Banking sector lifted once again

The S&P 500 increased on Monday due to relief in the banking sector. This came in form of First Citizens BancShares signed an agreement to acquire failing Silicon Valley Bank (SVB). However, a decline in the technology sector limited gains.

First Citizens BancShares acquired all of SVB remaining assets, deposits, and loans for $72 billion, a discount of $16.5 billion. First Citizens BancShares, which is anticipated to enter the top 20 US banks as a result of the transaction, increased by more than 55%.

More to read: BioNTech results have failed to raise the stock’s value

In addition to the SVB transaction, news that US officials are considering expanding the Federal Reserve’s emergency financing program to regional banks also improved optimism. First Republic Bank was up 15%, Comerica was up 6%, and Bank of America Corp was up 5%.

A pause in the technology sector capped market advances. Microsoft, Alphabet, Meta and Apple traded in the red by over 1.5%. The S&P 500 finished the day up 0.18%, the Dow Jones was up 0.6%, and the tech-heavy Nasdaq was down 0.47%.

Risk-taking appetite pushed the US dollar to the background

EUR/USD reverses two consecutive days of declines and advances after hitting a session low of 1.0744. Despite rising US Treasury bond rates, improved risk appetite and a weaker US dollar paved the way for more euro gains.

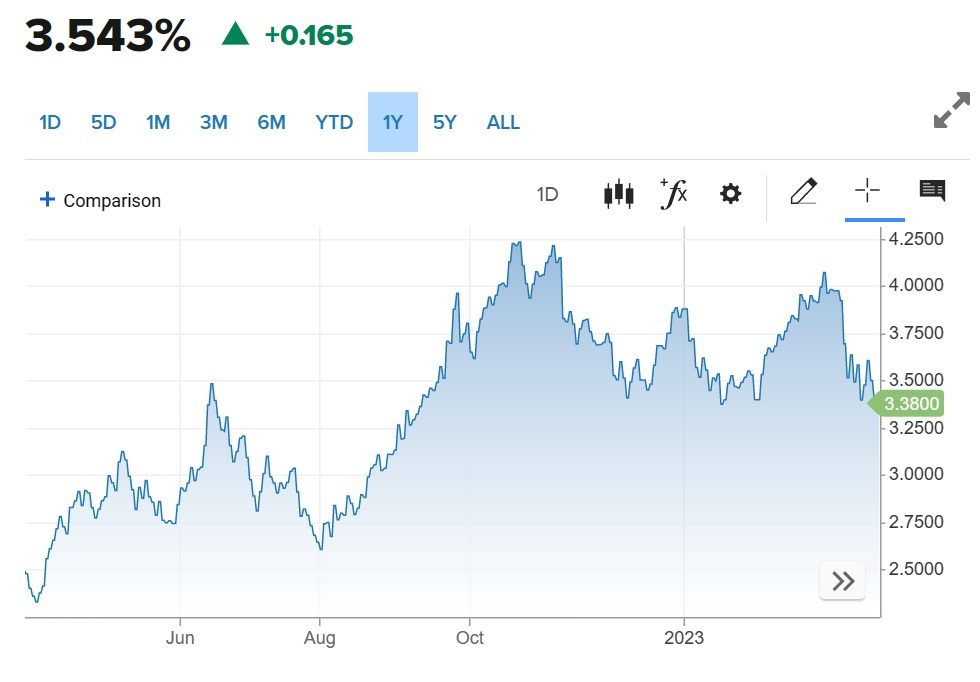

US Treasury bond rates rebounded, with 2-year yields fluctuating around 4% and 10-year yields at 3.515%, an increase of thirteen basis points. The US dollar Index (DXY) fell 0.19% to 102.915, failing to profit on the increase in US bond rates.

US 10-year Treasury yield, source: CNBC

As JPY is viewed as a safe-haven currency, the yen depreciated versus the dollar. The USD/JPY pair rose 0.7% to 131.60. GBP/USD added to the gains with a 0.5% increase to 1.2291.

Crude is the risk-on star

The price of crude rose as much as 5% on Monday’s stoppage of 500,000 barrels per day of Kurdish supplies. Vladimir Putin’s nuclear war bluster, and reassurance about the crisis-stricken US financial system also contributed to a risk-on appetite in oil.

WTI closed $3.55 higher, or 5.1%, at $72.81 per barrel. Monday’s gains contribute to the latest bounce in the US crude, which increased 3.8% the previous week after falling 13% the week prior. Brent crude closed up $3.13, or 4.2%, at $72.

Gold on the other hand, fulfilled the safe haven status and is declining with the hightened risk apetite. The new gold contract for June delivery ended 1.3% lower at $1975.80. Silver followed, with the May contract ending 0.54% lower at $23.210.

Comments

Post has no comment yet.