The EIA reported fresh storage data

Last week, utilities took 72 billion cubic feet (bcf) out of US storage facilities for natural gas used for heating and power generation. This was a little under levels predicted by industry experts, according to figures released by the government on Thursday. Analysts anticipated a 75 bcf withdrawal for the week ending March 17th.

As of March 17th, the EIA gas storage report indicated a balance of 1,9 tcf, or trillion cubic feet. This was up 22.7% compared to the five-year median of 1.549 tcf and up 36.1% over the previous year’s figure of 1.396 tcf.

More to read: FTSE struggles after BoE hike – future movement uncertain

Following the publication of the data, the gas commodity gained a momentum. Natural gas futures for April delivery, traded on the New York Mercantile Exchange’s Henry Hub increased to $2.237 per mmBtu, up 6.6 cents, or 3%, from Wednesday’s close.

The US dollar to commodity link should be restored soon

Typically, commodities and currencies, particularly the US dollar, have an inverse relationship. Analysts at ANZ Bank predict that a lower US dollar will give some support for commodities prices.

Supply concerns are now diminishing. Europe’s energy shortages have subsided, and the severity of interruptions to metal and oil supply has reached its highest point. The commodity price to the US dollar link should thus reappear in 2023.

Also interesting: US President’s Economic Report is wrong about crypto – here’s why

In addition, as the Fed’s aggressive rate rise cycle nears completion, it should push the US currency down, which will likely be a powerful tailwind for the commodities including natural gas. Following a 14-year high of $10 per mmBtu in August, gas prices have dropped to $7 per mmBtu in December and down to $2 per mmBtu since February as a result of the heat and poor storage withdrawals.

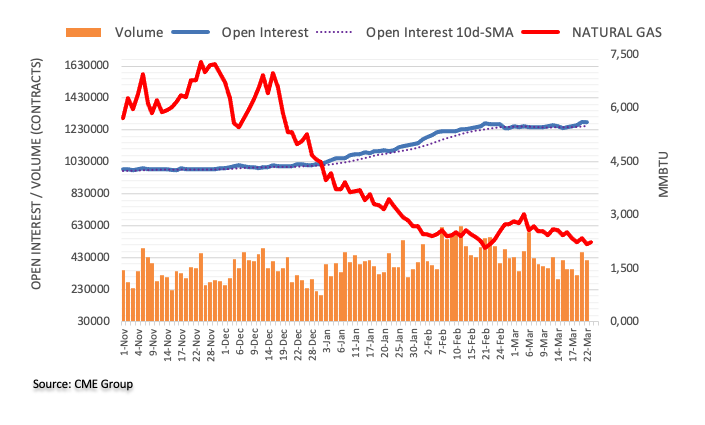

Wednesday saw a decline in natural gas prices, which was accompanied by a decline in open interest and volume. In light of this, the chance of a steeper decline in the near future is significantly less. In the meanwhile, the commodity faces the next notable support at $2.00 per MMBtu.

Price vs volume chart, source: CME group

Trading remains flat

The natural gas prices remain in the recent trading corridor. The recent months proved the gas prices will remain in the $2 to 3$ area. Unless some serious events change the course.

200-day average has been declining as well indicating the price will not hurry anywhere any time soon. The bears are still strong, aiming for the now well known $2 support.

The bulls are relying on corrections and hints of bears moving elsewhere. The current support appears to be at $2.50, with the potential of $3 from two weeks ago.

Natural gas 1D chart, source: tradingview.com, author’s analysis

Comments

Post has no comment yet.