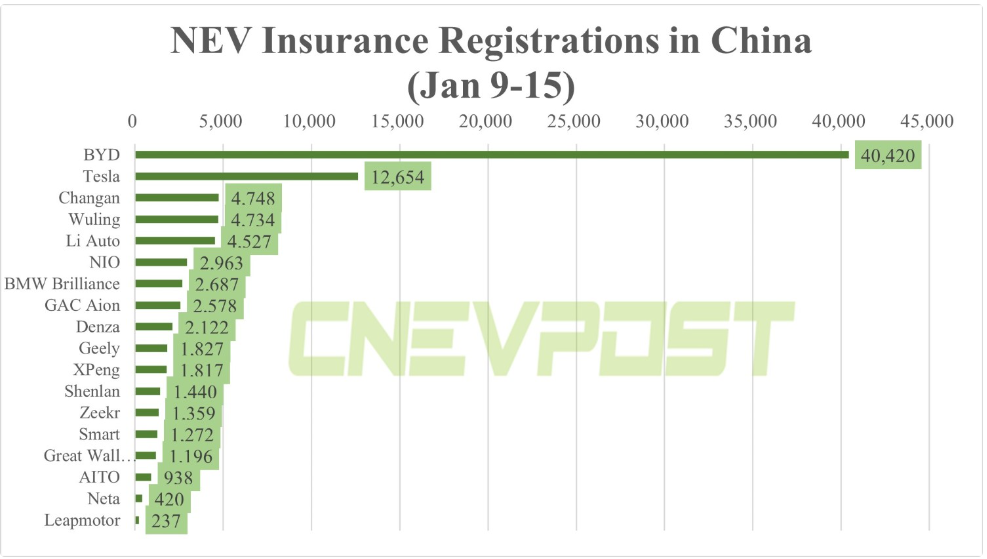

Important notes from earnings call about demand: “Thus far in January, we’ve seen the strongest orders YTD than ever in our history. We currently are seeing orders at almost twice the rate of production.” It is confirmation of our analysis, based on Chinese numbers-2nd week:

„Based on the most current data from the Chinese market, 12,654 new Tesla vehicles were sold in China during the 2nd week of January, based on insurance registrations. The previous week’s total was 2,110. Price reductions had an effect on the astounding growth. The chart below shows the historical perspective and does not count the current increase of 12,654 new cars. We believe such number can increase or remain similar during the next 2-3 weeks.“

NEV Insurance registrations in China (Jan 9 – 15), source: CNEVPOST

Summary

The earnings call revealed outstanding financial results and an optimistic outlook for 2023. It will be difficult for Tesla to meet its projections, but based on its past performance, it would not surprise us if the company exceeds its forecasts. We remain bullish on Tesla, but will closely monitor the upcoming data from Europe, the United States, and the Chinese market at the end of the month.

You may be also interested in: Intel craters after terrible earnings and catastrophic guidance

Price reductions were a strong weapon to boost the demand, and even the CEO reported that volume (book orders) is extremely high. However, we believe it will reduce the margins. We will also monitor the global economy to determine if it poses a significant threat to the company’s goals. We maintain our bullish outlook on Tesla, but we believe the stock is slightly overvalued.

Disclaimer: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.