The shared currency continued to advance Wednesday as the market’s general mood remains anti-USD, pushing the EUR/USD pair to ten-month highs near 1.09.

EU inflation remains elevated

Later today, the euro zone’s inflation data for January will be released. The headline inflation rate is anticipated to be 9.1% versus 9.2% in December, while the core rate is projected to be 5.1% versus 5.2% in December. The HICP on the old continent is predicted to decrease by -0.3% on a monthly basis over the reporting period, while the core HICP is similarly forecast to decline by -0.2%.

ECB in focus

This week’s European Central Bank monetary policy meeting will be the center of attention. Participants in the market anticipate a 50 basis point rate increase and a hint that rate increases would continue. According to Rabobank’s experts, a rate hike of 50 basis points is virtually assured. On the other hand, they continue to expect that the ECB will be able to decrease its rate hikes to 25 basis points beginning in March, but the improving outlook and wage pressures might delay this and raise upside risks.

The ADP’s private sector employment report and the ISM’s Manufacturing PMI survey for January will be featured on the US economic agenda today.

Fed to scale down rate hikes

However, today’s most important event will be the FOMC meeting. Anything less than a 0.25% rate increase would be a huge surprise, and comments about the terminal rate level will be the top priority for investors and market participants. The overall consensus anticipates hawkish communication, with markets pricing in a total of 58 bps of rate raises by June.

“Recent progress on inflation has encouraged market participants to expect the Fed to quickly pivot from interest rate hikes to interest rate cuts,” said Carol Kong, currency strategist at the Commonwealth Bank of Australia.

The dollar index has declined for four consecutive months. As investors believe the termination of the Fed’s rate-hike cycle, the greenback is considerably below its 20-year high of 114.78 reached on September 28.

You may also like: Another volatile day across the markets – countdown to CB releases

In contrast, the US dollar might experience a temporary uptrend if Powell re-establishes a hawkish tone today and markets reconsider their expectations for a swift FOMC pivot.

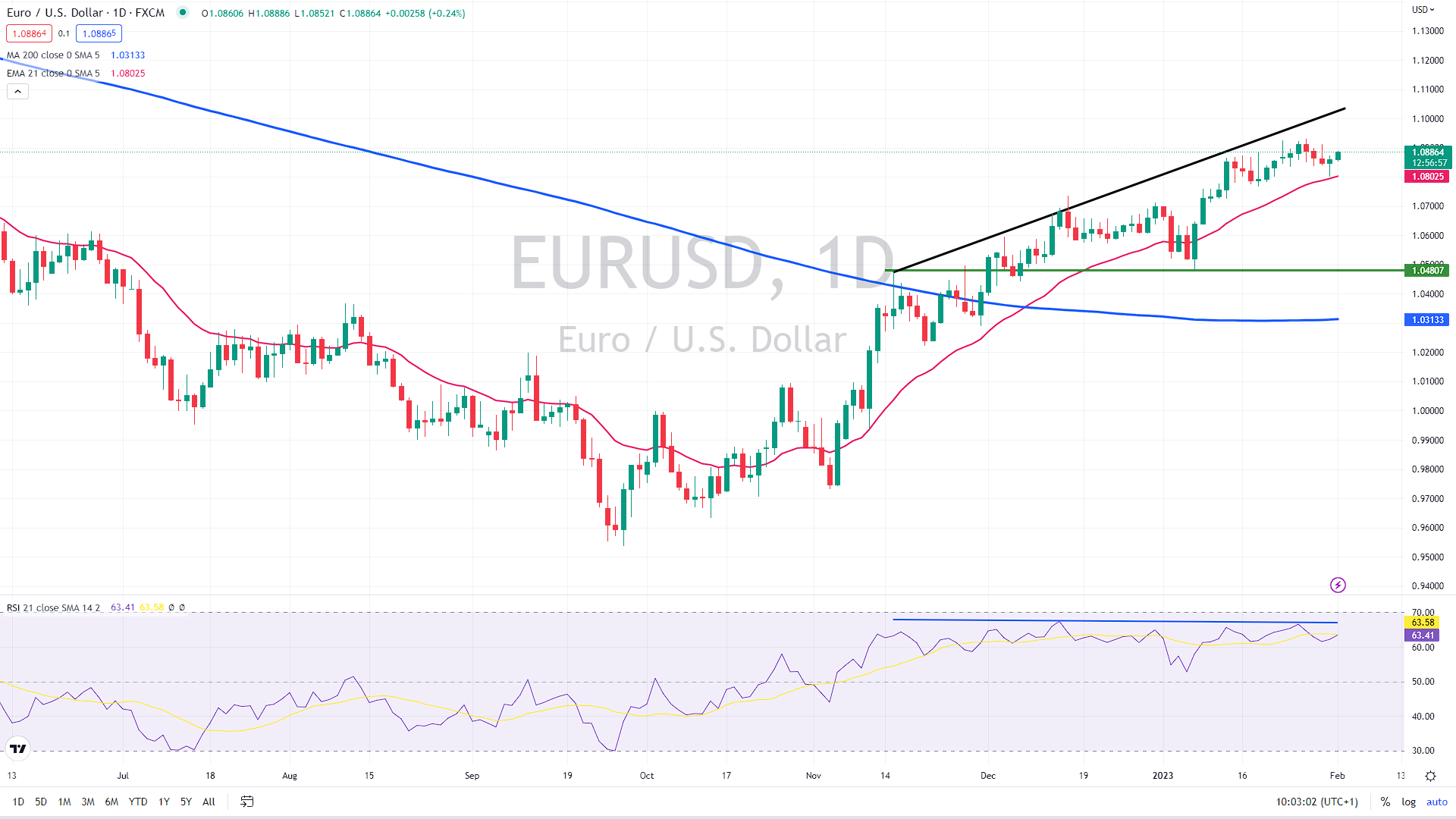

The charts show a clear uptrend, suggesting further gains toward the psychological 1.10 level. However, a massive bearish divergence between the RSI indicator and the price has formed, likely implying a decline in the upward momentum and a possible correction lower.

EUR/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.