The Pound declined notably Tuesday as the USD surged broadly, buoyed by the hawkish Powell comments. On Wednesday, it traded near 1.18, the lowest level since November 2022.

Powell caught markets off guard

In remarks prepared for his address before the US Senate Banking Committee, Powell admitted that recent increases in employment, consumption, and inflation were influenced by warmer weather.

Despite this, he emphasized that inflationary pressures are more than anticipated, as seen by the widespread reversal of economic trends and quarterly revisions.

Powell observed that while core goods prices declined, core services inflation, excluding housing, exhibited minor symptoms of deflation and amounted to more than half of core consumer expenditures.

As a result, he stated that interest rates would likely need to rise by a more significant amount than initially estimated. This led to a surge in US Treasury rates, with two-year yields above 5% for the first time since 2007, and a further inversion of the yield curve, leading to a notable US dollar strength.

UK housing sector improved slightly

In February, Halifax reported that home prices in the United Kingdom increased by 1.1% month-over-month, hitting £285,476, thanks to lowering mortgage rates and better consumer confidence. As a result, yearly expansion remained constant at 2.1% for the third month in a row.

You may also like: Natural gas massacred amid warmer forecasts

Despite the quarterly decline in property prices, the underlying activity continues to reflect a general downward trend.

In cash terms, house prices are down approximately £8,500, or 2.9%, from their peak in August 2022. However, they remain nearly £9,000 above the average prices seen at the beginning of 2022 and are still above pre-pandemic levels, indicating that most sellers will retain price gains made during the pandemic.

“Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labor market are arguably helping to stabilize prices following the falls seen in November and December,” said Kim Kinnaird, director at Halifax Mortgages.

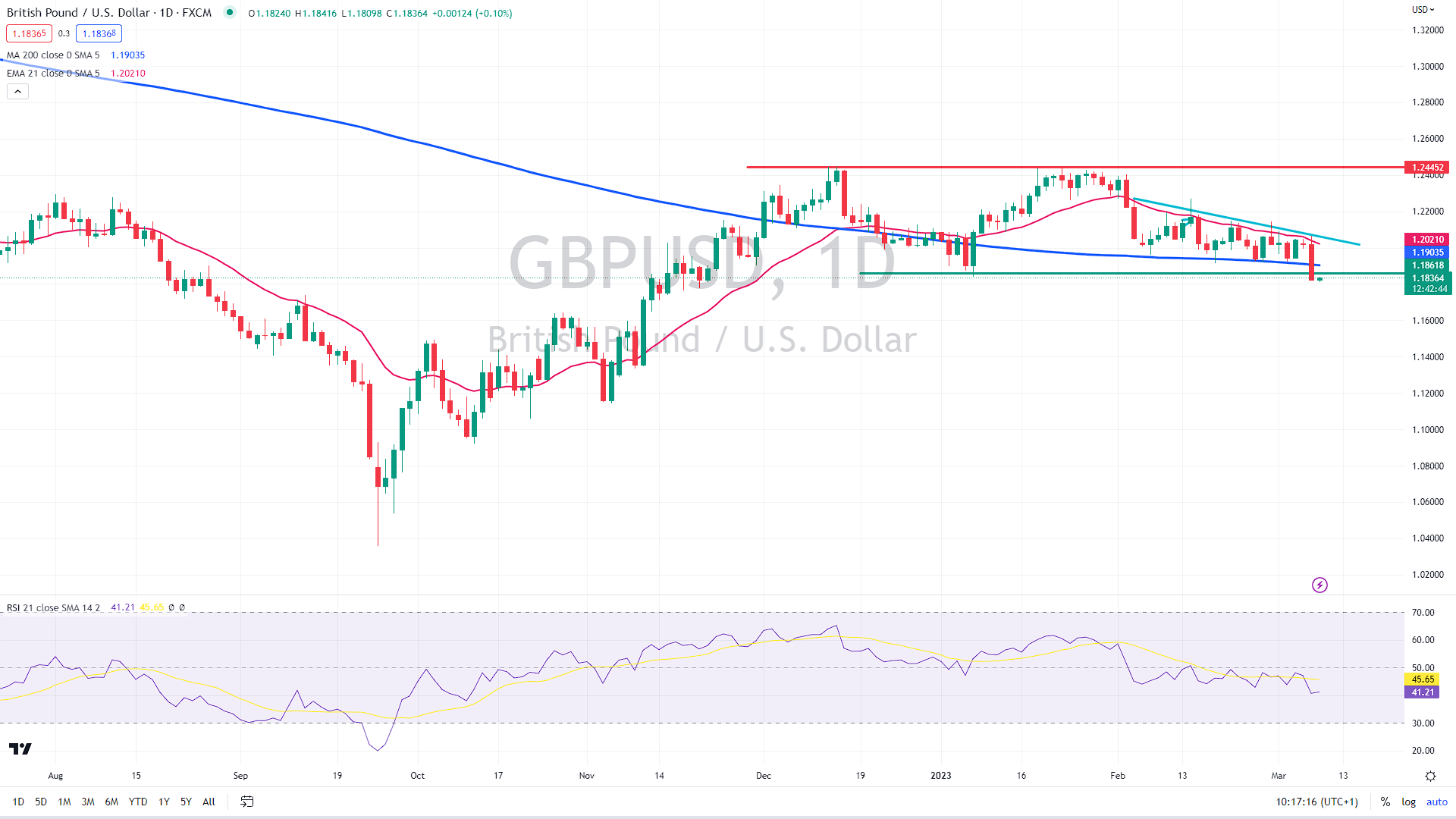

Technical situation is now bearish

In yesterday’s decline, Sterling fell both below the 200-day moving average and previous swing lows, changing the immediate trend to bearish. Should the GBP/USD pair drop below 1.18, the next target could be in the 1.15 region from the medium-term perspective.

On the upside, the Pound must climb back above 1.19 to cancel the short-term bearish pressure.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.