Big tech pulls the markets to the green

Meta’s leap on better-than-expected quarterly earnings sparked a wave of green in technology companies on Thursday, driving the indices. Even though first-quarter economic growth was weaker than predicted, the stock market as a whole posted gains today.

The show stopper, Meta, published its quarterly earnings on both fronts. The social media behemoth provided a bullish forecast, driving its shares up by more than 15%. According to Credit Suisse, “from a cost cut to a revenue recovery story,” the quarterly results and expectations indicate a shift for the social media powerhouse.

More to read: Market optimism is back: Matrixport expert predicts $45,000 per BTC

With Alphabet, Apple, and Microsoft Corporation all up more than 2%, Meta’s earnings maintained a market reaction pattern of better-than-expected quarterly earnings. This has lifted sentiment on big tech. The Dow Jones increased by 1.5%, while the S&P 500 climbed 2% and the Nasdaq gained 2.5%.

Rate hikes are good for the US dollar

The dollar gained ground on Thursday on expectations that the Federal Reserve would raise interest rates next week despite weaker-than-expected growth in Q1 of the year in the US. GDP grew at a yearly pace of 1.1% in Q1, according to the preliminary estimate. In the final quarter of 2022, economic growth was 2.6%.

You may also like: Big tech rallies – are recession fears over?

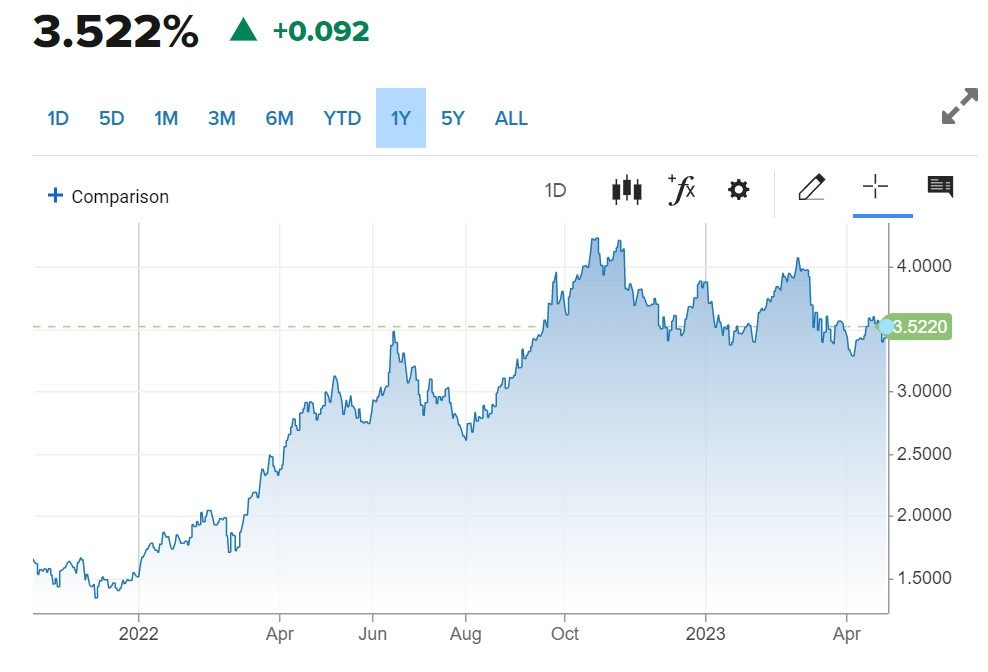

Treasuries rose as well, after an initial dump. The US 2-year rose 0.154 to 4.078%. The 10-year Treasury yield rose 9 points to 3.522%.

US 10-year yield chart, source: CNBC

At 101.50, the dollar Index was up 0.1%. The euro fell below $1.1024 during the same period. The Aussie reversed some of its losses on Thursday, posting a green day against the US dollar. The greenback fell 0.49% into 0.6630 territory.

Oil finally breaks the losing streak

With global economic concerns pushing the oil trade into a second consecutive week of losses, crude prices gained on Thursday after three days as bulls attempted to shift the oil trade away from concerns. However, the US economic statistics that increased the likelihood of a Fed raise to 90% capped gains.

The price of a barrel of WTI crude oil rose 46 cents, or 0.6%, to $74.76. Still, however, a long way to reach back above $80. Brent oil, traded in London and considered the world’s most expensive commodity, gained 68 cents, or 0.9%, to end the day at $78.37 a barrel.

You can listen to: #4: How to trade earnings season with Andrew Aziz

Gold futures for June delivery closed below the $2,000 mark again. Even though in the green, the yellow metal ended 0.07% flat at $1,997.45.

Silver futures for July had a better close than their yellow brother. With a 0.2% in the green, silver futures closed at $25.200.

Comments

Post has no comment yet.