Traders decided to take profits from the recent rally in the EUR/USD pair, bringing it half a percent down on Thursday, just before the ECB monetary policy decision.

Fed sounded hawkish, fails to help the USD

The Federal Reserve ended its final policy-setting meeting of the year on Wednesday, raising interest rates by 50 basis points, as generally anticipated, a decrease from the four straight 75 basis point increases, signaling further increases by the end of 2023.

In addition, Fed Chair Jerome Powell warned that borrowing rates are likely to peak at higher-than-anticipated levels since inflation remains substantially over the central bank’s target range.

“It will take substantially more evidence to have confidence that inflation is on a sustained downward” path, Powell said during his post-meeting news conference.

Equities dropped after the decision. However, bonds advanced (pushing yields lower), and the USD failed to capitalize on the hawkish rhetoric, ending the day weaker against its major peers.

All eyes are on ECB

Traders may also want to remain on the sidelines until the European Central Bank (ECB) decision is released later today. The European Central Bank is expected to hike interest rates for the fourth consecutive time, but at a slower pace than the previous two sessions. As inflationary pressures appear to be diminishing, the current market pricing suggests a larger likelihood of a 50 bps rate hike.

You may also read: Tesla falls below another key technical level

Moreover, investors will study Christine Lagarde’s statements at the press conference following the ECB meeting, which will impact the shared currency.

“Some observers are already writing that the ECB is more hawkish than the Fed. However, that would be a condition we haven’t seen for a long time. In our perception, not since the summer of 2011. We may not be there yet.” Economists at Commerzbank said ahead of the ECB decision.

If the Fed concludes its rate rises before the ECB and the ECB remains quiet while the Fed sets the markets for rate cuts, we will have reached that stage. Not yet, but the likelihood that it will be achieved in the near future is growing. This validates the EUR’s continued strength. If not today, then at a later date, according to Commerzbank.

Moreover, the US macro data – Retail Sales, the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims data, and Industrial Production data – might cause additional volatility in the EUR/USD pair.

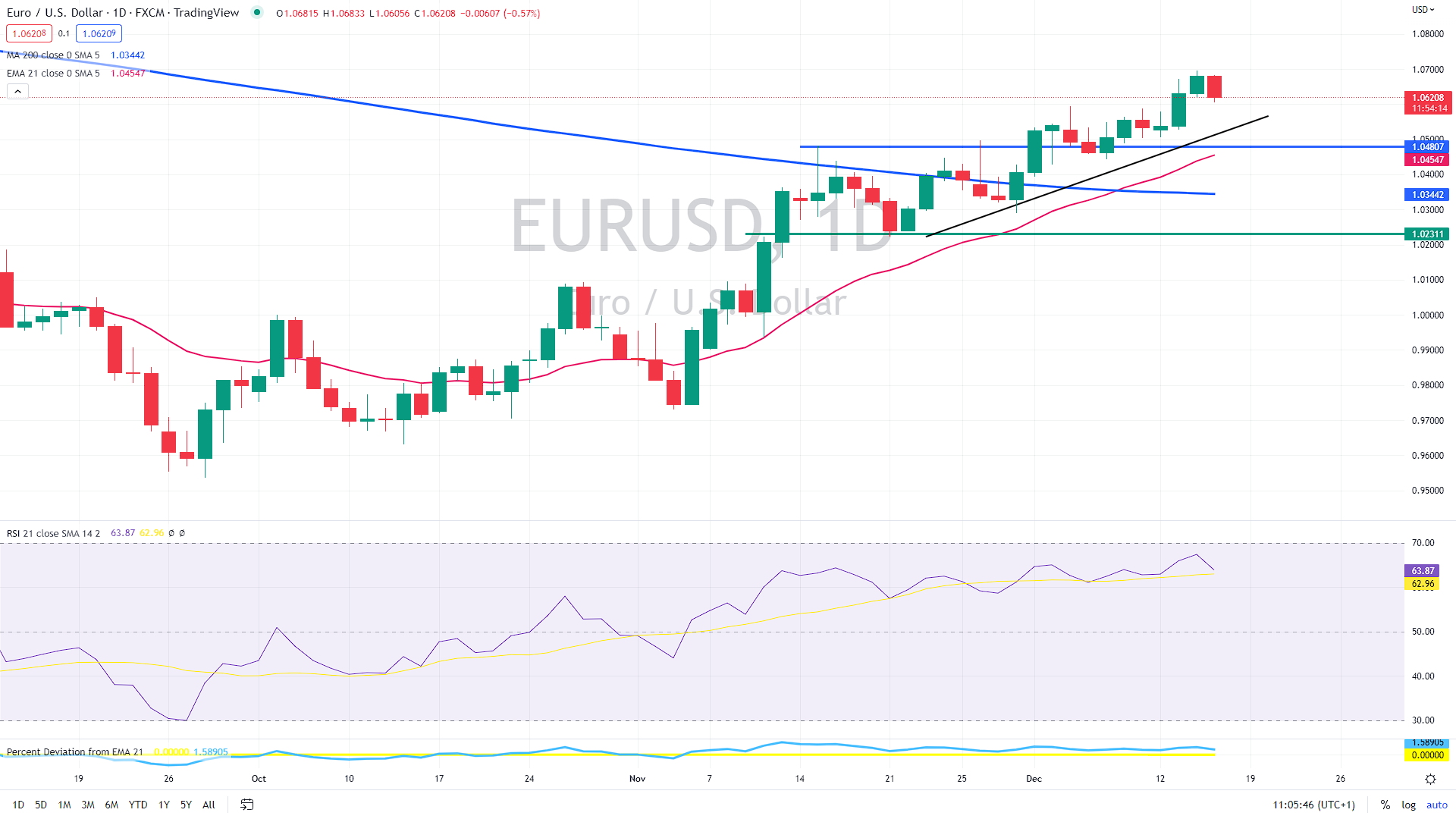

The following line of support is now at previous highs at around 1.048. Below, we can see the 21-day moving average (the red line) near 1.0450 and, afterward, the 200-day moving average (the blue line) at around 1.035. Therefore, as long as the euro trades above these levels, the outlook seems bullish.

EURUSD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.