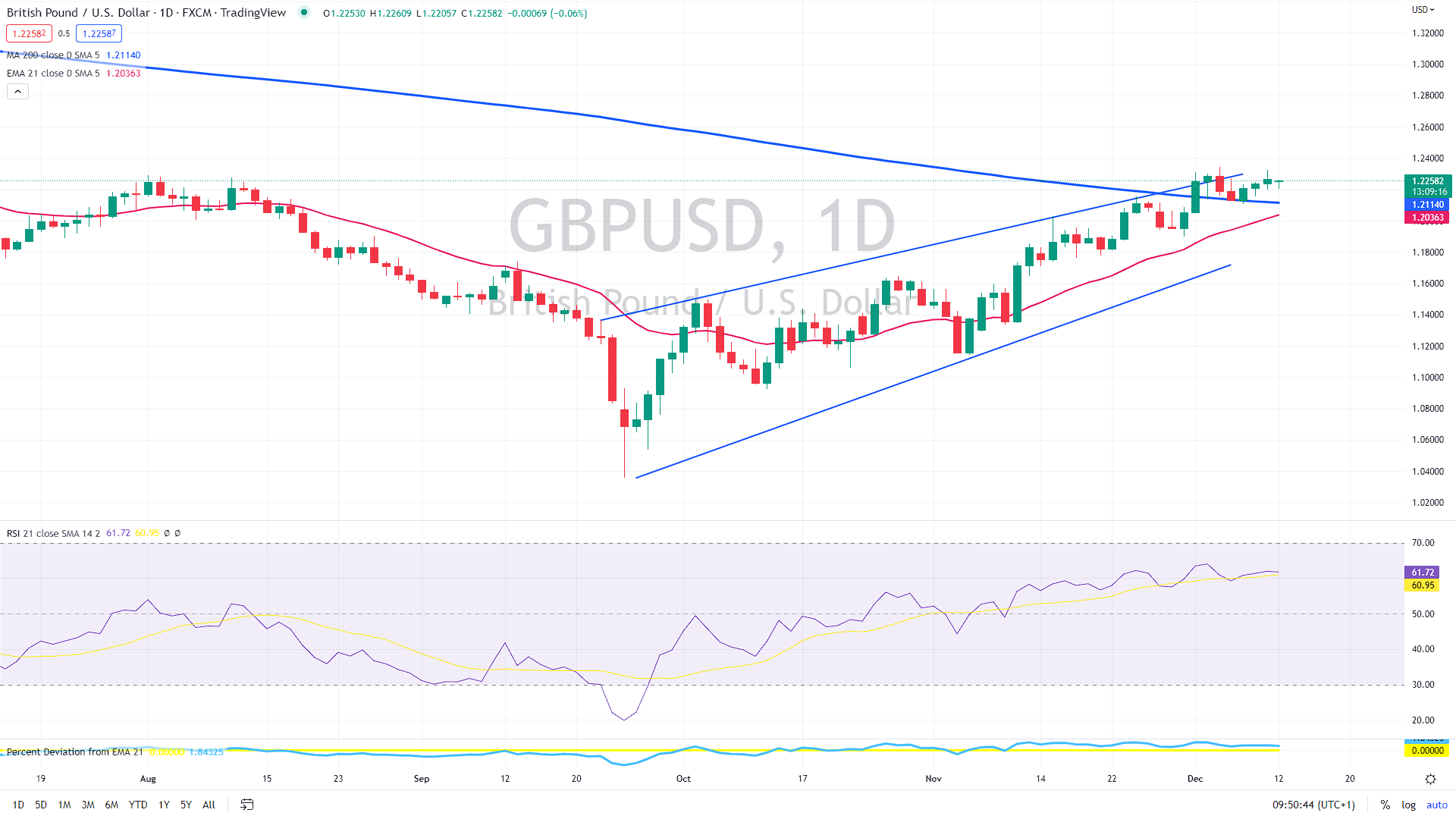

The Pound traded flattish on Monday morning, rather unimpressed by the recent batch of UK data. More importantly, the GBP/USD pair has remained above the critical 200-day moving average, which is currently near 1.21150.

UK GDP unexpectedly rises

The monthly release of Gross Domestic Product (GDP) for the United Kingdom revealed on Monday that the economy rebounded to growth in October, coming in at 0.5% versus -0.1% projections and -0.6% before.

You can also read: Have no fear, Christmas is here!

The Index of services (October) ended at -0.1% 3M/3M compared to -0.1% expected and 0% before. The UK’s GDP in October 2022 exceeded the pre-COVID-19 level of 0.4% in February 2020.

Upward surprise in the industry too

Moreover, the industrial sector appears to have maintained its recovery momentum in October, according to the latest UK industrial and manufacturing production figures released on Monday by the Office of National Statistics (ONS).

In October, manufacturing production was 0.7% MoM compared to -0.1% predicted and 0% in September, while total industrial output was 0% compared to -0.3% expected and 0.2% in September.

Another interesting topic: GameStop or what happens when you bet on the wrong horse

The annualized manufacturing production data for the United Kingdom in October came in at -4.6%, above predictions of -6.3%. However, in the year’s tenth month, total industrial production decreased by 2.4% compared to the predicted -4.2% decline and the prior -3.0% decline.

Separately, the UK goods trade balance was reported at -£14.476 billion in October, compared to -£20.894 billion expected and -£15.676 billion in the previous month. In October, the overall trade balance (non-EU) was £4.823 billion, compared to £8.551 billion in September.

On the other hand, Make UK, a trade association, stated in research released on Monday that British manufacturers anticipate a 3.2% decline in production in 2023, following a 4.4% decline this year.

“There is simply no sugar-coating the outlook for next year and possibly beyond. These are remarkably challenging times which are testing even the best and most successful of companies to the limit.” the report said.

Furthermore, UK Finance Minister Jeremy Hunt stated that the economy is “certain to worsen before it improves. I do not know whether or not inflation has peaked.”

As previously stated, the essential support is near 1.21150. As long as it trades above it, the outlook seems bullish, targeting the 1.25 barrier. Alternatively, a decline below 1.21150 could result in more USD strength, likely sending the GBP/USD pair to the psychological threshold at 1.20.

GBPUSD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.